Best Mortgage Branding and Web Design Services

Partner with us and experience the best mortgage branding website design and web support services that will take your online presence to new heights, attracting more clients and growing your mortgage company. We design creative and user-friendly web solutions customized for mortgage companies and professionals. With ATI, you don’t just get a website – you get a strategic tool that will resonate with your target audience and provide them with an exceptional digital platform.

Our professional web design and branding solutions help generate leads for mortgage brokers, agents, loan officers, lending businesses, real estate agents, and anyone related to the lending business.

Top-Rated Branding And Web Design Partner for the Mortgage Industry

We solidify your brand, build your image, and propel it to the path of infinite growth from where your mortgage company attracts potential clients, leaves your competitors behind, and makes your firm one of a kind.

Brand Building

Brand Building

Brand Designing

Brand Designing

Brand Implementation

Brand Implementation

Website Design & Development

Website Design & Development

Marketing Automation

Marketing Automation

Website Support

Website Support

Mortgage Company Brand Discovery & Planning

Before we start branding or rebranding your mortgage company’s online presence, our team takes the time to deeply understand your financial company. We look at your mortgage company goals, clients, partnerships, strengths, and weaknesses in detail. This helps us place your mortgage business within the lending industry and figure out the story that will connect with your target audience and attract them. We carry out several tasks during this initial stage.

- Careful Examination of the Market

- SWOT Analysis for Your Brand

- Talking To Key Leaders

- Initial Presentation of Your Brand

- Creating a Customized Brand Strategy

- Determining Company’s USP

Mortgage Company Brand Building

With a strong, unique brand and professionally designed brand strategy, your mortgage company will stand out in the financial market. It’s like giving your company a distinct personality and image that will make it memorable and appealing to customers. This, in turn, can lead to more business, as customers are likely to choose your company over competitors. Our experts focus on creating and enhancing brands for mortgage companies, aiming to design a brand identity that sets you apart and flourishes trust and loyalty among your customers.

- Tagline Creation

- Color Palette Selection

- Typography Choices

- Brand Voice

- Brand Guidelines

- Customer Experience Design

Mortgage Company Website Design and Development

Our extensive experience serving financial institutions has made us the #1 web design and development agency for mortgage companies. We know the mortgage industry by heart and the challenges of growing your mortgage business online. Our team focuses on creating unique web designs to boost your conversion rates, attract more online leads, and improve your marketing and sales outcomes. Your website will present your brand, services, loan options, and resources in a way that pleases potential loan applicants and customers.

- Responsive Design

- Analytics Setup

- Contact Forms

- Interactive Elements

- Compliance with Web Standards

- Secure Hosting

Digital Support for Mortgage Companies

Get hassle-free web support for your mortgage company with our dedicated team based in the US. We specialize in managing your mortgage website, content, and online tools. Our focus is to amplify your conversion rates day by day, ensuring long-term growth for your mortgage company. Count on us for brand and online tool support, as well as optimization for site speed, security, and accessibility.

- Mortgage Company specific web support

- Customer Support Portal

- Conversion Rate Optimization

- Mobile-Optimized Solutions

- Customized Brand Assistance

- Advanced Security Measures

Our Services Help Your Mortgage Company Achieve

Standout Features of Our Web Designs

Mortgage Loan Calculators

Our interactive tools that allow users to estimate loan payments, creating an engaging and informative experience.

Engaging Templates

Our mortgage website templates are designed to captivate and inform your visitors, making it easy for businesses to showcase their expertise.

Social Media Integration

Extend your online presence with the integration of social media platforms, connecting with a broader audience.

Lead Magnets

Convert visitors into leads with strategically designed mortgage landing pages that guide users toward taking action.

Optimized for Loan Officers

We design brands and websites catered to loan officers/mortgage brokers, equipping them with the tools to attract clients.

Client Testimonials

Build trust and credibility through prominently displayed client testimonials highlighting your success stories.

Is Your Mortgage Company BenefitingFrom Your Brand And Website?

We are here to make sure you’re getting all the potential sales

80%

Incorporating a unique and signature color into your brand significantly enhances recognition by 80%, giving you a competitive edge.

75%

Join the ranks of industry leaders who recognize the critical role a brand plays in business value. 75% of banking leaders consider a strong brand a key factor in their success.

33%

Consistency pays off! Studies show that maintaining a consistent brand presentation can lead to a remarkable 33% increase in revenues. Let us help you achieve and maintain that consistency for lasting success.

25%

Companies with stronger brand identities consistently outshine their competitors by 25%. Elevate your brand identity and position yourself for success with our expert branding services.

Technologies

HTML5

CSS3 (Sass, Less)

JavaScript (React, Angular, Vue.js)

TypeScript

Node.js

Python (Django, Flask)

Ruby on Rails

PHP (Laravel, Symfony)

Java (Spring, Hibernate)

MySQL

PostgreSQL

MongoDB

Microsoft SQL Server

WordPress

Drupal

Joomla

Shopify

WooCommerce

Magento

Shopify

BigCommerce

React Native

Flutter

Swift (iOS)

Kotlin (Android)

Amazon Web Services (AWS)

Microsoft Azure

Google Cloud Platform (GCP)

Docker

Kubernetes

Jenkins

GitLab CI/CD

Git

GitHub

Bitbucket

SSL Certificates

OAuth

JWT (JSON Web Tokens)

What Makes Us The Best Mortgage Branding Company

Our branding process has ensured the online success and expansion of numerous mortgage companies. Our specialized team focuses on the mortgage, loan, and financial services sectors. We understand the ins and outs of designing brands and websites that align with and adhere to the mortgage industry’s standards. With ATI, your mortgage brand will receive a custom design strategically positioned to draw in more customers and significantly enhance the success of your marketing campaigns.

‘From’ and ‘To’ Mortgage Experts

Our team can provide everything your mortgage company might need to enhance its brand, website, and online presence. We specialize in content creation, logo design, graphic design, brand strategy, web design, and development focused on the mortgage industry. Contact our top-rated mortgage branding and web design agency today for a complimentary quote, and let us help grow your mortgage company.

Let's Do Awesome Branding Together!

Schedule a call with our team of experts to discuss your free brand strategy. We have years of experience in designing, developing, and growing mortgage companies. Our aim is to help financial companies find out the best of the best for their brand and effectively communicate their message to the world. If you want to improve and boost your online brand visibility, connect with us for a discussion.

DRIVING MORTGAGE SUCCESS WITH DIGITAL INNOVATION

We aim to streamline the mortgage lending process, making it more efficient, transparent, and user-friendly for lenders and customers.

How AI Is Changing the Mortgage Process

Introduction

Mortgage applications exist as a complex process requiring many weeks of documentation review and manual assessment for applicants. The adoption of AI in lending brings about rapid developments in the market. The lending process becomes faster because Artificial Intelligence provides accessible home loan approval systems to both borrowers and lenders.

Modern banking institutions together with mortgage brokers achieve enhanced data evaluation capabilities through AI technology. It enhances both the quality and speed of approval processes. AI affects every part of the mortgage industry including mortgage rate optimization, fraud detection, and customer assistance.

Artificial Intelligence operates regardless of the fundamentals which include human thinking capabilities that machines replicate through programming.

What is AI?

Programmed machines achieve human-like thinking abilities through their decision-making learning capabilities to mimic intellectual functions. Programmed computers use AI technologies to mimic human cognitive functions for task processing. It includes problem-solving, pattern recognition, prediction development, and language understanding abilities.

The intelligence level of AI systems rises when it accesses increased datasets because the amount of data affects both efficiency and precision during AI operations.

The various industries such as healthcare, finance, retail, and mortgage AI solutions experience transformative changes through the power of AI technology. The mortgage lending process becomes more automated through loan approvals while optimizing interest rates and delivering better customer service through AI applications.

How AI is Changing the Mortgage Process?

Before diving into how Artificial Intelligence is changing the mortgage process, let’s break down what AI for lending actually is and how it works.

- Machine Learning (ML) & Predictive Analytics

AI systems operate because of machine learning functionality that makes predictions by processing historical data. AI analyzes large banking data to determine mortgage borrowers’ creditworthiness throughout mortgage industry operations.

For example, instead of relying only on credit scores, mortgage AI can analyze alternative data points like:

- Rental payment history

- Utility bill payments

- Bank transactions

- Employment trends

The expanded assessment method enables AI to judge applicants better so it can accept individuals who standard scoring models would reject.

- Natural Language Processing (NLP) & Chatbots

Computer-driven chatbots alongside virtual assistant apps are shaping customer administration throughout the mortgage industry.

For instance, if a borrower asks, “What’s the best mortgage rate I can get?”, an AI-powered chatbot can instantly analyze market trends and provide real-time mortgage rate optimization insights.

- Robotic Process Automation (RPA)

AI brings forth one major advantage because it undertakes automatic functions. Robotic Process Automation (RPA) helps enhance mortgage processing by eliminating manual paperwork, speeding up underwriting, and reducing errors.

Through AI-driven RPA technology both mortgage lenders and brokers achieve the following outcomes:

- Automate document verification

- Reduce human intervention in data entry

- Streamline compliance checks

How AI Is Revolutionizing How Mortgage Brokers Work?

Artificial intelligence leads to a total transformation of mortgage broker operations. The help of mortgage brokers is essential because they present borrowers with their most suitable loan options. Historically mortgage brokerage processes have proven slow and demanding of great physical effort by brokers. Now, AI mortgage brokers are changing the game by offering smarter, data-driven recommendations.

- Faster Loan Approvals

A traditional mortgage application used to consume several weeks or entire months of processing time. AI technology has revamped mortgage processing through its automatic performance of multiple time-consuming tasks which include:

- Loan application reviews

- Income verification

- Credit risk assessment

With AI for mortgage loan officers, approvals are now happening in days instead of weeks. By analyzing borrower data in real-time AI helps lenders make quick decisions that do not affect accuracy.

- AI Mortgage Lending Increases Fairness

The standard method for mortgage approvals uses credit scores and income records yet fails applicants who have different types of financial histories. With AI mortgage lending, lenders can use alternative credit assessment methods to help approve borrowers who might have been rejected under old systems. AI looks at:

- Rental history

- Utility payments

- Bank cash flow patterns

The mortgage accessibility expands through this method which leads to fairer and more inclusive home loan opportunities.

- Mortgage Rate Optimization with AI

It becomes difficult to secure optimal mortgage conditions because interest rates show regular variations. Mortgage AI can analyze thousands of financial factors in real time to optimize mortgage rates for borrowers.

AI-powered platforms help borrowers:

- Track market trends

- Mortgage AI enables clients to secure the current lowest interest rate offers.

- Receive personalized rate recommendations.

Mortgage processes have become important to all parties through competitive rates and effective risk management which lenders can provide.

- AI for Mortgage Loan Officers

Previously mortgage loan officers spent extensive time reviewing documents before they verified incomes while doing manual debt-to-income ratio calculations. Now, AI for mortgage loan officers automates these processes, allowing them to:

- Focus more on customer service

- Reduce approval time

- Offer customized loan recommendations

Loan officers using AI-based tools achieve higher productivity levels in their work and deliver better services to borrowers.

- AI Mortgage Brokers Deliver Customized Loan Options

Mortgage borrowers find it difficult to identify between different loan options available to them. AI mortgage brokers solve this problem by analyzing borrower profiles and matching them with the most suitable loans.

AI-driven mortgage brokers consider:

- Income stability

- Future financial goals

- Current market conditions

The individualized assessment lets borrowers receive mortgages that align perfectly with their specific requirements.

- Fraud Detection & Risk Mitigation

Modern artificial intelligence systems help the mortgage industry lower risks while fighting fraud activities. Before approving loans, AI-based fraud detection tools search applications for patterns which indicate fraud activity.

For example, AI can:

- Identify inconsistencies in financial documents

- Detect fake income statements

- Prevent identity fraud

This makes AI in lending a valuable tool for protecting both lenders and borrowers from fraudulent activities.

The Future of AI in Mortgage Lending:

Mortgage lending through AI technology will continue to develop because of better process flow and improved customer satisfaction. The Mortgage industry’s evolution will introduce new features like voice-command mortgages and automated property assessments. It will be enhanced through blockchain systems to safeguard transactions. AI advances the loan processing speed and proves vital for detecting fraud to create an open and dependable lending space.

Additionally, AI-powered Mortgage Software Development services will continue to refine risk assessment models, allowing lenders to offer more personalized mortgage solutions. AI assumes leadership in the mortgage sector to establish a system which becomes wiser and more honest as well as broader in accessibility.

How Artificial Intelligence is Improving Mortgage Customer Experience?

Robotics technology through Artificial Intelligence boosts the mortgage experience of customers. The previous era of prolonged waiting times with excessive documentation has fully dissipated. With AI mortgage lending, borrowers now enjoy a much smoother, faster, and more personalized mortgage process. Through AI-powered chatbots and virtual assistants borrowers obtain quick answers to their loan application questions thereby improving their experience.

Additionally, AI can analyze a borrower’s financial situation in real-time, offering mortgage AI recommendations customized to their specific needs. Whether it’s helping first-time buyers understand their options or assisting homeowners with mortgage rate optimization, AI is making home financing more transparent and stress-free than ever before.

Why Do Mortgage Professionals Need AI for Lending?

The application of AI has become essential for mortgage brokers together with loan officers to succeed within their industry. AI for mortgage loan officers automates tasks like document verification, income analysis, and credit checks, freeing up time for them to focus on client relationships. With AI-driven insights, brokers can quickly match borrowers with the best loan options. It also makes AI mortgage brokers more efficient and accurate.

Plus, with the rise of custom mortgage development services, lenders can integrate AI tools that enhance security, reduce fraud, and improve risk assessments. The function of AI in the mortgage industry does not eliminate human professionals; rather it provides them modern solutions for improved performance and efficiency in deal-making processes.

Conclusion

Artificial intelligence brings positive changes to mortgage transactions. From AI mortgage lending that speeds up approvals to mortgage AI tools that personalize loan recommendations, artificial intelligence is making the mortgage experience faster, smarter, and more efficient.

For borrowers, AI means easier applications, better mortgage rate optimization, and a fairer approval process. AI technology allows mortgage brokers along with loan officers to manage their workflows better while minimizing paperwork and delivering superior care to customers.

With the rise of mortgage software development services, AI will only become more advanced in the years to come. The near future will bring forth speedier mortgage approvals that use AI for home appraisals while implementing voice control interfaces for loan applications.

AI technology now leads a transformation in home mortgages and you should prepare yourself for these changes. Whether you’re applying for a home loan or working in the mortgage industry, AI is here to enhance mortgage lending and make the process smoother than ever before.

LOS vs LMS: Which One Does Your Business Need?

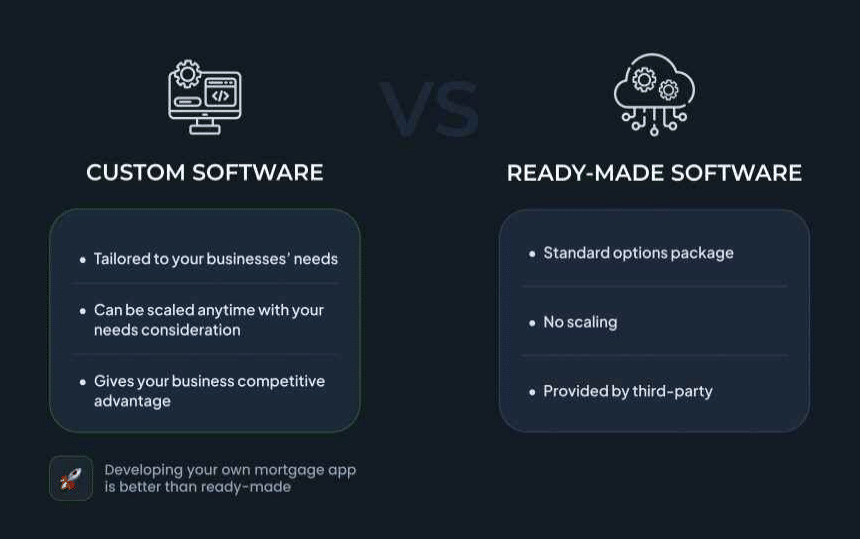

Imagine your lending process running like a well-oiled machine: Customers would exit the process with satisfaction while both payment maintenance and application approvals moved at speeds of minutes. Sounds ideal, right? Your business needs either a Loan Origination System (LOS) or a Loan Management System (LMS) to reach ideal operational efficiency. To distinguish them properly and determine your exact requirements, we need to understand the fundamental differences between these systems.

A Loan Origination System (LOS) optimizes the application process from request to approval decision through its front-end framework. These systems transform the way customers experience the loan process by performing automatic credit checks while serving as advanced loan originators. Interactions with either mortgage los meaning or lending origination software begin with LOS to achieve efficient lending.

The actual system manages loan processes with efficiency since it tracks payments accurately while assisting staff with delinquent account management. LMS design is core to banking operations as they sustain continuous operations after a loan is successful.

In this blog, we will cover the Loan Origination System (LOS) and Loan Management System (LMS) difference: Which one does your business need? Let’s dig into this!

What is a Loan Origination System (LOS)?

The digital platform called Loan Origination System functions as an operational system that simplifies application processing and approval procedures for loans. The system serves front-end banking needs, which begin with loan applications through the choice decision. These institutions use this system for banking and mortgage procedures alongside financial institutions to increase operational effectiveness and improve customer interactions during the loan application process.

Key Features of LOS:

- Loan Application Software: An automated system enables borrowers along with their loan officers to avoid paperwork while reducing human-made application errors.

- Automated Underwriting: The system accelerates decisions through its programming algorithms and credit scoring models, which evaluate borrower creditworthiness.

- Document Management: A digital system accesses important documents that confirm critical application elements exist for continuous processing.

- Compliance Management: Through its operational functions, the system drives regulatory compliance, thus averting legal problems and monetary penalties.

- Integration with Other Systems: The product enables real-time integration between customer relationship management tools and credit bureaus to generate complete data analyses.

Loan origination system examples

- The digital loan origination solution Blend allows banks to offer their customers a simple interface through which both lenders and borrowers can work.

- Ellie Mae Encompass dominates the mortgage sector through its advanced system together with extensive customizable components.

- The technology platform TurnKey Lender utilizes artificial intelligence to power decisions during its loan origination automation process.

- The corporate loan origination system makes the loan management process quite easy when you have the right tools in place

What is a Loan Management System (LMS)?

From approval through repayment, the Loan Management System (LMS) handles operational loan management procedures. After approval the system manages product advancement throughout its lifecycle until full repayment occurs. Loan Management Systems function as essential tools that support precise record maintenance together with loan servicing process management and repayment system monitoring.

Key Features of LMS:

- Payment Processing: The system automates EMI payments through a scheduling system that decreases customer service interventions and speeds up payment processing.

- Account Management: The system provides instant access to manage all borrower data and automatically tracks borrowing amounts and interest rates throughout their loan term and saves all past regulated transactions.

- Tracking: The system performs delinquency tracking by enabling automatic tasks that generate recovery procedures with programmed notification controls.

- Reporting Tools: Advanced analytical features allow lenders to accomplish better financial portfolio management along with improved loan risk evaluation and superior lending decisions.

- Compliance Management: The system supports full regulation compliance while executing audits as well as implementing serving requirements.

Examples of Loan Management Systems:

- Modern lending businesses access effective loan servicing tools from LoanPro through its cloud infrastructure.

- This system demonstrates an intense capability to handle intricate loan requirements and design flexible system configurations.

- Modern loan platform technology delivers comprehensive loan service functions and simple operational features.

- Through its exceptional Los platform, LMS maintains loan servicing operations for multiple financial sector products.

Difference Between Loan Origination System (LOS) and Loan Management System (LMS)

In their operational roles, LOS and LMS function independently yet alongside each other through loan lifecycle stages. Here’s a breakdown of their differences:

| Feature | Loan Origination System (LOS) | Loan Management System (LMS) |

| Primary Focus | Loan application, approval, and underwriting | Loan servicing, repayment, and delinquency management |

| Key Users | Loan officers, underwriters, and borrowers | Operations teams, finance teams, and borrowers |

| Process Stage | Front-end of the loan lifecycle | Back-end of the loan lifecycle |

| Automation Tools | Application processing, credit scoring | Payment tracking, reporting, and compliance |

| Examples | Blend, Ellie Mae Encompass, Turn-Key Lender | LoanPro, Nortridge Loan Software, and origin Lending Systems |

The Loan Origination and Loan Management Process in Detail

Loan Origination Process:

- Application and Data Capture: The loan process initiation begins with the customer, who provides information to LOS as part of a secure data collection process.

- Credit Review and Verification: Personal credit evaluation together with data verification occur as part of the institutional assessment process.

- Risk Assessment and Decisioning: Lenders evaluate risk by applying scoring models to make loan approval choices.

- Document Management and Workflow: LOS manages both form processing workflows alongside document acquisition processes while tracking how approvals advance.

- Interest Rates and Loan Terms: Through analyzing risk factors, the tool establishes corresponding proposal offers and rates together with loan terms for customers to review.

- Compliance and Risk Mitigation: Through its framework, LOS protects regulatory requirements while creating records and detecting fraudulent activities.

Loan Management Process:

The loan management process is quite easy when you have the right tools in place.

- Onboarding: When loans become disbursed, the LMS enters the system to process the borrower’s accounts.

- Repayment Scheduling: It generates a payment plan that shows both primary debt and interest amounts.

- Monitoring Payments: The system traces payment activities live so business records remain precise.

- Handling Delinquencies: The system automatically sends reminders along with charging penalties when debt payments become past due.

- Closure: The system will tag loans as complete after borrowers finish making their full payments.

Benefits of Implementing LOS and LMS in Banking

- Enhanced Customer Experience: Statistical data from surveys reveals borrowers use loan origination systems more when they have smooth platforms that simplify loan processing.

- Improved Efficiency: Systems with automated functions reduce costs and decrease processing duration to permit personnel to work on strategic tasks.

- Regulatory Compliance: Through their Loan Origination System platforms, institutions maintain origination compliance and the Loan Management System tracks service requirements to reduce potential risks.

- Data-Driven Insights: The reporting features of both systems give essential data necessary to understand borrower behavior as well as track portfolio outcomes against market movements.

- Scalability: The systems support business growth requirements through their capacity to process multiple loan volumes alongside different types of loans.

- Reduced Errors: The automated system performs compliance checks while eliminating manual data entry processing and handling calculations to decrease human mistakes.

How Do Loan Origination Systems Work with Loan Management Systems?

Different loan systems accomplish separate tasks within lending yet they collaborate to provide flow from origination through management. Moving data between LOS and LMS running systems keeps information reliable while improving business speed and it creates an effortless process for financial institutions and consumers.

How Much Do LOS and LMS Solutions Cost?

System deployments of Loan Origination Systems (LOS) and Loan Management Systems (LMS) require evaluating standard features together with expansion capabilities and necessary deployment strategies.

- Entry-Level Solutions: $500–$2,000/month (ideal for small to medium businesses).

- Enterprise Solutions: $10,000+/month (for large-scale, highly customized systems).

- Implementation Costs: The implementation and integration requirements for this system will determine costs ranging from $5,000 to $50,000.

Choosing the Right System: Key Considerations

- Business Goals: Your business operation’s main focus must define whether acquiring new customers or improving existing loan management takes precedence.

- Scalability: The system needs to have maintained operational performance that matches the anticipated future growth of your organization, including growing loan operations.

- Integration: Your new platform needs to integrate smoothly with your existing software system, which includes Customer Relationship Management and accounting platforms.

- Cost: Consider present and future business advantages when you evaluate total investment costs to calculate the return on investment.

- Customization: Systems selection necessitates features which allow customized modifications to system features to meet the business needs of your organization.

Let’s Find Out Why Loan Management System is a Game-Changer for Lenders

Analytics show the global loan management software market will reach $30 billion by 2031 because banks require smarter loan origination systems to stay competitive.

Lenders from every sector, including banks, credit unions and fintech companies, benefit from deploying advanced loan origination platform for their lending activities.

The following discussion will outline the various advantages of loan management system usage while analyzing their ability to optimize your lending approach.

- Faster Loan Approvals with Automation

A modern loan origination system that handles applications and calculations will track payments while processing ever greater numbers of applications more rapidly. Loans obtain faster approvals through a loan origination solution that minimizes processing delays while optimizing operational efficiency.

- Zero Errors, Maximum Accuracy

Processes based on manual calculations tend to result in high-cost errors. A digital loan origination system provides accurate financial computations throughout the process, preventing both compliance failures and disputes with customers. Loan processing with this platform becomes reliable because lenders can trust its accuracy equipment.

- Stay 100% Compliant Without the Stress

A corporate loan origination system provides lenders a competitive advantage as it monitors and integrates current financial sector regulations in real-time. Loan management systems feature automated reporting tools that help lenders follow regulatory requirements and escape penalties while fulfilling industry requirements without stress.

- Smarter Risk Management for Safer Lending

The loan origination software for banks enables immediate monitoring of customer creditworthiness while providing live visibility into payment habits and danger signals. Lenders can use this system to identify warning signals during their pre-escalation monitoring of credit score adjustments and missed payments. The implementation of a properly designed loan management platform leads to enhanced security of portfolio assets alongside fewer incidents of default.

- Seamless Customer Experience that Builds Loyalty

Modern borrowers demand simple digital processes while interacting with financial institutions. Robotized loan application services bring comfort to customers who need loans. It is so because they supply interactive web fonts that show real-time updates alongside payment tracking and request processing.

Effective loan origination systems provide expedited transaction procedures that lead to shorter waiting periods and satisfied borrowers.

- Scalability to Grow with Your Business

The growth strategy for lenders depends on choosing a loan origination software system that adjusts to their expanding needs. A loan origination system provide capabilities to process different loan products and business patterns so institutions can introduce new financing models under the same platform structure. A loan origination solution offers your lending business protection against future growth requirements.

Trends in Loan Origination and Management Systems

- AI and Machine Learning: The technologies implement improvements to the credit scoring capabilities while expanding risk assessment through advanced detection of fraud activities in LOS and LMS.

- Cloud-Based Solutions: The combination of cloud technology provides LOS and LMS with flexible computing power while supporting scalability and lower operational costs.

- Mobile-Friendly Interfaces: Documents evaluated by lenders benefit from mobile-friendly functionality to allow borrowers to conduct their operations from anywhere at any time.

- Blockchain technology: Both security and creature transparency increase through the use of innovative technology in loan phase creation and financial services management.

- Personalization: The newest systems tailor loans and payment schedules to individual borrower information through profile analytics.

Frequent Question Answer

1. What sets Loan Origination Systems (LOS) apart from Loan Management Systems (LMS)?

Customers interact with a Loan Origination System (LOS) through all stages, beginning with loan application and proceeding through credit evaluation and approval. The infrastructure of a Loan Management System (LMS) manages three core back-office functions, which include tracking repayments, delivering account services and managing delinquent accounts. Both systems provide end-to-end coverage for the whole loan process.

2. Does my lending business require the simultaneous implementation of a Loan Origination System (LOS) side by side with a Loan Management System (LMS)?

The choice of system depends on the number of areas your operations cover. A Loan Origination System meets all your requirements when you want to improve loan application procedures and approval cycles. The combination of these systems maintains complete efficiency across the loan lifecycle if you need to manage repayments together with account tracking needs.

3. Do Modern platforms exist that enable LOS and LMS to synchronize data?

Present-day LOS and LMS platforms work effortlessly to link with each other. Business operations benefit because their entire lending process, from initiation through servicing, functions as one unified system that requires no system switching.

4. What does the standard pricing range look like for Loan Origination Systems and Loan Management Systems?

The price for platform development and Loan Origination Systems (LOS) or Loan Management Systems (LMS) escalates according to the system’s features together with the implementation approach, either cloud integration or on-site use. Entry-level solutions for businesses with 1–500 employees cost between $500 and $2,000 monthly. The advanced functionality combined with customization and scalability for big organizations leads to monthly LOS and LMS expenses of $10,000 or higher. Standalone implementation fees combined with integration charges require budgets between $5,000 and up to $50,000, determined by system complexity. Each business should thoroughly evaluate its requirements combined with financial constraints before opting for a system decision.

Final Thoughts

LOS meaning in mortgage as a software system to control all stages of loan applications beginning from submission through approval until final processing.

Showcasing Loan Origination Systems (LOS) together with Loan Management Systems (LMS) serve as necessary tools for the entire lending process. The main responsibilities of the Loan Origination System include loan application and approval. However, the Loan Management System handles post-approval loan management functions. Determining your business demands lets you decide between one system or adopting an integrated approach with both systems as your optimal solution.

Research leading loan origination systems and loan management platforms that will help your operations improve significantly today. By adopting these modern tools, businesses can accelerate workflow processing and fulfill their customers better while securing leadership in financial market competition.

ATI—the Real loan origination platform

Are you ready to advance your lending origination system? Opt for ATI as your partner to transform your lending operations and achieve a smarter, more efficient future!

10 Advantages of Using Mortgage CRM in the Banking Sector

In today’s financial landscape, the CRM in banking industry is reshaping the industry. It is so because it works on how banks can easily connect with their customers. Mortgage CRM for banking industry becomes even more evident due to the projected digital banking market expansion of up to $12 trillion by 2026, combined with 73% of bank customers who use digital services each month.

Mortgage CRM applications automate business procedures while decreasing documentation workloads and manual errors to provide broker operators with superior customer experiences. Modern banking CRM solutions and bank CRM systems enable financial institutions to deliver superior customer satisfaction and operational excellence. It results in market competitiveness within the evolving banking industry.

In this blog, we will cover 10 Advantages of Using mortgage CRM system banking industry, customer relationship management financial services and customer relationship management banking. Let’s dive into it.

What is a Banking CRM System?

A Customer Relationship Management system called Banking CRM exists specifically for banking applications and enables better customer interactions and process streamlining while enabling personalized financial service delivery. Banks utilize this system to monitor customer information while tracking interactions between their customers and staff to both enhance satisfaction and maintain loyalty.

Service-driven program solutions active throughout banking enable institutions to operate relationship management systems that support their interactions with customers. In addition, the banking industry uses this system to discover existing customer needs while identifying preferred service methods as well as automated operational improvements that result in personalized customer experiences.

Furthermore, a banking CRM solution enables banks to connect core systems to marketing tools through centralizing customer interaction and data viewing. Banks implement banking CRM solutions to connect with customers via social media and mobile channels while instantly collecting valuable customer feedback.

10 Advantages of CRM in the Banking Sector

Do you remember missing a crucial document from your massive paper pile while you urgently needed it? Mortgage and banking firms encounter this situation regularly.

Digital document tools, along with automation software, drive the processing of paperwork and business operations while supporting mortgage marketing functions.

Any CRM for bank featuring cloud-based storage enables businesses to decrease manual labor while boosting their loan pipeline management, thus delivering enhanced revenue alongside enhanced customer satisfaction.

Following are some of the benefits of enforcing a devoted bank CRM system result.

1. Gain a Complete 360-degree Client Perspective.

Clients get complete profile coverage because banking CRM systems deliver integral insights. When CRM systems integrate banking platforms with software operations, banks produce one connected application that fully displays all client account data.

Moreover, CRM bank systems automatically record every set behavior, including ATM usage and loan questions from customers. The extended customer insights provided by banking CRM systems lead to more precise financial product matching for client requirements.

2. User-specific management of customer service interactions constitutes an essential strategy for differentiation

Customer choice has shifted toward multiple bank services after CRM banks started competing aggressively, causing customers to split their banking requirements across multiple banking institutions.

In addition, banks need to establish unique client profiles through customer relationship management to develop personalized interactions that help them shine in the banking sector.

3. Achieve Customer satisfaction

Bank CRM systems enable financial institutions to transform their business model toward customer-centric operations. Customer segmentation tools provided by these platforms function by organizing people through variables that include gender and demographic characteristics, age groups and economic levels. Credit rating status and additional parameters.

Through CRM for bank solutions, organizations can segment their client base based on investment preferences, relationship duration and client business sizes.

4. Drive Growth in Loan Sales

Succeeding with customer relationship management for banks enables the delivery of unified digital-first service, which today’s customers require.

The customer relationship management tool for banking allows sales managers to increase loan sales by understanding customer intent along with loan requirements while reviewing previous interactions.

These tools support multi-channel communication with customers while managing lead contacts and providing practical data about customer interactions.

5. Boost Marketing and Sales Efficiency

Financial services powered by customer relationship management solutions transform obtainable business data into strategic analytical reports. CRM system banking industry tools enable easy pattern detection and marketing assessment that helps bankers create better future strategies.

6. Strengthen Customer Loyalty

Financial institutions that execute CRM optimally deliver agents complete knowledge of client contact interactions, thus leading to efficient problem resolution. The implementation of this process establishes trust with clients and leads to positive satisfaction results. Through banking CRM system development and automated emails and dynamic templates based on customer behavior banks can strengthen customer loyalty.

7. The existing underwriting framework needs improvements through simplification and optimization protocols.

The existing methods for underwriting loans often prove slow as well as prone to mistakes. When teams use a robust banking CRM system to view client history and financial portfolios, they make more precise decisions.

8. Leverage Data for Enhanced Customer Service

The real-time customer relationship management in banking tool enables staff to capture client information effortlessly, which improves follow-up efficiency. Banks can monitor winning marketing elements throughout their various outlets, where they access data that guides their operational enhancement.

9. Encourage Seamless Team Collaboration

A banking CRM solution centralizes data so every department works together using the same knowledge base that avoids customer trips between different banking departments. The banking industry needs a cohesive CRM system that delivers whole-scale service alignment between digital channels and direct interactions with clients.

10. Retain Clients with Strategic Insights

Real-time banking CRM system data helps financial institutions make informed decisions that both enhance client satisfaction and resolve issues right away.

Furthermore, financial services strategies based on customer relationship management enable banks to stand out in their competitive market while successfully maintaining client loyalty.

Read also -> How Much Does It Cost to Build Mortgage CRM Software?

The Power of CRM: Real Transformation

Each bank needs to adopt a CRM in banking industry to achieve current market success. The use of customer relationship management (CRM) by banks brings streamlined operations, which allows them to offer greater customer satisfaction while producing enhanced business growth. The CRM banks approach revolutionizes customer management operations through efficient procedural optimization while developing tailored solutions that build enduring customer commitment.

Today’s financial organizations must install CRM for bank solutions to reach improved customer service levels. Contextualized customer data collection through banking CRM system development generates complete client visibility for banks to provide individualized services. Through online portals and in-branch interactions, banking CRM systems create uniform, engaging experiences with personalized delivery for every customer.

- The connection and communication

Through CRM for bank industry solutions, banks establish smooth and connected communication experiences between customers and institutions across different interaction channels. These systems provide banks with tools to learn about customer preferences and behaviors, allowing them to detect emerging customer needs in order to provide products at ideal moments. Customer relationship management banking solutions create stronger ties with customers, which leads to fewer customers leaving, along with improved customer loyalty.

- Data-Driven Insights for Profitability

Customer relationship management systems in banking applications generate efficient operations by building automation features that handle standard jobs, including data entry and communication processes. Automation through this system lowers errors in addition to accelerating efficient operations, which generates increased productivity.

- Compliance and Tracking interaction

CRM system banking industry solutions provide the ability for users to analyze customer data which reveals important usage patterns. The data-driven model helps financial institutions recognize potential cross-selling prospects, which leads to higher profitability results. When customer interaction shows interest in home loans, banks may deliver tailored mortgage product offers through personalized communications.

- The Data protection and growth

Trouble-free bank CRM systems enable industry businesses to follow data protection standards simultaneously providing customer interaction traceability. Customer Relationship Management in banking solutions creates benefits, including enhanced customer satisfaction and upward revenue growth opportunities that foster durable customer relationships.

How to choose the right banking CRM

Still confused about how to choose the right banking CRM that works best for your business deals? Here is the best way to choose the right one.

Businesses maintaining financial institutions must deploy appropriate CRM solutions to obtain superior customer care and process refinement together with operational performance enhancement. An optimal CRM system for banks reduces internal complexity; it helps enhance customer relationships and leads to better financial profits. Purchasing the right system demands more than fast checks of commercially available software systems. Your bank needs an evaluation process to determine its unique requirements before selecting a solution. To ensure that you select the best CRM for bank, here are some important factors to consider:

Final thoughts

Banking services depend on the Banking CRM platform to maintain effective and efficient connections with customers. By providing a unified data storage platform, the system enables recording interactions while enabling analysis to enhance banking customer relationship management capabilities.

Banking organizations use this data to create better customer experiences while building client loyalty, which results in improved profit growth. In addition, financial institutions use bank CRM systems and banking CRM solutions to customize services according to customer needs, which generates both strong customer relationship management financial services and market competitiveness. Optimize your lending operations with our custom Mortgage software development services.

Loan Process Automation for Better Customer Experience

In the rapidly growing field of finance, competition becomes an important aspect of business operations. Adopting technologies such as loan process automation and automated loan processing will play a critical role in increasing efficiency and satisfying the customer.

Moreover, loan automation has become a revolutionary factor in lending activity and its bringing revolution in the management of loans right from origin to its closure. Through loan origination automation and automated loan processing systems, there will be faster service delivery with less or no errors to the borrowers.

The advantages of mortgage process automation or loan management system workflows are numerous; cutting across the area of cut operating cost and high accuracy/ compliance. Such sophisticated developments actually help to facilitate the processes and assist the lenders in handling applications more efficiently and managing the resources intelligently. Borrowers on their end get loans approved faster and the process of getting the loan approved is much more transparent, thus demonstrating the importance of a functional loan processing system.

This blog post takes you on a journey covering the opportunities and uses of automated lending platforms and the technologies behind them. Come with us to discover how ideas like loan origination automation as well as loan processing systems are changing the face of the financial industry and preparing for a place where the customer is always front and center.

Loan Automation for Improved Loan Origination Process

Loan origination automation is a process that takes place in the lending’s life cycle and is a very important stage in it. It involves steps ranging from pre-contractual stage, contractual stage, and post-contractual stage. In addition, this process required complex paperwork inflow, manual input, and information exchange between departments. However, the loan process automation converted it from being difficult and time consuming to easy, efficient, and friendly to carry out.

Major Elements of Loan Origination Automation

Digital Applications: Via an online interface, borrowers can fill in an application form and, as a result – receive a credit. These platforms provide users with guidance and do not allow them to skip any step and omit some important data.

Document Verification: This means that the loan processing system works with verification tools that ensure the authenticity of the documents and avoid any delays in the processing of documents.

Integrated Credit Assessments: Loan automation platforms are capable of real-time data interchange with credit bureaus to obtain credit scores and reports.

loan management system workflow: Transaction type dependent: Some loan products are very different from others, for instance, mortgages, personal loans, etc. These needs can be catered for automatically, guaranteeing that all the various loans yield the desired, efficient processing.

Real-Time Updates: The customers get notified instantly about their application status therefore increasing their trust with the borrowers.

Efficient Borrower and Lender Interfaces

Loan processing eliminates many manual activities that enable borrowers to fill application schedules within minutes and lenders to devote their time to crucial evaluation. This consolidation does away with time wastage and in the process increases the efficiency and accuracy of the business venture as well as decreases operational costs.

How Loan Automation Enhances the Loan Origination Process

Faster Processing Times

Lending platforms have no barriers of automated processes reducing the constraint of manually operated systems. From the moment an application is processed through the moment it is approved, it is done with efficiency. Borrowers are no longer forced to wait for weeks to get approval – most auto systems take hours or only minutes.

Reduced Errors

Adding data manually is very much associated with errors that may cause delays in approval processes or trigger compliance lacunas. Loan automation also provides accuracy when it comes to the data by checking for any problem and alerting a human.

Improved Compliance

Lenders are most concerned with regulatory compliance. In auto loan processing, compliance checks are integrated within the process, so every loan being processed meets the legal specifications. This cuts down on risk and also improves operational soundness.

Personalized Loan Offers

Borrower information is used to deliver loan offers and these offers are in line with a borrower’s financial situation due to machine learning. What is more, it corresponds to borrowers’ needs and at the same time contributes to the company’s loyalty.

Enhanced Collaboration

Loan automation enhances the kind of information sharing within teams. The use of the automated workflow means that activities are smoothly transferred from one department to the other thus eliminating gaps.

Benefits of Loan Origination Automation

Let’s discuss some of the benefits of loan origination automation.

Enhanced Customer Experience

Loan origination automation mainly focuses on convenience to the customer. Customers can apply for loans wherever they are, monitor the status of their applications online, and be responded to in real time. Such fame and easy access are very advantageous in raising customer satisfaction to that level of transparency.

Cost Savings

Owing to automation, such processes do not require much manpower as would be expected. Such cost savings can be plowed back into:

- product development and innovation to source new products.

- improved service delivery to the customers.

Scalability

They facilitate lenders to address more cases while at the same time optimizing in efficiency. Whether at the periods when there is high demand for loans or during the expanding of a company, the loan automation guarantees successful results.

Risk Mitigation

Automated loan processing proves beneficial as it tends to use sophisticated methods for analysing the risks related to the borrowers. Identification of possible risky cases prevents high rates of defaults and enhances portfolio quality.

The Degree of Workflow Implementation Towards Loan Management System

More so, the automated working model would enhance the efficiency of the supplied loan management system where the applications would strictly follow the working model without undue delay. Credit checks, document verification, and approvals are made timely helping to boost the flow of work or business.

Technology in Loan Automation

- Artificial Intelligence (AI) and Machine Learning

Artificial intelligence and machine learning are critical components of current loan processing processes. These technologies use borrower data to assess credit risk, flag fraudulent operations, and recommend product offerings. Machine learning algorithms are constantly being developed making it possible for lenders to use them consequently to further their advantage in decision making.

- Robotic Process Automation (RPA)

They incorporate the following repetitive actions such as the data entry, approval of documents and others, to be processed faster and accurately when undertaken by RPA. In this way, RPA reduces the impact of human interference in a process and fasts up a process.

- Blockchain Technology

Blockchain guarantees clients secure transactions while maintaining high levels of transparency. Since it records all the loan activities then it minimizes fraud and increases trust. Another area that Blockchain incorporates in the loan origination process is document sharing which also makes it easier.

- Cloud Computing

One advantage of cloud-based loan processing systems is that they are generally scalable loan processing systems. They help lenders pull off data remotely and ensure that there is efficiency in the processes, even at busy periods. Cloud solutions also ensure data safety through use of more advanced encryption methods than can be employed by the local IT Department.

Read also -> Mortgage Loan Origination Process

Mortgage Process Automation: A Closer Look

Mortgage lending which is often lauded as a complex process is enhanced greatly by automation. Mortgage process automation is the process of automating through digital technologies the access to credit starting from the pre-qualification stage up to the closing of the credit.

Most Common Benefits Associated with Mortgage Automation

Simplified Pre-Qualification: All the details concerning borrowers’ income, scores, and goals about the debt-to-income ratios are quickly evaluated by Automated systems.

Streamlined Document Management: Digital platforms keep all documents secured and check every document needed to be submitted through online platforms.

Faster Underwriting: The self-learning algorithms used to automate borrower data analysis and underwriting result in shorter loan approval turnaround times.

Improved Compliance: It becomes easier to control all the processes in order to reach the set standards of mortgages thus avoiding risks for the lenders.

Customer Convenience: Mortgage customers can apply online and can sign their documents electronically.

Building an Automated Lending Platform: Best Practices

Understand Your Needs

The studies also highlight the importance of evaluating your organization’s needs before automating the system. Determine regions in your process where it is painful and locate areas that will most benefit from automation.

Choose the Right Technology

Accelerate commitment to elastic and configurable loan processing systems. Make sure that the platform is compatible with your current activities and complies with all the necessary regulations.

Train Your Team

Automated processes do not fully replace one’s need for good employees. Educate your staff on how best to work with the new system available and ensure that they concentrate on important activities that will benefit the organization.

Monitor and Optimize

You need to assess the effectiveness of the given automated processes. Consumer engagement can be improved by using many analytics forms to find areas that need enhancements and improve operational procedures.

Conclusion

Bridging loan automation technology is transforming the lending sector through a faster, efficient, and more client-oriented approach. Currently, AI, RPA, and blockchain can be adopted as tools that help lenders improve their loan origination and management, cut expenses, and guarantee valuable client experiences.

Such technologies facilitate loan origination automation, improve automated loan processing solutions, and optimize LSM, thereby helping financial institutions minimize their cost without devaluing the opportunities for providing relevant and quality client services.

While internet-based lending is revolutionizing the future of finance, loan automation is critical in automating credit decision-making. Loan customers should get flatter, better explained, and more effortless loan experiences due to new technologies in mortgages and automatic loan processing systems. These continue to provide clear and effective processes to lenders as well as borrowers and are of immense value to them.

In general, it is no longer a choice for lenders to integrate automated lending platforms into their borrowing operations. Automation gives us the means of sustaining competitive advantage, legal operational requirements, and the ability to respond to the ever-challenging industrial environment. Through innovative loan processing systems and loan origination automation tools, today’s financial institutions can benefit from a fast-changing market and demand flowing from the need to deliver efficient and satisfactory services.

Internet-based lending is the future of lending and is an important automation of credit decision-making. With more and more financial institutions employing these solutions, borrowers should expect smooth, fully explained, and even convenient loan experiences. For lenders, automation is the means to have in their arsenal the tools that provide them the option to remain thriving, viable, and legal to conduct business in a constantly shifting industry.

Integrating Mortgage Software with LOS and CRM

What a synchronic moment it would be to see that your systems, LOS and CRM, are talking to each other in real-time. The best part is that the data flows easily from one platform to the other! Moreover, all the loan officers also have access to the data. It is imperative to set an example when the information taken from leads syncs with your CRM, too. Hence, the first benefit is that human-driven tasks are handled with automation.

Loan applications are managed faster with few to zero errors! This is possible because the encompass LOS is incorporated with your CRM. And what is the most excellent part of the entire process? Your borrowers will be delighted to have perfect and clear processing—be it acceptance of the application or any other related procedure.

Ready to learn how you can take your lending operations to the next level? Let’s get started and understand the benefits of CRM and LOS integration!

What Are LOS and CRM, and Why Do They Matter?

Loan Origination System (LOS)

LOS is a software used by banks and other financial institutions. It is a full-fledged software that manages the complete loan origination process, from the starting point to the successful closing of the process.

Why does LOS matter?

LOS ensures an efficient loan origination process. It eases the entire process, making it quick and seamless. When the borrower’s experience improves, the customer experience can also be enhanced to encompass software for mortgages. Evaluating the debtor’s credit risk becomes simple.

Customer Relationship Management (CRM)

CRM software manages the entire mechanism of customer relationships. It stores the complete details of the customers’ data, manages communication, and facilitates customer service.

Why Does CRM Matters?

CRM is important as it improves customer retention with a focus on personalized experiences. If a business has a CRM, it can recognize and set new goals. With a unified database and analysis tools, businesses can also make intelligent decisions. So, use CRM to optimize workflows and improve team collaboration in encompass loan origination system specifically!

Defining The Core Components

The Essence of LOS:

Here is what it does for your business:

- With limited human interaction, encompass loan software manages the entire loan application process. Hence, a simplified LOS process minimizes errors and smooths out the application procedure.

- With the incorporation of third-party services, it is easy to reduce the processing times.

Customer Relationship Management (CRM): Your Relationship Power House

Here’s how your CRM impacts your business:

- A CRM can help obtain leads from various sources. Then, all the leads are organized in a centralized hub.

- Personalized communication is easy to manage with a CRM because it has complete details about every borrower.

- The CRM helps in managing long-term relations to refine the opportunities beyond closing the loan.

Why Integration Is Crucial: Unifying Your Systems for Maximum Efficiency

When LOS and CRM come together, a great synergy is created, and your business operations can be improved. Let’s explore the main reasons to integrate LOS with CRM:

- The data flows are seamless between the two. When a lead enters your CRM, the data related to the lead is immediately obtainable.

- Data is auto populated and harmonized in the LOS and CRM systems. Therefore, your business is devoid of human errors and improves the loan origination process.

The Pain Points in Mortgage Lending Without Integration

The lenders have the stress of unintegrated LOS and CRM. Let’s discuss the challenges faced by mortgage lenders:

1. Manual Workflows: The Silent Productivity Killer

Have you ever thought about the silent productivity killer known as manual and repetitive workflows? This becomes the common practice when LOS and CRM are not syncing together.

Here is how it goes:

- Data silos create recurring tasks when a CRM is not connected to LOS. The data silos mean that your team will be doing the same thing repeatedly. Hence, it wastes time and increases cost as well.

- Moreover, the team needs to switch between many platforms while checking for continuous updates and manually updating each one. In such a scenario, important benchmarks can be missed.

2. Customer Experience Challenges: Fragmented Borrower Journeys

Borrowers look for efficient, obvious and approachable processes offered by encompass loan software. Hence, the disconnection of CRM and LOS can be problematic.

Here is how it goes:

- Due to the disconnection of CRM and LOS, the borrower’s information is dispersed across many platforms. This confusion causes the borrower to get different messages from different resources, causing delays and confusion.

- Neither CRM nor LOS is connected. Hence, loan officers use their expertise and professionalism to manually update loan status or input borrower data to various other places. As a result, processing times increase, sometimes even causing loans to get stuck in limbo.

The Benefits of Integrating LOS with Mortgage Software

Right integration brings forth several advantages, like quicker loan approvals and improved risk management, which enhance internal processes and customer satisfaction as well as growth for the business. Let’s discuss some of the most notable advantages of integrating LOS with your encompass mortgage software.

1. Streamline Loan Origination

Loan origination is the heart of mortgage functions. To stay ahead of the competition, it is important to process loans faster and more accurately. Borrowers can submit their documents and data online, and the encompass LOS automatically captures and organizes everything—no more manual entry!

2. Seamless Data Flow Across Teams

Through close coupling of LOS with mortgage software, real-time data transfer across systems is offered. The entire crew works with real-time data, which reduces check-ins and follow-ups while increasing interdisciplinary collaboration.

3. Improved Risk Management

With the integration of mortgage processing software LOS, credit reporting agencies can opt for an improved risk management strategy. Organizations can now make rapid decisions based on their in-house teams’ data without manual assessments or using historical information. This would further augment the approval route and make queries more accurate in risk evaluations.

Read also -> How Much Does It Cost to Build Mortgage CRM Software?

How to Integrate LOS and CRM with Mortgage Software: The Technical Side

When you integrate mortgage LOS software with CRM, you can see the technical complexities too. But worry not! This is needed to improve the experience of the borrowers. So, to make the integration successful, the technical side also needs to be stronger:

- You need to understand how systems collaborate and share data. Incorporating LOS and CRM into mortgage software takes work, and a strong footing and structure are needed.

- When you pick the correct integration tool/framework, it will ultimately be useful in terms of convenience, safety and scalability. So, you need to do proper work on them and test them first.

- Once the testing is completed, the next step is to adopt the best practices for smooth integration with encompass loan software. This begins with clear communication across teams, selecting experienced integration partners, and monitoring and optimizing post-integration.

Real-Life Case Studies: How Integration Transforms Mortgage Lenders’ Operations

Case 1: Small Mortgage Lender Achieves 30% Reduction in Processing Time

The Challenge:

A small mortgage lender was at risk of ineffective workflows. Both LOS and CRM operated in isolation, causing a vast gap in data entry errors, processing time, and borrowers’ satisfaction. Manual data entry slowed down the whole process from lead capturing to document submission, affecting borrower satisfaction and employee output.

The Solution:

Lender found a way to integrate LOS encompass with CRM so that it acts like a wholesome system. This system will reduce errors through automated data entry and other efficient processes.

The Outcomes:

- As there were no manual processes and the workflows were also automated, loan officers reported a 30% reduction in processing times.

- Borrower satisfaction was improved because of automated collaboration and instantaneous updates.

- The team gets a chance to look after more loans without onboarding more experts.

Key Takeaways:

- Minimized processing times

- Better borrower relationships

- Competitive edge

Case 2: Mid-Size Lender Increases Lead-to-Loan Conversion and Marketing ROI

The Challenge:

A lender was experiencing problems related to lead management and conversion tracking. He could not manage the leads, which were dispersed across many platforms. As the CRM was not linked to their LOS, the information of the leads was entered manually. Eventually, the loan officers couldn’t pick the most valuable potential clients.

The Solution:

When the lender connects the CRM with the LOS, he can generate constant data flow. The CRM fetches all the leads, no matter the type of channel. Moreover, the sales team cherry-picks those leads that are eligible for obtaining a loan and are also based on engagement. Not to forget, the lender also sets clear goals relevant to sending tailored emails, giving offers of customized loan products, etc.

The Results:

- 25% boost in conversion (Request to loan)

- 20% increased marketing ROI

- 15% improved retention rates

Key Takeaways:

- Automatically track leads

- Move them through the funnel

- Upkeep tailored communication

- Higher ROI and overall improved performance

Overcoming Common Challenges in Integration

Data Mapping and Consistency:

Inconsistent data formats can create many problems. This is very common when integrating encompass loan origination system, CRM and mortgage software. Therefore, the solution is to perform data auditing and systemize the process of mapping data. Once the integration is set up, running test cycles is essential to ensure stability and accuracy.

System Compatibility Issues:

System compatibility issues may arise because the old data doesn’t fit the modern technologies and protocols. Such problems can cause data silos. Hence, the solutions are to begin by identifying the most critical integrations in encompass software for mortgage. Moreover, an API gateway can help bridge the gap between the old and the new systems. You can also integrate LOS and CRM fruitfully by investing in the latest cloud solution.

ROI of Integrating Mortgage Software with LOS and CRM

Short-Term vs. Long-Term Benefits: Immediate Gains and Future Growth

| Immediate Benefits | Long-term Benefits |

| 1. With automation, the processing times can be faster as there are also fewer manual steps. 2. The borrower can be satisfied with enhanced communication, real-time data flow and quicker responses. 3. Sound integration between CRM and LOS can significantly reduce errors, such as incomplete loan applications. | 1. Higher lead conversion rates are one of the long-term benefits of syncing CRM with LOS. Moreover, you can develop solid relationships with clients. 2. Integration of CRM with encompass LOS fosters operational efficiency across many departments, which improves the output of the team. 3. When you reduce the overall costs by operating efficiently, you can grow your business more and improve customer service with LOS mortgage software. |

Cost vs. Value: Is the Investment Worth It?

| Breaking Down The Costs | Weighing The Value |

| 1. License and subscription fees are charged by both LOS and CRM. Hence, you can adopt cloud-based software solutions that encourage reduced costs and scalability. 2. Training costs arise to speed up the team’s functionality through manuals, sessions, etc. However, this training also hampers the daily tasks, which is ultimately a disadvantage. | 1. The faster loan processing means that your team can look after multiple loan applications at one time. 2. With integration for mortgage LOS software, data flows can be improved, and errors can be reduced. Hence, there is no need for expensive rework or involvement in legal matters. 3. The smoother the experience, the better will be customer retention. |

The Future of Mortgage Software Integration

Artificial Intelligence and Automation

Thanks to AI, mortgage processing software LOS integration could be improved with the help of AI-powered application processing. This means that with the help of AI, loan applications can be automated. Moreover, the Chatbots and virtual assistants will provide excellent support without the need for a human as an agent. For timely communication, AI also backs automated CRM collaboration where the CRM offers tailored products according to the needs of the clients.

The Role of Data Analytics in Integration

When you integrate data analytics with your encompass loan origination system, you can get great data-driven insights. This way, lenders can improve the processes, and your team can look after all the processes, too. In addition, data analytics can also foster excellent customer retention. The team can aim for targeted strategies where the borrowers can get refinancing options or tailored customer support from you.

How to Get Started: A Step-by-Step Guide for Lenders

Step 1: Assess Your Present Systems

In the first step, it is essential to audit the current encompass LOS and CRM. It is vital to ensure they are working according to business needs. Next, you should identify the integration gaps, which means that data silos can cause problems. Also, there is a need to list down the primary needs of the documents; in other words, look for the right features for integration.

Step 2: Choose the Right Integration Tools

Step 2 refers to selecting suitable integration tools that simplify LOS and CRM integration. Indeed, the right tools are helpful to ease communication, reduce data silos and streamline workflows.

Step 3: Partner with Experts

In the third step, contact the specialized experts who promise efficiency and profitable integration in encompass LOS software. Indeed, the experts have a comprehensive understanding of both LOS and CRM. If you need clarification on their competencies, you can access testimonials about them and evaluate their track record. Next, you can share the benchmarks and expectations with the experts. These details include the deadline for completing the project and make them understand the responsibilities, too.

Step 4: Develop a Roadmap for Successful Integration

When you develop a transparent and detailed roadmap, you can ensure your project has a clear timeline. Moreover, the roadmap also entails clear milestones to guarantee that the project development aligns with the goals. You can get all the stakeholders involved to care for the company goals for more relevancy.

Step 5: Test, Train, and Deploy: Ensuring Smooth Adoption

In the last step, testing, training, and deployment are undertaken. These three processes will ensure that the integrated LOS and CRM reflect a seamless transition in mortgage processing software LOS. This will also reduce the chances of errors. The 24/7 support system ensures the streamlined process is completed and integrated across the company.

Conclusion: Why Integration is the Future of Mortgage Lending

In today’s fast-paced world, integration of LOS and CRM is beneficial. For businesses that want to strive, seamless integration of LOS and CRM to encompass software for mortgage is essential. All these points out that in today’s world, automated workflow integration has become an essential tool for modern mortgage lenders. To make the most of the future, one must use technology to automate business processes and improve customer experience.

In the loan mortgage industry, time is money. So, the faster you decide, the better it is to stay ahead of the competitors. Every day matters, and you might be vulnerable to regretting the missed opportunities. So, set up your company for the desirable success with custom mortgage software development. An innovative service and a tailored borrower experience are the success factors behind the scenes!