As we all know, the traditional loan application is relatively slow and lengthy. To overcome these obstacles, a custom mortgage software solution makes the process smoother and easier.

The manual system creates many hurdles in the mortgage process, making the situation even worse for lenders and borrowers.

In the past, custom mortgage software development services were one way that lenders could change how they operated. This new feature for mortgage application software collects data and later submits it for approval. In addition, it enables lenders to address and quickly respond to business demands and compliance and provide better client services.

In this blog, we will get to know the major benefits of customizable mortgage services and development. Moreover, it saves time and stays up to the mark in the mortgage market. Let’s learn together how custom mortgage software transforms the mortgage industry.

But wait, here’s the kicker: a custom mortgage solution goes beyond simply enhancing your internal operations!

In today’s world, digital change disrupts the architecture of mortgage systems, and it is gradually gaining attention.

In addition, corporate mortgage lending software is steadily dominating the industry due to its fast process, purpose, ability to capture clients’ attention, and ability to provide better enhancement. Other than that, the usage and endorsement impact positively due to the value created for borrowers and lenders.

Furthermore, the CAGR rate is approximately 13.8%, and it will reach $20.5B in the mortgage market by 2026. This was 1.7x the $10.7B of the prior year and shows the potential for mortgage software firms.

Moreover, in 2024, they said that the price of mortgages in the U.S. would decrease, which will ultimately be good news for the borrowers.

The Benefits of Building Custom Mortgage Software

As well, we all understand that custom mortgage apps have many advantages, including custom-built, effective apps that focus on the end user.

Developing suitable mortgage software will also help meet the specific needs of loan applicants. Innovation opportunities and satisfaction improvement are the best indicators that influence the adoption of mortgage automation.

Let’s read out the core benefits of customized mortgage software.

1. Improved Compliance

The major benefit of custom mortgage software development is that you can meet your company’s compliance requirements, including data privacy, anti-discrimination, and consumer protection.

In addition, the statistics show that back in 2020, the mortgage application ratio decreased to 16.1%. White borrowers had the lowest percentage of loan denials (13.6%), while Black borrowers had the highest percentage (27.1%).

Along with generally supporting more democratic mortgage origination principles, it also helps the lender and broker avoid expensive fines and legal issues.

2. Better Data Management

Mortgage application development also helps to manage your data. In order to make better decisions, it allows brokers and lenders to have greater visibility into their data.

Moreover, it also facilitates monitoring performance, spotting trends, and improving lending tactics.

3. Enhanced Mortgages and Sales

As we all know, financing is the most crucial as well as complicated domain. Why we call it complicated is because it needs a lot of consideration, particularly about reporting initiation.

Additionally, all the reports of investors and borrowers are maintained and made using mortgage automation software.

4. Processes Facilitation

In the mortgage industry, the two most challenging aspects are loan processing and property transactions. After mortgage software, it became easier and more manageable.

Adding more key benefits to it by using mortgage software, which includes loan origination, serving underwriting, etc., impacts less time and effort. Ultimately, it improves the efficiency of the mortgage lending process.

5. Scalability for Business Growth

Custom mortgage software evolves at the company’s scale. If your activity scales up, the software you can change to allow for more consumers or connected systems and reflect the recent tendencies. Unlike other ready-made solutions, this scalability entails that your software remains useful, regardless of your business dynamic nature.

6. Cost Efficiency Over Time

When comparing with the purchase of ready-made software, it is necessary to say that custom mortgage software might seem very expensive at the beginning of its development, yet the potential benefits level the costs. These Automation relieve the need for more employees, eliminate manually made errors, and accelerate processes. Furthermore, a custom system frees the business from licensing charges generally attributed to third-party software.

7. Personalized User Experience

Another major benefit of custom mortgage software is that it enables you to make it according to the end user, i.e., borrower, broker, or lender. In addition, when opting for mortgage development, there is no limitation to synchronizing to every aspect if the user experience to improve satisfaction.

8. Reduce error and elevate Automation

There are many consequences of manual working. It is so because there is a much higher chance of human error. However, in custom mortgage software, there is a lesser chance as it minimizes the role of human error and delays of loan applications and approvals.

9. Better Customer Relationship Management (CRM)

There are two possibilities: mortgage application software can contain the CRM tools or link the CRM tools of different lenders, which will allow them to get closer to the borrower. Customer-centricity, fast & efficient communication, -time updates on application status, and ultimately increased customer satisfaction and retention.

Read also -> How Much Does It Cost to Build Mortgage CRM Software?

10. Integration with Third-Party Systems

However, the development of a custom mortgage software solution can easily interface with other services provided, such as credit score providers, appraisal services and even payment platforms.

Moreover, this leads to increased efficiency in the processing of several activities in the mortgage application process, a decrease in the manual entry of some data, and a make sure to streamline operations, reduce manual entry, and ensure that all parts of the mortgage application process work smoothly together.

11. Real-Time Reporting and Analytics

Opting for custom mortgage software helps to provide real-time reports and analytics and performance and modify complexities.

In addition, with this, you can get detailed insights and data-driven decisions and modify the business strategy accordingly.

12. Adaptability to Market Changes

In mortgage software, flexibility of operation allows easy integration with new changes in a usual short time. When there are fluctuations in interest rates, when there are new guidelines for lending, or when customers’ demands change, it is possible to adapt easily through customized software.

13. Advanced Loan Customization Options

When it comes to loan products, custom mortgage software becomes more beneficial because it also meets the borrower’s requirements.

However, what are those requirements? These are adjustable loan terms, interest rates, and repayment options.

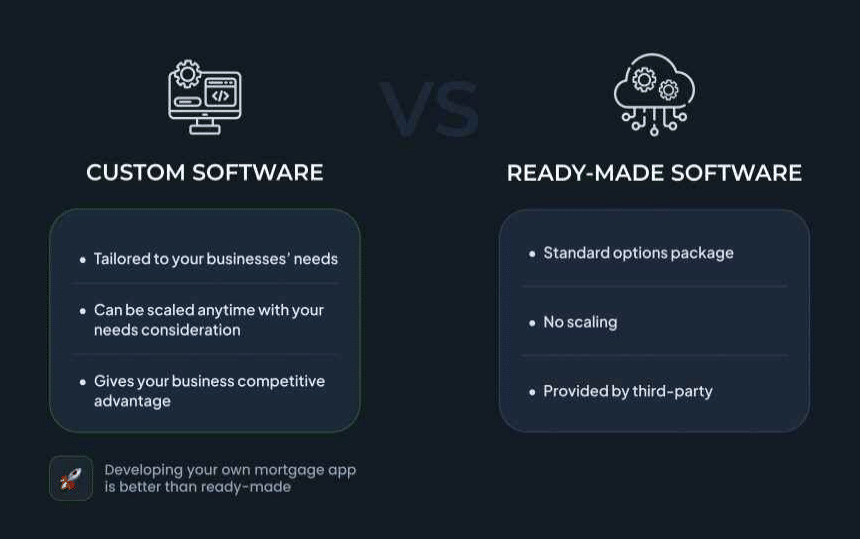

Let’s evaluate the development of custom mortgage software or use ready-made software. What is better?

Many experts come to the point that people must opt for online mortgage application software rather than to buy it. Let’s evaluate why!

- Personalized to Meet Your Company’s Needs

To all the newbies in the market, a custom mortgage platform can be built and meet your business needs easily and provide competitive benefits in the marketplace.

In addition, the owners can design it according to their specific needs, including features and functionalities that can align with your business process and workflow.

Conversely, an off-the-shelf app is only built in with standard features that simplify your company’s operations the way you desire.

- Adaptability

The best part is to build a custom mortgage application you can scale with your business. It means it acts as future-proof for your business. In addition, it also helps to reduce the cost of platforming or updating the system.

As compared to a ready-made solution, you won’t have full control over the features or system, and these all depend on the providers.

- Competitive Advantage

When we ranked the custom mortgage website development vs. a ready-made solution, experts preferred the custom solution in this case as well.

It helps you to differentiate your business from others with the abilities and features that make your business more smooth and seamless.

Let’s clear this with an example: when we compare ready-made user apps or those built by ourselves. Built by your own user experience, you have to command more and can change it according to your preference.

However, even though a ready-made app looks faster, it does not give you the same competitive advantage as a custom app.

Final Thoughts!

Mortgage apps are actively reshaping the lending industry.

Getting approved for a loan is not a very easy process, and therefore taking a mortgage is not an easy process either. Well, today there is a solution to make the process smooth and even more efficient with custom mortgage software development.

The mortgage custom software is all about how you can empower the sector. The focus here is on riskless lending, which will also be responsible for sparing all the parties involved. When the offer is less generic, it proves to be more beneficial in terms of increased sales, user satisfaction, and legal compliance.

Looking for mortgage software solutions with high market potential? Our expert team specializes in crafting customized solutions with advanced features and seamless user engagement. Contact us for more information on how we can support your business goals.