Custom Mortgage Website Design & Development

Are you tired of blending into the crowd with generic mortgage websites that fail to capture the essence of your brand? There’s nothing to worry about with ATI by your side. We build the best custom mortgage websites, ready to deliver the ultimate digital experience to your customers. We are focused on serving everyone involved in the lending sector: loan officers, mortgage brokers, agents, and small to big mortgage companies. Each of our bespoke mortgage website design and development efforts replicates your brand identity and is bound to help you generate leads.

It's Time To Get

The Best Bespoke Mortgage Website Design

There’s a reason the mortgage world trusts us with one of their most important business aspects – their digital identity. We custom-build your mortgage websites, which means they can include everything you want to run your business smoothly without switching to different tools or platforms. Known as the #1 tailored website builders for mortgage brokers, teams, and companies, we don’t let you settle for anything less than extraordinary. When your clients are happy with your service, your business grows. With your company making profits, we are progressing in the right direction. And nothing makes us happier and more motivated than to see you succeed!

Top Mortgage Websites Tailored

For Loan Officers, Brokers, & Lenders

We have been building mortgage websites for decades, and we know all the ins and outs of the business. Over the years, we’ve helped hundreds of lending companies and individual mortgage loan officers, brokers, and bankers create an unforgettable online presence with powerful, professional, and affordable websites that boost sales. Equipped with the necessary tools and modern web designs, it’s all that mortgage loan originators need to become more successful. Inspire, convey competence, and watch as your loan opportunities multiply.

We are a Professional And Affordable

Loan Website Design Company

We build bespoke mortgage websites to be compatible across all devices, customized to reach larger audiences, and fully loaded with tools and automation that lending companies, mortgage brokers, or loan officers need. Featuring easy modification capabilities, we can change the menus, icons, colors, or anything else you feel can create a more personalized experience for your employees. Let us design and build your website while you focus on what you do best – mortgages.

Did you know…

We ensure only good things happen to your visitors, and they soon become customers. We design intuitive user experiences with swift navigation on mobile devices so your potential clients always get the best of your impression.

Loan Website Design Company

Mobile Friendly

We make sure you get a responsive design for flawless viewing across devices.

Landing Pages

We help drive your product or service promotion with impactful landing pages.

Easily Update Content

Effortlessly update content, add images, and optimize for Google.

Webstats & Analytics

We can also include web stats and analytics, including Google Analytics integration.

Domain Names & Email

We can purchase the domain name for you and set up an email account.

SSL Built-in

Your website will have a built-in SSL for clients' trust-building with the green lock.

Lead Capture

You get to experience streamlined lead capture for easy tracking of website leads.

Live Chat

With premium chat incorporated on your website, make sure your visitors always have someone for their assistance.

Broker/Owner Solutions

With us, you have complete web solutions for brokers and company owners.

Automation

We help you with time-saving automation of news feeds, rates, and more.

Amazing Add-Ons

We offer a range of powerful add-ons and 3rd party widgets so your website has it all.

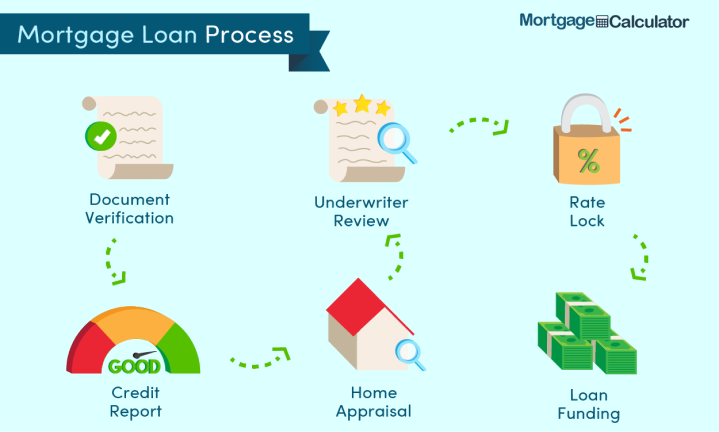

Loan Process Pages

We can create different pages for every stage of the mortgage loan process.

Content Ready

We can also provide content ready for Mortgage and Real Estate sites.

Additional PopUps

Do you love popups? We can include several CTAs, so there's no chance of missing a lead.

Mortgage Calculator

We can add a mortgage calculator to your site so potential customers can draw their budget then and there.

Top Rated Custom Mortgage Broker Website

Latest Tech Stack

We know you only want the best bespoke website for your mortgage business. We design websites that incorporate the latest trends and use next-generation tech so you always stay one step ahead of the competition.

Scalability

As the mortgage industry changes or your business grows, your bespoke website can respond effectively to new dynamics. Addition of a new branch or a couple of new officers? Everything is manageable.

![{"type":"elementor","siteurl":"https://p3d.34b.myftpupload.com/wp-json/","elements":[{"id":"069e0d2","elType":"widget","isInner":false,"isLocked":false,"settings":{"image":{"url":"https://staging.awesometechinc.com/wp-content/uploads/2023/09/Vector-Smart-Object-1.png","id":9844,"size":"","alt":"","source":"library"},"title_text":"Easy Access Anywhere, Anytime","description_text":" Our mobile-friendly design ensures you can effortlessly access your dashboards and reports from any location, providing unparalleled convenience.\n","text_align":"left","image_space":{"unit":"px","size":0,"sizes":[]},"title_bottom_space":{"unit":"px","size":5,"sizes":[]},"description_typography_typography":"custom","description_typography_font_family":"Lato","description_typography_font_size":{"unit":"px","size":20,"sizes":[]},"description_typography_font_weight":"400","description_typography_line_height":{"unit":"px","size":30,"sizes":[]},"_element_width":"initial","_element_custom_width":{"unit":"%","size":94.421},"_css_classes":"bx-featurelead","__globals__":{"title_typography_typography":"globals/typography?id=47b7720","description_typography_typography":""},"cards_title_title_typography_typography":"custom","cards_title_title_typography_font_family":"Roboto","cards_title_title_typography_font_size":{"unit":"px","size":30,"sizes":[]},"cards_title_title_typography_font_weight":"700","cards_meta_title_typography_typography":"custom","cards_meta_title_typography_font_family":"Roboto","cards_meta_title_typography_font_size":{"unit":"px","size":16,"sizes":[]},"cards_meta_title_typography_font_weight":"700","cards_meta_title_typography_line_height":{"unit":"em","size":"","sizes":[]},"cards_meta_title_typography_word_spacing":{"unit":"em","size":"","sizes":[]},"cards_excerpt_title_typography_typography":"custom","cards_excerpt_title_typography_font_family":"Roboto","cards_excerpt_title_typography_font_size":{"unit":"px","size":22,"sizes":[]},"cards_excerpt_title_typography_font_weight":"400","cards_excerpt_title_typography_line_height":{"unit":"px","size":30,"sizes":[]},"cards_read_more_title_typography_typography":"custom","cards_read_more_title_typography_font_family":"Roboto","cards_read_more_title_typography_font_size":{"unit":"px","size":18,"sizes":[]},"cards_read_more_title_typography_font_weight":"600","cards_read_more_title_typography_line_height":{"unit":"em","size":"","sizes":[]},"cards_read_more_title_typography_word_spacing":{"unit":"em","size":"","sizes":[]},"thumbnail_size":"full","thumbnail_custom_dimension":{"width":"","height":""},"link":{"url":"","is_external":"","nofollow":"","custom_attributes":""},"title_size":"h3","view":"traditional","position":"top","content_vertical_alignment":"top","text_align_tablet":"","text_align_mobile":"","image_space_tablet":{"unit":"px","size":"","sizes":[]},"image_space_mobile":{"unit":"px","size":"","sizes":[]},"image_size":{"unit":"%","size":30,"sizes":[]},"image_size_tablet":{"unit":"%","size":"","sizes":[]},"image_size_mobile":{"unit":"%","size":"","sizes":[]},"image_border_border":"","image_border_width":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"image_border_width_tablet":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"image_border_width_mobile":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"image_border_color":"","image_border_radius":{"unit":"px","size":"","sizes":[]},"image_border_radius_tablet":{"unit":"px","size":"","sizes":[]},"image_border_radius_mobile":{"unit":"px","size":"","sizes":[]},"hover_animation":"","css_filters_css_filter":"","css_filters_blur":{"unit":"px","size":0,"sizes":[]},"css_filters_brightness":{"unit":"px","size":100,"sizes":[]},"css_filters_contrast":{"unit":"px","size":100,"sizes":[]},"css_filters_saturate":{"unit":"px","size":100,"sizes":[]},"css_filters_hue":{"unit":"px","size":0,"sizes":[]},"image_opacity":{"unit":"px","size":"","sizes":[]},"background_hover_transition":{"unit":"px","size":0.3,"sizes":[]},"css_filters_hover_css_filter":"","css_filters_hover_blur":{"unit":"px","size":0,"sizes":[]},"css_filters_hover_brightness":{"unit":"px","size":100,"sizes":[]},"css_filters_hover_contrast":{"unit":"px","size":100,"sizes":[]},"css_filters_hover_saturate":{"unit":"px","size":100,"sizes":[]},"css_filters_hover_hue":{"unit":"px","size":0,"sizes":[]},"image_opacity_hover":{"unit":"px","size":"","sizes":[]},"title_bottom_space_tablet":{"unit":"px","size":"","sizes":[]},"title_bottom_space_mobile":{"unit":"px","size":"","sizes":[]},"title_color":"","title_typography_typography":"","title_typography_font_family":"","title_typography_font_size":{"unit":"px","size":"","sizes":[]},"title_typography_font_size_tablet":{"unit":"px","size":"","sizes":[]},"title_typography_font_size_mobile":{"unit":"px","size":"","sizes":[]},"title_typography_font_weight":"","title_typography_text_transform":"","title_typography_font_style":"","title_typography_text_decoration":"","title_typography_line_height":{"unit":"px","size":"","sizes":[]},"title_typography_line_height_tablet":{"unit":"em","size":"","sizes":[]},"title_typography_line_height_mobile":{"unit":"em","size":"","sizes":[]},"title_typography_letter_spacing":{"unit":"px","size":"","sizes":[]},"title_typography_letter_spacing_tablet":{"unit":"px","size":"","sizes":[]},"title_typography_letter_spacing_mobile":{"unit":"px","size":"","sizes":[]},"title_typography_word_spacing":{"unit":"px","size":"","sizes":[]},"title_typography_word_spacing_tablet":{"unit":"em","size":"","sizes":[]},"title_typography_word_spacing_mobile":{"unit":"em","size":"","sizes":[]},"title_stroke_text_stroke_type":"","title_stroke_text_stroke":{"unit":"px","size":"","sizes":[]},"title_stroke_text_stroke_tablet":{"unit":"px","size":"","sizes":[]},"title_stroke_text_stroke_mobile":{"unit":"px","size":"","sizes":[]},"title_stroke_stroke_color":"#000","title_shadow_text_shadow_type":"","title_shadow_text_shadow":{"horizontal":0,"vertical":0,"blur":10,"color":"rgba(0,0,0,0.3)"},"description_color":"","description_typography_font_size_tablet":{"unit":"px","size":"","sizes":[]},"description_typography_font_size_mobile":{"unit":"px","size":"","sizes":[]},"description_typography_text_transform":"","description_typography_font_style":"","description_typography_text_decoration":"","description_typography_line_height_tablet":{"unit":"em","size":"","sizes":[]},"description_typography_line_height_mobile":{"unit":"em","size":"","sizes":[]},"description_typography_letter_spacing":{"unit":"px","size":"","sizes":[]},"description_typography_letter_spacing_tablet":{"unit":"px","size":"","sizes":[]},"description_typography_letter_spacing_mobile":{"unit":"px","size":"","sizes":[]},"description_typography_word_spacing":{"unit":"px","size":"","sizes":[]},"description_typography_word_spacing_tablet":{"unit":"em","size":"","sizes":[]},"description_typography_word_spacing_mobile":{"unit":"em","size":"","sizes":[]},"description_shadow_text_shadow_type":"","description_shadow_text_shadow":{"horizontal":0,"vertical":0,"blur":10,"color":"rgba(0,0,0,0.3)"},"_title":"","_margin":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"_margin_tablet":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"_margin_mobile":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"_padding":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"_padding_tablet":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"_padding_mobile":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"_element_width_tablet":"","_element_width_mobile":"","_element_custom_width_tablet":{"unit":"px","size":"","sizes":[]},"_element_custom_width_mobile":{"unit":"px","size":"","sizes":[]},"_element_vertical_align":"","_element_vertical_align_tablet":"","_element_vertical_align_mobile":"","_position":"","_offset_orientation_h":"start","_offset_x":{"unit":"px","size":"0","sizes":[]},"_offset_x_tablet":{"unit":"px","size":"","sizes":[]},"_offset_x_mobile":{"unit":"px","size":"","sizes":[]},"_offset_x_end":{"unit":"px","size":"0","sizes":[]},"_offset_x_end_tablet":{"unit":"px","size":"","sizes":[]},"_offset_x_end_mobile":{"unit":"px","size":"","sizes":[]},"_offset_orientation_v":"start","_offset_y":{"unit":"px","size":"0","sizes":[]},"_offset_y_tablet":{"unit":"px","size":"","sizes":[]},"_offset_y_mobile":{"unit":"px","size":"","sizes":[]},"_offset_y_end":{"unit":"px","size":"0","sizes":[]},"_offset_y_end_tablet":{"unit":"px","size":"","sizes":[]},"_offset_y_end_mobile":{"unit":"px","size":"","sizes":[]},"_z_index":"","_z_index_tablet":"","_z_index_mobile":"","_element_id":"","ha_floating_fx":"","ha_floating_fx_translate_toggle":"","ha_floating_fx_translate_x":{"unit":"px","size":"","sizes":{"from":0,"to":5}},"ha_floating_fx_translate_y":{"unit":"px","size":"","sizes":{"from":0,"to":5}},"ha_floating_fx_translate_duration":{"unit":"px","size":1000,"sizes":[]},"ha_floating_fx_translate_delay":{"unit":"px","size":"","sizes":[]},"ha_floating_fx_rotate_toggle":"","ha_floating_fx_rotate_x":{"unit":"px","size":"","sizes":{"from":0,"to":45}},"ha_floating_fx_rotate_y":{"unit":"px","size":"","sizes":{"from":0,"to":45}},"ha_floating_fx_rotate_z":{"unit":"px","size":"","sizes":{"from":0,"to":45}},"ha_floating_fx_rotate_duration":{"unit":"px","size":1000,"sizes":[]},"ha_floating_fx_rotate_delay":{"unit":"px","size":"","sizes":[]},"ha_floating_fx_scale_toggle":"","ha_floating_fx_scale_x":{"unit":"px","size":"","sizes":{"from":1,"to":1.2}},"ha_floating_fx_scale_y":{"unit":"px","size":"","sizes":{"from":1,"to":1.2}},"ha_floating_fx_scale_duration":{"unit":"px","size":1000,"sizes":[]},"ha_floating_fx_scale_delay":{"unit":"px","size":"","sizes":[]},"ha_element_link":{"url":"","is_external":"","nofollow":"","custom_attributes":""},"ha_transform_fx":"","ha_transform_fx_translate_toggle":"","ha_transform_fx_translate_x":{"unit":"px","size":"","sizes":[]},"ha_transform_fx_translate_x_tablet":{"unit":"px","size":"","sizes":[]},"ha_transform_fx_translate_x_mobile":{"unit":"px","size":"","sizes":[]},"ha_transform_fx_translate_y":{"unit":"px","size":"","sizes":[]},"ha_transform_fx_translate_y_tablet":{"unit":"px","size":"","sizes":[]},"ha_transform_fx_translate_y_mobile":{"unit":"px","size":"","sizes":[]},"ha_transform_fx_rotate_toggle":"","ha_transform_fx_rotate_mode":"loose","ha_transform_fx_rotate_x":{"unit":"px","size":"","sizes":[]},"ha_transform_fx_rotate_x_tablet":{"unit":"px","size":"","sizes":[]},"ha_transform_fx_rotate_x_mobile":{"unit":"px","size":"","sizes":[]},"ha_transform_fx_rotate_y":{"unit":"px","size":"","sizes":[]},"ha_transform_fx_rotate_y_tablet":{"unit":"px","size":"","sizes":[]},"ha_transform_fx_rotate_y_mobile":{"unit":"px","size":"","sizes":[]},"ha_transform_fx_rotate_z":{"unit":"px","size":"","sizes":[]},"ha_transform_fx_rotate_z_tablet":{"unit":"px","size":"","sizes":[]},"ha_transform_fx_rotate_z_mobile":{"unit":"px","size":"","sizes":[]},"ha_transform_fx_scale_toggle":"","ha_transform_fx_scale_mode":"loose","ha_transform_fx_scale_x":{"unit":"px","size":1,"sizes":[]},"ha_transform_fx_scale_x_tablet":{"unit":"px","size":"","sizes":[]},"ha_transform_fx_scale_x_mobile":{"unit":"px","size":"","sizes":[]},"ha_transform_fx_scale_y":{"unit":"px","size":1,"sizes":[]},"ha_transform_fx_scale_y_tablet":{"unit":"px","size":"","sizes":[]},"ha_transform_fx_scale_y_mobile":{"unit":"px","size":"","sizes":[]},"ha_transform_fx_skew_toggle":"","ha_transform_fx_skew_x":{"unit":"px","size":"","sizes":[]},"ha_transform_fx_skew_x_tablet":{"unit":"px","size":"","sizes":[]},"ha_transform_fx_skew_x_mobile":{"unit":"px","size":"","sizes":[]},"ha_transform_fx_skew_y":{"unit":"px","size":"","sizes":[]},"ha_transform_fx_skew_y_tablet":{"unit":"px","size":"","sizes":[]},"ha_transform_fx_skew_y_mobile":{"unit":"px","size":"","sizes":[]},"ha_transform_fx_translate_toggle_hover":"","ha_transform_fx_translate_x_hover":{"unit":"px","size":"","sizes":[]},"ha_transform_fx_translate_x_hover_tablet":{"unit":"px","size":"","sizes":[]},"ha_transform_fx_translate_x_hover_mobile":{"unit":"px","size":"","sizes":[]},"ha_transform_fx_translate_y_hover":{"unit":"px","size":"","sizes":[]},"ha_transform_fx_translate_y_hover_tablet":{"unit":"px","size":"","sizes":[]},"ha_transform_fx_translate_y_hover_mobile":{"unit":"px","size":"","sizes":[]},"ha_transform_fx_rotate_toggle_hover":"","ha_transform_fx_rotate_mode_hover":"loose","ha_transform_fx_rotate_x_hover":{"unit":"px","size":"","sizes":[]},"ha_transform_fx_rotate_x_hover_tablet":{"unit":"px","size":"","sizes":[]},"ha_transform_fx_rotate_x_hover_mobile":{"unit":"px","size":"","sizes":[]},"ha_transform_fx_rotate_y_hover":{"unit":"px","size":"","sizes":[]},"ha_transform_fx_rotate_y_hover_tablet":{"unit":"px","size":"","sizes":[]},"ha_transform_fx_rotate_y_hover_mobile":{"unit":"px","size":"","sizes":[]},"ha_transform_fx_rotate_z_hover":{"unit":"px","size":"","sizes":[]},"ha_transform_fx_rotate_z_hover_tablet":{"unit":"px","size":"","sizes":[]},"ha_transform_fx_rotate_z_hover_mobile":{"unit":"px","size":"","sizes":[]},"ha_transform_fx_scale_toggle_hover":"","ha_transform_fx_scale_mode_hover":"loose","ha_transform_fx_scale_x_hover":{"unit":"px","size":1,"sizes":[]},"ha_transform_fx_scale_x_hover_tablet":{"unit":"px","size":"","sizes":[]},"ha_transform_fx_scale_x_hover_mobile":{"unit":"px","size":"","sizes":[]},"ha_transform_fx_scale_y_hover":{"unit":"px","size":1,"sizes":[]},"ha_transform_fx_scale_y_hover_tablet":{"unit":"px","size":"","sizes":[]},"ha_transform_fx_scale_y_hover_mobile":{"unit":"px","size":"","sizes":[]},"ha_transform_fx_skew_toggle_hover":"","ha_transform_fx_skew_x_hover":{"unit":"px","size":"","sizes":[]},"ha_transform_fx_skew_x_hover_tablet":{"unit":"px","size":"","sizes":[]},"ha_transform_fx_skew_x_hover_mobile":{"unit":"px","size":"","sizes":[]},"ha_transform_fx_skew_y_hover":{"unit":"px","size":"","sizes":[]},"ha_transform_fx_skew_y_hover_tablet":{"unit":"px","size":"","sizes":[]},"ha_transform_fx_skew_y_hover_mobile":{"unit":"px","size":"","sizes":[]},"ha_transform_fx_transition_duration":{"unit":"px","size":"","sizes":[]},"motion_fx_motion_fx_scrolling":"","motion_fx_translateY_effect":"","motion_fx_translateY_direction":"","motion_fx_translateY_speed":{"unit":"px","size":4,"sizes":[]},"motion_fx_translateY_affectedRange":{"unit":"%","size":"","sizes":{"start":0,"end":100}},"motion_fx_translateX_effect":"","motion_fx_translateX_direction":"","motion_fx_translateX_speed":{"unit":"px","size":4,"sizes":[]},"motion_fx_translateX_affectedRange":{"unit":"%","size":"","sizes":{"start":0,"end":100}},"motion_fx_opacity_effect":"","motion_fx_opacity_direction":"out-in","motion_fx_opacity_level":{"unit":"px","size":10,"sizes":[]},"motion_fx_opacity_range":{"unit":"%","size":"","sizes":{"start":20,"end":80}},"motion_fx_blur_effect":"","motion_fx_blur_direction":"out-in","motion_fx_blur_level":{"unit":"px","size":7,"sizes":[]},"motion_fx_blur_range":{"unit":"%","size":"","sizes":{"start":20,"end":80}},"motion_fx_rotateZ_effect":"","motion_fx_rotateZ_direction":"","motion_fx_rotateZ_speed":{"unit":"px","size":1,"sizes":[]},"motion_fx_rotateZ_affectedRange":{"unit":"%","size":"","sizes":{"start":0,"end":100}},"motion_fx_scale_effect":"","motion_fx_scale_direction":"out-in","motion_fx_scale_speed":{"unit":"px","size":4,"sizes":[]},"motion_fx_scale_range":{"unit":"%","size":"","sizes":{"start":20,"end":80}},"motion_fx_transform_origin_x":"center","motion_fx_transform_origin_y":"center","motion_fx_devices":["desktop","tablet","mobile"],"motion_fx_range":"","motion_fx_motion_fx_mouse":"","motion_fx_mouseTrack_effect":"","motion_fx_mouseTrack_direction":"","motion_fx_mouseTrack_speed":{"unit":"px","size":1,"sizes":[]},"motion_fx_tilt_effect":"","motion_fx_tilt_direction":"","motion_fx_tilt_speed":{"unit":"px","size":4,"sizes":[]},"sticky":"","sticky_on":["desktop","tablet","mobile"],"sticky_offset":0,"sticky_offset_tablet":"","sticky_offset_mobile":"","sticky_effects_offset":0,"sticky_effects_offset_tablet":"","sticky_effects_offset_mobile":"","sticky_parent":"","_animation":"","_animation_tablet":"","_animation_mobile":"","animation_duration":"","_animation_delay":"","_transform_rotate_popover":"","_transform_rotateZ_effect":{"unit":"px","size":"","sizes":[]},"_transform_rotateZ_effect_tablet":{"unit":"deg","size":"","sizes":[]},"_transform_rotateZ_effect_mobile":{"unit":"deg","size":"","sizes":[]},"_transform_rotate_3d":"","_transform_rotateX_effect":{"unit":"px","size":"","sizes":[]},"_transform_rotateX_effect_tablet":{"unit":"deg","size":"","sizes":[]},"_transform_rotateX_effect_mobile":{"unit":"deg","size":"","sizes":[]},"_transform_rotateY_effect":{"unit":"px","size":"","sizes":[]},"_transform_rotateY_effect_tablet":{"unit":"deg","size":"","sizes":[]},"_transform_rotateY_effect_mobile":{"unit":"deg","size":"","sizes":[]},"_transform_perspective_effect":{"unit":"px","size":"","sizes":[]},"_transform_perspective_effect_tablet":{"unit":"px","size":"","sizes":[]},"_transform_perspective_effect_mobile":{"unit":"px","size":"","sizes":[]},"_transform_translate_popover":"","_transform_translateX_effect":{"unit":"px","size":"","sizes":[]},"_transform_translateX_effect_tablet":{"unit":"px","size":"","sizes":[]},"_transform_translateX_effect_mobile":{"unit":"px","size":"","sizes":[]},"_transform_translateY_effect":{"unit":"px","size":"","sizes":[]},"_transform_translateY_effect_tablet":{"unit":"px","size":"","sizes":[]},"_transform_translateY_effect_mobile":{"unit":"px","size":"","sizes":[]},"_transform_scale_popover":"","_transform_keep_proportions":"yes","_transform_scale_effect":{"unit":"px","size":"","sizes":[]},"_transform_scale_effect_tablet":{"unit":"px","size":"","sizes":[]},"_transform_scale_effect_mobile":{"unit":"px","size":"","sizes":[]},"_transform_scaleX_effect":{"unit":"px","size":"","sizes":[]},"_transform_scaleX_effect_tablet":{"unit":"px","size":"","sizes":[]},"_transform_scaleX_effect_mobile":{"unit":"px","size":"","sizes":[]},"_transform_scaleY_effect":{"unit":"px","size":"","sizes":[]},"_transform_scaleY_effect_tablet":{"unit":"px","size":"","sizes":[]},"_transform_scaleY_effect_mobile":{"unit":"px","size":"","sizes":[]},"_transform_skew_popover":"","_transform_skewX_effect":{"unit":"px","size":"","sizes":[]},"_transform_skewX_effect_tablet":{"unit":"deg","size":"","sizes":[]},"_transform_skewX_effect_mobile":{"unit":"deg","size":"","sizes":[]},"_transform_skewY_effect":{"unit":"px","size":"","sizes":[]},"_transform_skewY_effect_tablet":{"unit":"deg","size":"","sizes":[]},"_transform_skewY_effect_mobile":{"unit":"deg","size":"","sizes":[]},"_transform_flipX_effect":"","_transform_flipY_effect":"","_transform_rotate_popover_hover":"","_transform_rotateZ_effect_hover":{"unit":"px","size":"","sizes":[]},"_transform_rotateZ_effect_hover_tablet":{"unit":"deg","size":"","sizes":[]},"_transform_rotateZ_effect_hover_mobile":{"unit":"deg","size":"","sizes":[]},"_transform_rotate_3d_hover":"","_transform_rotateX_effect_hover":{"unit":"px","size":"","sizes":[]},"_transform_rotateX_effect_hover_tablet":{"unit":"deg","size":"","sizes":[]},"_transform_rotateX_effect_hover_mobile":{"unit":"deg","size":"","sizes":[]},"_transform_rotateY_effect_hover":{"unit":"px","size":"","sizes":[]},"_transform_rotateY_effect_hover_tablet":{"unit":"deg","size":"","sizes":[]},"_transform_rotateY_effect_hover_mobile":{"unit":"deg","size":"","sizes":[]},"_transform_perspective_effect_hover":{"unit":"px","size":"","sizes":[]},"_transform_perspective_effect_hover_tablet":{"unit":"px","size":"","sizes":[]},"_transform_perspective_effect_hover_mobile":{"unit":"px","size":"","sizes":[]},"_transform_translate_popover_hover":"","_transform_translateX_effect_hover":{"unit":"px","size":"","sizes":[]},"_transform_translateX_effect_hover_tablet":{"unit":"px","size":"","sizes":[]},"_transform_translateX_effect_hover_mobile":{"unit":"px","size":"","sizes":[]},"_transform_translateY_effect_hover":{"unit":"px","size":"","sizes":[]},"_transform_translateY_effect_hover_tablet":{"unit":"px","size":"","sizes":[]},"_transform_translateY_effect_hover_mobile":{"unit":"px","size":"","sizes":[]},"_transform_scale_popover_hover":"","_transform_keep_proportions_hover":"yes","_transform_scale_effect_hover":{"unit":"px","size":"","sizes":[]},"_transform_scale_effect_hover_tablet":{"unit":"px","size":"","sizes":[]},"_transform_scale_effect_hover_mobile":{"unit":"px","size":"","sizes":[]},"_transform_scaleX_effect_hover":{"unit":"px","size":"","sizes":[]},"_transform_scaleX_effect_hover_tablet":{"unit":"px","size":"","sizes":[]},"_transform_scaleX_effect_hover_mobile":{"unit":"px","size":"","sizes":[]},"_transform_scaleY_effect_hover":{"unit":"px","size":"","sizes":[]},"_transform_scaleY_effect_hover_tablet":{"unit":"px","size":"","sizes":[]},"_transform_scaleY_effect_hover_mobile":{"unit":"px","size":"","sizes":[]},"_transform_skew_popover_hover":"","_transform_skewX_effect_hover":{"unit":"px","size":"","sizes":[]},"_transform_skewX_effect_hover_tablet":{"unit":"deg","size":"","sizes":[]},"_transform_skewX_effect_hover_mobile":{"unit":"deg","size":"","sizes":[]},"_transform_skewY_effect_hover":{"unit":"px","size":"","sizes":[]},"_transform_skewY_effect_hover_tablet":{"unit":"deg","size":"","sizes":[]},"_transform_skewY_effect_hover_mobile":{"unit":"deg","size":"","sizes":[]},"_transform_flipX_effect_hover":"","_transform_flipY_effect_hover":"","_transform_transition_hover":{"unit":"px","size":"","sizes":[]},"motion_fx_transform_x_anchor_point":"","motion_fx_transform_x_anchor_point_tablet":"","motion_fx_transform_x_anchor_point_mobile":"","motion_fx_transform_y_anchor_point":"","motion_fx_transform_y_anchor_point_tablet":"","motion_fx_transform_y_anchor_point_mobile":"","_background_background":"","_background_color":"","_background_color_stop":{"unit":"%","size":0,"sizes":[]},"_background_color_b":"#f2295b","_background_color_b_stop":{"unit":"%","size":100,"sizes":[]},"_background_gradient_type":"linear","_background_gradient_angle":{"unit":"deg","size":180,"sizes":[]},"_background_gradient_position":"center center","_background_image":{"url":"","id":"","size":""},"_background_image_tablet":{"url":"","id":"","size":""},"_background_image_mobile":{"url":"","id":"","size":""},"_background_position":"","_background_position_tablet":"","_background_position_mobile":"","_background_xpos":{"unit":"px","size":0,"sizes":[]},"_background_xpos_tablet":{"unit":"px","size":0,"sizes":[]},"_background_xpos_mobile":{"unit":"px","size":0,"sizes":[]},"_background_ypos":{"unit":"px","size":0,"sizes":[]},"_background_ypos_tablet":{"unit":"px","size":0,"sizes":[]},"_background_ypos_mobile":{"unit":"px","size":0,"sizes":[]},"_background_attachment":"","_background_repeat":"","_background_repeat_tablet":"","_background_repeat_mobile":"","_background_size":"","_background_size_tablet":"","_background_size_mobile":"","_background_bg_width":{"unit":"%","size":100,"sizes":[]},"_background_bg_width_tablet":{"unit":"px","size":"","sizes":[]},"_background_bg_width_mobile":{"unit":"px","size":"","sizes":[]},"_background_video_link":"","_background_video_start":"","_background_video_end":"","_background_play_once":"","_background_play_on_mobile":"","_background_privacy_mode":"","_background_video_fallback":{"url":"","id":"","size":""},"_background_slideshow_gallery":[],"_background_slideshow_loop":"yes","_background_slideshow_slide_duration":5000,"_background_slideshow_slide_transition":"fade","_background_slideshow_transition_duration":500,"_background_slideshow_background_size":"","_background_slideshow_background_size_tablet":"","_background_slideshow_background_size_mobile":"","_background_slideshow_background_position":"","_background_slideshow_background_position_tablet":"","_background_slideshow_background_position_mobile":"","_background_slideshow_lazyload":"","_background_slideshow_ken_burns":"","_background_slideshow_ken_burns_zoom_direction":"in","_background_hover_background":"","_background_hover_color":"","_background_hover_color_stop":{"unit":"%","size":0,"sizes":[]},"_background_hover_color_b":"#f2295b","_background_hover_color_b_stop":{"unit":"%","size":100,"sizes":[]},"_background_hover_gradient_type":"linear","_background_hover_gradient_angle":{"unit":"deg","size":180,"sizes":[]},"_background_hover_gradient_position":"center center","_background_hover_image":{"url":"","id":"","size":""},"_background_hover_image_tablet":{"url":"","id":"","size":""},"_background_hover_image_mobile":{"url":"","id":"","size":""},"_background_hover_position":"","_background_hover_position_tablet":"","_background_hover_position_mobile":"","_background_hover_xpos":{"unit":"px","size":0,"sizes":[]},"_background_hover_xpos_tablet":{"unit":"px","size":0,"sizes":[]},"_background_hover_xpos_mobile":{"unit":"px","size":0,"sizes":[]},"_background_hover_ypos":{"unit":"px","size":0,"sizes":[]},"_background_hover_ypos_tablet":{"unit":"px","size":0,"sizes":[]},"_background_hover_ypos_mobile":{"unit":"px","size":0,"sizes":[]},"_background_hover_attachment":"","_background_hover_repeat":"","_background_hover_repeat_tablet":"","_background_hover_repeat_mobile":"","_background_hover_size":"","_background_hover_size_tablet":"","_background_hover_size_mobile":"","_background_hover_bg_width":{"unit":"%","size":100,"sizes":[]},"_background_hover_bg_width_tablet":{"unit":"px","size":"","sizes":[]},"_background_hover_bg_width_mobile":{"unit":"px","size":"","sizes":[]},"_background_hover_video_link":"","_background_hover_video_start":"","_background_hover_video_end":"","_background_hover_play_once":"","_background_hover_play_on_mobile":"","_background_hover_privacy_mode":"","_background_hover_video_fallback":{"url":"","id":"","size":""},"_background_hover_slideshow_gallery":[],"_background_hover_slideshow_loop":"yes","_background_hover_slideshow_slide_duration":5000,"_background_hover_slideshow_slide_transition":"fade","_background_hover_slideshow_transition_duration":500,"_background_hover_slideshow_background_size":"","_background_hover_slideshow_background_size_tablet":"","_background_hover_slideshow_background_size_mobile":"","_background_hover_slideshow_background_position":"","_background_hover_slideshow_background_position_tablet":"","_background_hover_slideshow_background_position_mobile":"","_background_hover_slideshow_lazyload":"","_background_hover_slideshow_ken_burns":"","_background_hover_slideshow_ken_burns_zoom_direction":"in","_background_hover_transition":{"unit":"px","size":"","sizes":[]},"_ha_background_overlay_background":"","_ha_background_overlay_color":"","_ha_background_overlay_color_stop":{"unit":"%","size":0,"sizes":[]},"_ha_background_overlay_color_b":"#f2295b","_ha_background_overlay_color_b_stop":{"unit":"%","size":100,"sizes":[]},"_ha_background_overlay_gradient_type":"linear","_ha_background_overlay_gradient_angle":{"unit":"deg","size":180,"sizes":[]},"_ha_background_overlay_gradient_position":"center center","_ha_background_overlay_image":{"url":"","id":"","size":""},"_ha_background_overlay_image_tablet":{"url":"","id":"","size":""},"_ha_background_overlay_image_mobile":{"url":"","id":"","size":""},"_ha_background_overlay_position":"","_ha_background_overlay_position_tablet":"","_ha_background_overlay_position_mobile":"","_ha_background_overlay_xpos":{"unit":"px","size":0,"sizes":[]},"_ha_background_overlay_xpos_tablet":{"unit":"px","size":0,"sizes":[]},"_ha_background_overlay_xpos_mobile":{"unit":"px","size":0,"sizes":[]},"_ha_background_overlay_ypos":{"unit":"px","size":0,"sizes":[]},"_ha_background_overlay_ypos_tablet":{"unit":"px","size":0,"sizes":[]},"_ha_background_overlay_ypos_mobile":{"unit":"px","size":0,"sizes":[]},"_ha_background_overlay_attachment":"","_ha_background_overlay_repeat":"","_ha_background_overlay_repeat_tablet":"","_ha_background_overlay_repeat_mobile":"","_ha_background_overlay_size":"","_ha_background_overlay_size_tablet":"","_ha_background_overlay_size_mobile":"","_ha_background_overlay_bg_width":{"unit":"%","size":100,"sizes":[]},"_ha_background_overlay_bg_width_tablet":{"unit":"px","size":"","sizes":[]},"_ha_background_overlay_bg_width_mobile":{"unit":"px","size":"","sizes":[]},"_ha_background_overlay_video_link":"","_ha_background_overlay_video_start":"","_ha_background_overlay_video_end":"","_ha_background_overlay_play_once":"","_ha_background_overlay_play_on_mobile":"","_ha_background_overlay_privacy_mode":"","_ha_background_overlay_video_fallback":{"url":"","id":"","size":""},"_ha_background_overlay_slideshow_gallery":[],"_ha_background_overlay_slideshow_loop":"yes","_ha_background_overlay_slideshow_slide_duration":5000,"_ha_background_overlay_slideshow_slide_transition":"fade","_ha_background_overlay_slideshow_transition_duration":500,"_ha_background_overlay_slideshow_background_size":"","_ha_background_overlay_slideshow_background_size_tablet":"","_ha_background_overlay_slideshow_background_size_mobile":"","_ha_background_overlay_slideshow_background_position":"","_ha_background_overlay_slideshow_background_position_tablet":"","_ha_background_overlay_slideshow_background_position_mobile":"","_ha_background_overlay_slideshow_lazyload":"","_ha_background_overlay_slideshow_ken_burns":"","_ha_background_overlay_slideshow_ken_burns_zoom_direction":"in","_ha_background_overlay_opacity":{"unit":"px","size":0.5,"sizes":[]},"_ha_css_filters_css_filter":"","_ha_css_filters_blur":{"unit":"px","size":0,"sizes":[]},"_ha_css_filters_brightness":{"unit":"px","size":100,"sizes":[]},"_ha_css_filters_contrast":{"unit":"px","size":100,"sizes":[]},"_ha_css_filters_saturate":{"unit":"px","size":100,"sizes":[]},"_ha_css_filters_hue":{"unit":"px","size":0,"sizes":[]},"_ha_overlay_blend_mode":"","_ha_background_overlay_hover_background":"","_ha_background_overlay_hover_color":"","_ha_background_overlay_hover_color_stop":{"unit":"%","size":0,"sizes":[]},"_ha_background_overlay_hover_color_b":"#f2295b","_ha_background_overlay_hover_color_b_stop":{"unit":"%","size":100,"sizes":[]},"_ha_background_overlay_hover_gradient_type":"linear","_ha_background_overlay_hover_gradient_angle":{"unit":"deg","size":180,"sizes":[]},"_ha_background_overlay_hover_gradient_position":"center center","_ha_background_overlay_hover_image":{"url":"","id":"","size":""},"_ha_background_overlay_hover_image_tablet":{"url":"","id":"","size":""},"_ha_background_overlay_hover_image_mobile":{"url":"","id":"","size":""},"_ha_background_overlay_hover_position":"","_ha_background_overlay_hover_position_tablet":"","_ha_background_overlay_hover_position_mobile":"","_ha_background_overlay_hover_xpos":{"unit":"px","size":0,"sizes":[]},"_ha_background_overlay_hover_xpos_tablet":{"unit":"px","size":0,"sizes":[]},"_ha_background_overlay_hover_xpos_mobile":{"unit":"px","size":0,"sizes":[]},"_ha_background_overlay_hover_ypos":{"unit":"px","size":0,"sizes":[]},"_ha_background_overlay_hover_ypos_tablet":{"unit":"px","size":0,"sizes":[]},"_ha_background_overlay_hover_ypos_mobile":{"unit":"px","size":0,"sizes":[]},"_ha_background_overlay_hover_attachment":"","_ha_background_overlay_hover_repeat":"","_ha_background_overlay_hover_repeat_tablet":"","_ha_background_overlay_hover_repeat_mobile":"","_ha_background_overlay_hover_size":"","_ha_background_overlay_hover_size_tablet":"","_ha_background_overlay_hover_size_mobile":"","_ha_background_overlay_hover_bg_width":{"unit":"%","size":100,"sizes":[]},"_ha_background_overlay_hover_bg_width_tablet":{"unit":"px","size":"","sizes":[]},"_ha_background_overlay_hover_bg_width_mobile":{"unit":"px","size":"","sizes":[]},"_ha_background_overlay_hover_video_link":"","_ha_background_overlay_hover_video_start":"","_ha_background_overlay_hover_video_end":"","_ha_background_overlay_hover_play_once":"","_ha_background_overlay_hover_play_on_mobile":"","_ha_background_overlay_hover_privacy_mode":"","_ha_background_overlay_hover_video_fallback":{"url":"","id":"","size":""},"_ha_background_overlay_hover_slideshow_gallery":[],"_ha_background_overlay_hover_slideshow_loop":"yes","_ha_background_overlay_hover_slideshow_slide_duration":5000,"_ha_background_overlay_hover_slideshow_slide_transition":"fade","_ha_background_overlay_hover_slideshow_transition_duration":500,"_ha_background_overlay_hover_slideshow_background_size":"","_ha_background_overlay_hover_slideshow_background_size_tablet":"","_ha_background_overlay_hover_slideshow_background_size_mobile":"","_ha_background_overlay_hover_slideshow_background_position":"","_ha_background_overlay_hover_slideshow_background_position_tablet":"","_ha_background_overlay_hover_slideshow_background_position_mobile":"","_ha_background_overlay_hover_slideshow_lazyload":"","_ha_background_overlay_hover_slideshow_ken_burns":"","_ha_background_overlay_hover_slideshow_ken_burns_zoom_direction":"in","_ha_background_overlay_hover_opacity":{"unit":"px","size":0.5,"sizes":[]},"_ha_css_filters_hover_css_filter":"","_ha_css_filters_hover_blur":{"unit":"px","size":0,"sizes":[]},"_ha_css_filters_hover_brightness":{"unit":"px","size":100,"sizes":[]},"_ha_css_filters_hover_contrast":{"unit":"px","size":100,"sizes":[]},"_ha_css_filters_hover_saturate":{"unit":"px","size":100,"sizes":[]},"_ha_css_filters_hover_hue":{"unit":"px","size":0,"sizes":[]},"_ha_background_overlay_hover_transition":{"unit":"px","size":0.3,"sizes":[]},"_border_border":"","_border_width":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"_border_width_tablet":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"_border_width_mobile":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"_border_color":"","_border_radius":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"_border_radius_tablet":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"_border_radius_mobile":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"_box_shadow_box_shadow_type":"","_box_shadow_box_shadow":{"horizontal":0,"vertical":0,"blur":10,"spread":0,"color":"rgba(0,0,0,0.5)"},"_box_shadow_box_shadow_position":" ","_border_hover_border":"","_border_hover_width":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"_border_hover_width_tablet":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"_border_hover_width_mobile":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"_border_hover_color":"","_border_radius_hover":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"_border_radius_hover_tablet":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"_border_radius_hover_mobile":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"_box_shadow_hover_box_shadow_type":"","_box_shadow_hover_box_shadow":{"horizontal":0,"vertical":0,"blur":10,"spread":0,"color":"rgba(0,0,0,0.5)"},"_box_shadow_hover_box_shadow_position":" ","_border_hover_transition":{"unit":"px","size":"","sizes":[]},"_mask_switch":"","_mask_shape":"circle","_mask_image":{"url":"","id":"","size":""},"_mask_notice":"","_mask_size":"contain","_mask_size_tablet":"","_mask_size_mobile":"","_mask_size_scale":{"unit":"%","size":100,"sizes":[]},"_mask_size_scale_tablet":{"unit":"px","size":"","sizes":[]},"_mask_size_scale_mobile":{"unit":"px","size":"","sizes":[]},"_mask_position":"center center","_mask_position_tablet":"","_mask_position_mobile":"","_mask_position_x":{"unit":"%","size":0,"sizes":[]},"_mask_position_x_tablet":{"unit":"px","size":"","sizes":[]},"_mask_position_x_mobile":{"unit":"px","size":"","sizes":[]},"_mask_position_y":{"unit":"%","size":0,"sizes":[]},"_mask_position_y_tablet":{"unit":"px","size":"","sizes":[]},"_mask_position_y_mobile":{"unit":"px","size":"","sizes":[]},"_mask_repeat":"no-repeat","_mask_repeat_tablet":"","_mask_repeat_mobile":"","hide_desktop":"","hide_tablet":"","hide_mobile":"","_attributes":"","custom_css":""},"defaultEditSettings":{"defaultEditRoute":"content"},"elements":[],"widgetType":"image-box","htmlCache":"\t\t\n\t\t\tEasy Access Anywhere, Anytime Our mobile-friendly design ensures you can effortlessly access your dashboards and reports from any location, providing unparalleled convenience.\n\t\t\n\t\t","editSettings":{"defaultEditRoute":"content","panel":{"activeTab":"content","activeSection":"section_image"}}}]}](https://awesometechinc.com/wp-content/uploads/2023/08/Mobile-Accessibility.png)

Ease to Use

Need a small change on the homepage content? Need to remove or replace an image? You or your team can easily update minor changes with an easy-to-navigate admin interface.

Data Security

Making your client's data secure is our top priority. Our engineers are the ultimate geeks who won't let a single bite slip away from the protection layer. So, you can relax and just think about expanding your lending.

Website Support

One of the most important reasons mortgage people love us is our devoted support mechanism. If you need support, no matter how major or minor the problem is, we are always ready to serve you.

Affordable

Made by the best, for the best. But don't think we are here to break your bank. We offer professional, robust, and affordable website development services for loan officers, mortgage brokers, and lending businesses.

Our Custom Mortgage Development Workflow

Designing a mortgage broker website involves creating a compelling and user-friendly online platform for potential clients. Here’s how our process works:

1. Understanding What You Want

To build a website that effectively promotes your brand identity and services, it's crucial to understand what you wish to achieve with your digital platform. We begin with an in-person or virtual meeting to understand your goals in-depth. After collecting all the necessary details, our creative team, engineers, and project head will engage in a head-to-head collision.

2. Site Designing & Development

Once you approve your mortgage website design, our developers, who have an exceptional understanding of the lending world, will start building your online platform. If you wish to have content and images pre-built into your website at the time of development, we can ask our creatives to work sideways.

3. Feedback Loop

We never get tired of iterations. Once the major functions or web portions are ready, we'll keep you in the loop to take your feedback and implement it dot to dot. We stop working only when you say, "This looks awesome!"

4. Going LIVE

Once the site is complete and everything looks great, we'll head to the final testing stage, where we make sure every pixel is picture-perfect. Once we hear 'clear to deploy' from our testing and dev team, we'll take the site live! We'll explain any technicalities to your users and prepare you for the support plan.

Standout Features of Our Mortgage Website Designs

Comprehensive Content

Informative content about different loan options, mortgage processes, and industry trends, positioning you as a knowledgeable resource.

Client Testimonials

Build trust and credibility through prominently displayed client testimonials highlighting your success stories.

Optimized for Loan Officers

We create websites explicitly catered to loan officers/mortgage brokers, equipping them with the tools to attract clients and provide valuable resources.

Mortgage Loan Calculators

Interactive tools that allow users to estimate loan payments, creating an engaging and informative experience.

Engaging Templates

Our mortgage website templates are designed to captivate and inform, making it easy for brokers to showcase their expertise.

Social Media Integration

Extend your online reach with seamless integration of social media platforms, connecting you with a broader audience.

DRIVING MORTGAGE SUCCESS WITH DIGITAL INNOVATION

We aim to streamline the mortgage lending process, making it more efficient, transparent, and user-friendly for lenders and customers.

Top 10 Benefits Of Automating Your Mortgage Loan Process

Essence of Automating Your Mortgage Loan Process

In the past, completing mortgage loans required much physical labor and prolonged data entry. It was more vulnerable to mistakes and was overall not useful. However, the mortgage firms had no other choice.

Thanks to the benefits of loan processing automation today, the mortgage industry can now get many loan operations. Be it a mortgage discharge or a loan application. Mortgage experts can focus on the client, and work on the loan application process as per the needs. Usually, their aim is to pick projects that better match their background and skills.

Even today, the present mortgage lenders face more difficulties than ever before. It is because the functional and supervisory developments progress and make the industry complex. This makes it easy to understand why so many small and medium-sized mortgage lenders are closing their doors.

The problems continue because most lenders still depend on old structures and legacy systems. They mostly count on manual ways. Also, most mortgage lenders have to spend their time and resources managing features which are not consistent.

Who Gains from Automation of the Mortgage Process?

The benefits of mortgage automation are many for company personnel, each affecting differently.

- Leadership & Management

The process of providing mortgage automation solutions promises compliance. This technology’s ability to provide information and data trails will also impress leaders. They’ll be able to act and make promises more confidently than they could have.

- Agents of Customer Service

Mortgage workflow automation will create records and information. It also helps in facilitating customer care departments to respond rapidly to customers. Also, they can also make more accurate product recommendations and update records. All these changes work on data from their existing customers.

- Teams In Charge Of Sales And Marketing

If sales and marketing teams work on risk evaluations and better understand their clients’ products, it is worth it. They can work on useful marketing techniques. Also, the sales team can make recommendations and upsell potential customers.

- Departments of Finance and Accounting

Automating the mortgage process creates information trails that make it easy to prove submission and observance. If these needs are changed, it is simple to alter them and request any missing documentation.

Top 10 Benefits Of Mortgage Automation Process

1. Increased Output

Any mortgage lender you speak with will tell you that time is what they value most. Mortgage lenders want to materialize the means, and buyers want to move into their new homes as instantly as possible.

Most mortgage lenders are unhappy with the tiresome tasks of processing applications. It is because they cut into the time allocated for other important issues. When the mortgage process is set, it helps lenders to process mortgages in a short time.

2. Enhanced Precision

Resolving human error in loan processing is painstaking. According to IRPA, people are projected to make 10 mistakes in every 100 loan processing stages, including dismissed work. Mortgage lenders must quickly employ RPA to automate their procedures. It reduces the need for formal training and creäte error-free work immediately.

3. Better Capture of Fraud

Due to the sharp rise in mortgage fraud, mortgage lenders are forced to utilize several strategies to reduce the damages. Hence, LOS (Loan Origination Systems) brings sophisticated predictive analytics.

On the other hand, lenders can influence robotic process automation for mortgage services. Because the process is automatic, you may reduce losses by quickly verifying which loan needs fraudster analysis. Undoubtedly, these mortgage software solutions are great!

4. Improved Customer Experience

Documentation during loan origination and closing may take two weeks to a month to process. It depends on the accuracy and speed of your employees, the details of your internal process, and the availability of buyers. Giving your clients the best experience possible will be a difficult challenge.

Hence, the systems guarantee 24/7/365 operations that quickly boost customer satisfaction. They have low interruption and can operate on cloud infrastructure appropriately.

5. IT Procedures Are Not Interrupted

It is feasible to complete automating mortgage tasks in as little as sixty days. This is a boon for a sector that must deal with antiquated infrastructure and protracted processes. It will be a switch to a more efficient, smooth, and instant process.

Powering the mortgage loan process is a handy process. Collection of information from many locations, combining checklist- and rule-driven tasks, validating information with a third party, etc. become easy. Thanks to mortgage automation solutions.

6. Defined and Consistent Workflows

Most mortgage lenders declare that their current processes must be laid out. There are too many variables for lenders to design specified processes. They range from data entry to document collection and routing, task assignments, email notifications, processing, etc.

As document management systems advance, acquiring loan applications becomes easier. Eventually, having a full grip of your process through the analytics offered by such a system facilitates you in many ways. Such as you can make more informed decisions and accommodate resources as needed.

7. Simple Auditing

Automating documentation and other loan processes helps you in a number of ways. It creates more efficient and consistent compliance requirements, limits risks, and responds to them more quickly. Obtaining a mortgage loan is a difficult process, even with today’s advanced tools and solutions.

As a result, following the regulations is also taken care of because the automation process does it. You don’t have to worry about whether all your employees followed the rules. Thanks to the mortgage workflow automation!

8. Improve Scalability

Scalability is vital for mortgage firms to execute machine-based automation. A strong grasp of the mortgage industry is essential to understand the thousands of diverse types of mortgage papers. It is useful for better data extraction, document stacking, data analysis, and organization.

For this reason, it is tricky to contract these jobs. However, the mortgage lending process becomes easy, specifically if cloud-based infrastructure installations are involved. Real-time server cloning facilitates immediate response to surges in demand.

9. Consistent Income

With loan process automation, you can forecast how much money your leads will bring in. Also, how much the loan procedure will earn right through your loan cycle.

Subsequently, this understanding of mortgage automation solutions will facilitate lenders to accommodate the evolving client demands. At the same time, they have to comply with freshly authorized legislation.

10. Better Adherence To Legal Requirements

Mortgage lenders show full devotion to difficult regulatory regulations while controlling the relevant risks.

Lenders can now gain improved compliance through automation processes. It is because it decreases operational risks, improves the reliability and quality of the operations. Also, they make sure that they are completed each time.

The Features Of Mortgage Automation Software

- Incorporating mortgage automation solutions with origination systems absolutely rationalizes the loan approval process.

- Using automated administering methods makes underwriting perfect and well-timed.

- Process efficiency is strengthened through workflow efficiency, which reduces manual faults.

- Automated document processing and management undertakes precision and fulfillment when handling financial papers.

Automating Your Mortgage Loan Process In 2024 And Beyond

The mortgage industry is continuing to quickly as 2024 draws near. It is driven by changes in borrowing expectations and technology improvements. It is because automating your mortgage loan procedure is necessary to remain competitive and efficient. So, don’t wait for this year to end and have an asset of your own! Awesome Technologies can help you to know the best options for the mortgage loan process. Do you know why? Blockchain, AI, cloud computing, and sophisticated data analytics can ease mortgage workflow automation. They also enhance borrower satisfaction and adherence.

In Conclusion

Automating your mortgage loan procedure can help speed up the consent and application procedures. By employing technology, you may need less time and less effort. This increases effectiveness, accuracy and pace.

Automating the mortgage loan procedure is a wise decision. It was much needed since the start and was necessary to renovate the mortgage industry. The benefits are that it reorganizes operations, decreases expenses, and improves the overall experience. The lenders and borrowers both have benefits from the loan automation system.

It also makes it feasible to manage regulatory responsibilities and fulfillment more successfully. Specifically, the mortgage market gains from the exploitation of automated technologies. It helps to create a more accessible and financially compliant environment for lenders and borrowers.

FAQs

How does Automation increase the Efficiency Of Mortgage Processing?

Employees can focus on other work while mortgage workflow automation works on its own. It can carry out its routine processes like data entry, document authentication, and risk evaluation. Automation also completes these jobs more quickly than manual methods.

Is It Possible For Automation To Reduce The Time Needed To Complete A Mortgage Application?

Certainly, automation lowers processing time by fastening data processing and authentication, restructuring workflows, and decreasing manual involvement.

What Financial Benefits Are Possible From Automating The Mortgage Process?

Less manual labor is needed. It is possible that fewer mistakes need costly corrections. And progressing operational competence lowers the cost of processing.

Is It Possible For Automated Systems To Process A Lot Of Mortgage Applications?

Automated systems are available, meaning they can administer higher application volumes without experiencing raises in costs.

How Does Automation Enhance The Security Of Data When Processing Mortgages?

Enhanced security aspects like encryption, access limits, and safe data storage are generally included in automation solutions. These aspects lower the risk of data violations and uphold sensitive borrower data.

Encompass® SDK To API: Step By Step Migration Guide

ICE Mortgage Technology’s Encompass® Software Development Kit (SDK) allows customers and partners to integrate, customize, and extend the Encompass® Loan Origination System (LOS) for various purposes, such as automating the loan origination process, integrating with third-party systems, creating custom fields and calculations, developing custom tools and plugins, and customizing the user interface for enhanced user experience.

Encompass® started in the 2000s and became very popular for mortgages. But things have changed a lot since then, including new rules and technology. Encompass® has now started using cloud-based APIs, which makes it easier to connect with other software and gives it more flexibility and power.

Encompass® SDK Sunset

As announced by ICE Mortgage Technology the Encompass® SDK (Software Development Kit) will be sunsetted on October 31, 2025. This means that Encompass® clients and partners will no longer have access to SDKs after this date.

Migrating from the Encompass® SDK to APIs can be a daunting task, but it’s an essential step for businesses that want to take advantage of the many benefits that APIs offer. This blog post will provide a step-by-step guide to help you through the migration process.

You’ll also learn about why it might be better to use Encompass® Developer Connect (EDC) APIs instead of the Encompass® SDK.

Getting Started on Encompass SDK to API Migration

Switching from Encompass® SDK to APIs requires a few steps to make sure your current features still work and are even better. Here are a few starting steps to get you started.

Step 1: Audit Current SDK Usage

To identify all custom workflows, automations, and integrations currently built using the Encompass® SDK development, you can follow these steps:

1. Review Encompass® Customization Reporting Module:

- Go to the Encompass® Home page and navigate to the Customization Reporting module.

- The SDK and Plugin tabs will list all SDK apps and plugins, including their names, last launch/run dates, and usage frequency within a specified date range.

2. Examine SDK App and Plugin Details:

- Click on an SDK app or plugin to view its details.

- The details may provide information about its purpose, functionality, and any associated workflows or automations.

3. Analyze Encompass® Configuration:

- Check Encompass’s® configuration settings for any references to custom SDK apps or plugins. This might involve looking at workflow definitions, automation rules, or integration settings.

4. Consult Documentation or Development Team:

- If you have documentation or access to the development team that created the custom SDK components, they can provide specific details about their functionality and integrations.

5. Test and Verify:

- To confirm the functionality of custom workflows, automations, and integrations, test them in a controlled environment or with test data.

Prioritize migrating critical functions that involve updating fields or exporting data.

Check the Partner Marketplace for all Encompass® Partner Connect (EPC) integrations that help order services from third-party providers. These integrations use our “Build Once, Use Everywhere” approach. This means that once a partner creates a product that works with Encompass®, lenders can use it in all IMT’s lending software.

Step 2: Identify API Alternatives

Look at the API documentation in Encompass® Developer Connect to find the new API endpoints that can replace what the SDK used to do. The sections below have links to API alternatives for the most common SDK methods and operations.

Instead of using the SDK to check for data changes, you can use webhook events like “Enhanced Field Change”. This will send you real-time updates when fields change.

Step 3: Refactor Business Logic

1. Convert custom logic to API calls:

- Identify the specific SDK methods or functions that implement your custom logic.

- Find the corresponding API endpoints in the Encompass® Developer Connect documentation.

- Replace the SDK calls with API calls, ensuring that you pass the necessary parameters and handle the API responses appropriately.

2. Shift to Event-Driven Architecture:

- Subscribe to relevant webhook events using the Encompass® Developer Connect webhook resources.

- Configure your custom application to receive and process webhook notifications.

- Implement the necessary logic to handle the webhook events and trigger the appropriate actions or updates based on the event data.

Key webhook events to consider:

- Loan: Loan creation, modification, submission, approval, denial, closing, etc.

- Document Delivery: Document delivery status changes, delivery failures, etc.

- Document Order: Document order creation, modification, fulfillment, etc.

- Enhanced Conditions: Condition creation, modification, fulfillment, etc.

- Organizations and Users: User creation, modification, role changes, etc.

- EPC Service Orders: Service order creation, modification, fulfillment, etc.

- Schedulers: Scheduled task execution, completion, etc.

- Trades: Trade creation, modification, settlement, etc.

- Workflow Tasks: Task assignment, completion, etc.

- Data & Document Automation: Automation rule triggers, document generation, etc.

To see a list of all webhook resources and events, please check the “Resources and Events” list in Encompass® Developer Connect.

Step 4: Setup API Authentication

The SDK uses old ways to authenticate, but the API uses newer methods like OAuth 2.0.

You’ll need to set up your client to use an OAuth token when you make API calls to Encompass®. You can find more information about the different authorization flows and API Key provisioning in Encompass® Developer Connect.

Step 5: Make your First API Call

Once you have your API keys, you can start using the APIs.

Look at the API Reference in Encompass® Developer Connect for detailed information about the endpoints and code samples.

Download Postman Files

Download the latest Postman Collection and Environment Variables. These files have pre-built API requests for common tasks, which can help you start automating your work. The Postman Collection is updated whenever Encompass® is updated, so check the Release Notes for the latest version.

Get Your Access Token

- Open the Postman collection.

- Go to the “Authentication” folder, then the “Get Access Token” folder.

- Find the “Resource Owner Password Credentials” sample.

- Replace the placeholder values in the path and request body with your actual credentials.

- Click “Send”.

If successful, you’ll see the “access_token” in the response.

Make an API Service Call

Now that you have the access token, you can make a service call.

If you’re using the Postman collection from Encompass® Developer Connect, the access token is already saved from your last call.

If the call is successful, the response will include all the details of the loan record.

Understanding the Shift: Why APIs?

The transition from Encompass® SDK to APIs marks a significant shift in how developers interact with the Encompass® platform. APIs (Application Programming Interfaces) offer a more flexible, scalable, and standardized way to access and manipulate Encompass® data. Here’s a breakdown of the key advantages:

Rapid Deployment

API-Based Approach

- Simplified Development: Leverage RESTful APIs that adhere to industry standards for efficient development.

- Comprehensive Documentation: Access detailed API reference documentation, including Postman samples for common scenarios, to accelerate integration.

SDK-Based Approach

- Complex Development: Custom development using SDKs requires in-depth knowledge of the Encompass® platform, which may slow down the development process.

Better Performance

API-Based Approach

- Efficient Data Processing: APIs enable more efficient data processing, leading to improved performance.

SDK-Based Approach

- Slower Data Processing: Relying on manual data syncing can result in slower data processing.

Cloud-Native Integration

API-Based Approach

- Cloud Integration: Encompass® APIs are designed to be cloud-native, facilitating easy integration with other cloud-based systems and promoting flexibility.

SDK-Based Approach

- Limited Cloud Compatibility: SDKs might be more suitable for on-premise or locally hosted applications, potentially limiting flexibility in cloud-driven environments. However, Encompass® has now fully embraced a cloud-native architecture and offers modern integration methods through APIs.

Expandable Architecture

API-Based Approach

- Scalable Architecture: APIs are designed to handle increasing loads and larger datasets efficiently, making them highly scalable.

SDK-Based Approach

- Scaling Limitations: SDKs might have limitations in scaling compared to APIs, especially when dealing with large-scale operations or significant data volumes.

Ecosystem Expansion

API-First Approach

- Continuous Investment: ICE Mortgage Technology is committed to investing in the API platform, ensuring its growth and longevity.

- API-First Strategy: Adopting an API-first approach aligns with industry trends and facilitates platform expansion.

SDK-Based Approach

- Legacy Option: SDKs will eventually become a legacy option as the platform transitions to an API-centric model.

Simplified Management

API-Based Approach

- Managed Updates: APIs are owned and maintained by ICE MT, ensuring ongoing feature enhancements and bug fixes without requiring modifications to custom integrations.

SDK-Based Approach

- Manual Maintenance: Maintaining SDK-based integrations involves more manual effort to manage dependencies and keep custom integrations aligned with the latest Encompass® releases.

Universal Compatibility

API-Based Approach

- Universal Compatibility: APIs can be consumed by any application or platform, regardless of underlying technology, enabling seamless cross-system integration.

SDK-Based Approach

- Windows-Centric: SDKs are often designed for specific environments, such as Windows, limiting their compatibility with other platforms.

Key Considerations and Best Practices

When migrating from an Encompass® SDK to their API, key considerations include thoroughly auditing current SDK usage, identifying equivalent API endpoints, refactoring code to utilize API calls instead of SDK functions, setting up proper OAuth authentication, and leveraging webhooks for event-driven architecture, while best practices involve detailed documentation, testing each migration step, and utilizing the Encompass Developer Connect portal for API reference and guidance.

Consider these when Encompass® SDK converting into API:

- Security: Treat API keys and access tokens with the utmost care, ensuring they are securely stored and not shared publicly.

- Versioning: Be mindful of API versioning and update your code accordingly if necessary.

- Documentation: Maintain comprehensive documentation throughout the migration process, including updated API usage and code changes.

Conclusion

Migrating from the Encompass® SDK sunset to APIs can be a complex process, but it is an essential step for businesses that want to take advantage of the many benefits that APIs offer. By following the step-by-step guide in this blog post, you can make the migration process as smooth as possible.

Everything You Should Know About Loan Origination System (LOS)

Unlocking The Secrets Of Loan Origination System: Prioritizing Its Essence!

Financial companies will always look for new ways to improve customer experience and services. Moreover, they want to practically alter ways to enhance operations according to the current loan industry. They work smartly and put in all their efforts fruitfully. Hence, the loan origination system (LOS) is one scheme that has gained traction.

For many organizations, LOS is a strength. It helps to lawfully process loans, improve decision-making, and work according to the needs of the borrowers. A good LOS system will steer risk management with ease. For example, encompass integration services comes up as a leading partner. It helps improve the borrowing process with ease and comfort.

Revolutionizing Lending: The Power of Loan Origination Systems

A loan origination system smooths the lending process by handling all the phases. From the beginning of the paperwork till the final approval. It ensures security and compliance when managing private customer data. In addition, the LOS can be more effective because there are no human errors. It is known to manage loan applications more quickly.

To put it simply, loan origination is a process that helps the mortgagor apply for a loan. In return, an investor either agrees or rejects the application. This process has various stages, from loan application to approval or refusal of the application. Overall, it helps ease out and manage the loan application and payment processes.

Loan Origination

When the borrower applies for a loan, he is unsure of the refusal or acceptance. This is because the lender’s risk assessment has yet to be discovered. The final decision cannot be forecasted in the beginning. Hence, there can be two outcomes—cash distribution and rejection. Many LOS are available in the market. However, reliable loan origination software is needed.

Encompass LOS optimization can be a good option to ease the loan application process. It helps optimize the difficult loan origination process flow. The core reason is that it increases the effectiveness of the workflow and lending experience for the lender. For the borrower, it simplifies the entire loan application procedure. So, we can say that it is a win-win situation for both parties.

A lender who wants to process many loan applications at once can do it. The good news is that there is more accuracy because of less manual work. There is a designed process that works on its own. Hence, the efficiency factor brought by custom mortgage development is vital in today’s world. The fast financial sector is enjoying booms because of this system. Every financial institution can gain success with more speed and reliability in the entire process.

Three Key Benefits of Systems for Loan Origination

The most important benefit is the factor of more productivity and efficiency. Thanks for fixing the processes within the organization. For a firm, it is affordable, improves production, and increases turnaround times.

Furthermore, loan origination procedures will increase your company’s competence to control risk. They are using automation and data analytics. By assessing risk before offering the loan, you can reduce the chance that a borrower will fail to pay.

Perhaps most importantly, the best loan origination approach, such as Encompass LOS optimization, improves the client experience. The borrower can benefit from fast loan administration, clear communication, and self-service possibilities, which are available via mobile apps and web portals.

Key Components of a Loan Origination System

LOS manages and simplifies The loan procedure from the funding application. Every aspect of a LOS is vital to ensure efficiency, conformity, and a positive borrower experience. Below is a full summary of the key elements:

- Application Receiving:

There are many ways to collect information about borrowers, including phone, direct application, and online forms.

- Gathering Documents:

It eases the process of getting documents from the borrower. The documents should contain identity, income, and job details.

- Integration Of Credit Reports:

LOS helps establish a relationship with credit agencies and obtain and evaluate credit reports, which are important for evaluating debtors’ creditworthiness.

- Analyzing Risk:

Credit scores and other financial data are useful for analyzing risk. Every loan application has a risk factor. Also, it helps to make a decision and attempt underwriting.

- Analytics Of Data:

Using LOS makes it easy to study trends, understand the borrower’s mind, and learn other important things. These include strategic planning and process development.

- Integrations With Third Parties:

Links to external systems, such as credit bureaus, appraisal management systems, and e-signature platforms, help to boost functionality and speed up processes.

Most Important Factors To Consider While Choosing A LOS

The following criteria should be considered when searching for fair lending software.

1. The Domain Experience Of The Vendor

In the FinTech industry, many software providers, such as Awesome Technology, are experts in many fields. A company like Awesome Technology has a legacy of trust and lending history. The experts know all the ins and outs, which are not available elsewhere.

2. Easy To Operate

Any automation project wants to reduce the time spent on onboarding and system usage. A vital feature of quality is how simple it is to integrate LOS into your business’s software.

3. Easy To Pick Up

User onboarding is important when adding on new technologies. The loan origination system you select should be easy for employees and clients to use and understand. It should offer a complete feature set and the ability to track loans more realistically.

4. Basic Modification Of Business Logic

Highly configurable LOS systems are the most efficient ones. They allow updates and changes to fulfill unique business demands.

5. Strict Security Measures

One of the main barriers to digitizing lending firms is protecting user privacy and security. Data protection systems should be smart to protect sensitive data, which can be a cause of concern for regulators and customers.

How To Pick The Finest Software For Loan Origination?

Here are a few things to remember while selecting your company’s loan origination software. The aspect of specializing in custom mortgage development should not be ignored:

- Flexible And Easy To Use:

A good loan origination system (LOS) should be simple to use. This is especially important for those who know little about software use.

- Sturdy Interfaces And Efficient Processes:

It should consider the workflow features and API connection of LOS. These two things are vital to managing many loan processes at once.

- A Unified Approach To Cost Effectiveness

Using a smart LOS will help to reduce expenses. Many financial companies consider smart functionality and take advantage of economies of scale.

- Entire Database:

A complete LOS should promise to link with credit principles during loan assessments and have an intelligent database.

Encompass Integration Services

Encompass Integration Services is a collection of tools and solutions. It helps companies make smart choices when using other software programs. Both systems will improve efficiency and create a continuous workflow. Moreover, they should enable all-in-data interchange and automation.

Benefits of Encompass Integration Services

1. Automated Processing Of Applications

Data entry, document authentication, and application review are difficult processes. Hence, a good platform should be systematized as part of application processing.

2. Flexibility And Customizability

Thanks to its smart design, mortgagees may use the loan origination platform more efficiently. Hence, the LOS should be suitable for business needs.

3. Risk Management And Compliance

Investors may smartly control risk and follow regulatory conditions. The benefit is that they can easily use a thriving loan origination platform.

Encompass LOS Optimization

Encompass LOS optimization involves increasing performance, productivity, and effectiveness. It is useful for better reassuring lenders of their needs and rationalizing the loan origination process.

Optimization involves fine-tuning systems to enhance their potential and agree that they connect with an organization’s goals and processes.

Pondering over these aspects of Encompass LOS Optimization can help businesses enhance their loan origination procedure. It helps increase throughput, save expenses, and offer a better experience for employees and clients.

Benefits Of Encompass LOS Optimization

1. Streamlined Processes

Workflows can be modified to fit the processes used by your company.

2. Regular Procedures

The regular process reduces the chances of errors. Unpredictable and manual processes can cause these errors.

3. Personalized Interfaces

Making the user interface more responsive to each user’s specific needs helps to improve the system’s usage.

Custom Mortgage Development

Creating expert mortgage lending solutions to address the exceptional goals and difficulties a lender or financial institution encounters is called custom mortgage development. Simplifying and improving the mortgage process may result in better software output. Moreover, it helps to modify modern systems and merge changing technologies. Through custom mortgage development, lenders can introduce advanced systems. These advanced systems become more efficient and beneficial in mortgage development.

Benefits Of Developing Custom Mortgages:

1. Increased Effectiveness

Customized solutions help to change functionalities. They also cut down on lengthy manual processes. Hence, they increase effectiveness and speed up loan processing.

2. Enhanced Precision

Custom solutions can be constructed to trim down mistakes and ensure precise recording and handling of all data.

3. Advantage Of Competition

Customized solutions may provide new features and expertise that make the mortgage stand out.

The Proud Offer Of Awesome Technologies

Awesome Technologies offers modified options for every kind of funding. It can help if you’re prepared to offer your staff the benefits of an extensive LOS. Financial institutions of all sizes can use the lending and loan origination software.

The following are some advantages of trusting LOS solutions from Awesome Technologies:

Simple Customization

Here at Awesome Technologies, the experts understand that lending software should be able to serve the needs. Because of this, you can quickly adjust to LOS to match your solo needs, regardless of whether you require more technical capability.

More Than 100 Integrations

Any third-party provider can be integrated with Awesome Technologies in a few days. Awesome Technologies, consequently, works perfectly with the apps you already have.

To Conclude

The ability of a (LOS) to systematize the loan process is very important to its operation. By adding all required aspects, lenders may enhance efficiency, decrease errors, and speed up turnaround times. As a result, customers will have a better experience, and your team will be far more dynamic.