Do you know that 85% of homebuyers in the US prefer home loan origination to finance their home? Yes, because they provide multiple benefits from tax advantages, manageable monthly payments, and the chance to build equity over time.

However, the process of mortgage loan origination sometimes seems complex and difficult. Knowing about each step makes it easier. Knowing the details of loan origination for anyone looking to buy a home, refinance, or get a commercial loan helps you confidently approach the US mortgage loan process.

In this blog, we will explore the mortgage lifecycle and deeply look at each and every step involved, from application to final stage. Let’s explore the role of lending origination systems, mortgage automation software, and business intelligence platforms in today’s mortgage world. Let’s dig into this.

What Is Mortgage Loan Origination?

Mortgage origination: a process in which you get a mortgage loan. This process has several stages, from the origination process to the approval.

Additionally, mortgage origination is an important part of the home-buying process because it ensures to properly repay the loan to purchase the property.

As a result, the quick, transparent, and accurate processing of mortgage origination is essential for lenders and buyers.

What Exactly is Loan Origination?

Loan origination is the process by which you get a mortgage or home loan. It includes several steps. It can also refer to other kinds of amortized personal loans. This process also includes a fee, which is usually about 1% of the loan. Intended to compensate the lender for the work in the process.

What Does Lender Processing Mean?

Lender processing is a critical step in the mortgage loan origination process. It refers to the lender’s process of reviewing, verifying, and assessing a mortgage application before proceeding to underwriting and closing. Here’s a deeper look at what the loan processing process really means:

Understanding the Six Essential Steps of the Mortgage Application Process

In general, there are several processes in the mortgage loan process, which are:

- Application Acceptance

- Offer for Property

- Loan Application

- Loan Processing

- Underwriting of the Loan

- Release of the loan amount or closing.

As we all understand, everyone has their own way to operate things, same as every lender has their own rules to operate the mortgage loan application process. It’s important that all the “boxes are checked” so the process can move forward without errors. It’s a critical process for customers as well.

In addition, for the first time, the process has some confusing and difficult procedures. Even experienced buyers can be confused by its complexity. For most applicants, there is a lot riding on the Mortgage Application Process; it is a tense time for them, and that adds extra pressure for accuracy. From the broker’s perspective, not being transparent or complete on all the terms of the deal and the mortgage usually means that the deal falls through.

However, a buyer, armed with the knowledge of the Mortgage Process. It is so because they were willing to do the homework that they stand a better chance of getting a deal on a purchase than an uninformed buyer who walks into the market like a lamb to the slaughter.

To avoid one of those lambs, we are discussing the Mortgage Loan Processing steps here.

Six Essential Steps of the Loan Process:

- Mortgage Preapproval

- Home Hunting and Offer

- Loan Application

- Loan Processing

- Mortgage Underwriting

- Mortgage Closing

Surviving the Mortgage Loan Process

Although the steps of a mortgage are easy to understand. However, they are complex and confusing, from the initial mortgage loan application to the closing.

The ownership process is quite easy but requires some preparation. The first thing to understand is that before starting a conversation with an agent. For about a home or a lender about the procedure of a mortgage loan. First, we should emphasize the early steps in the Mortgage Approval Process.

Mortgage Preapproval

In a home mortgage origination, the primary and essential step is to get preapproved for a mortgage. Coordinating with a lender and making a purchase are primarily based on financing terms and fees.

Moreover, the criteria and requirements of lenders income, debt and other financial facts anticipate lenders to investigate and affirm all your financial life so they are confident you will repay your loan.

Furthermore, it is a crucial step to evaluate what a loan preapproval does and ways to increase the probability of

- Credit history

- Credit score

- Debt-to-income ratio

- Employment history

- Income

- Assets and liabilities

Getting a preapproval letter gives you the space to speak about mortgage alternatives and budgeting with the lender, a good way to help you pay attention to your price range and the month-to-month mortgage price you could handle. Capability should be cautious in estimating their consolation stage with a given residence payment rather than a right-away goal for the pinnacle of their spending restriction.

Home Hunting and Offer

Once preapproved, start searching for a home as a way to fit your needs and your price range. Your preapproval will encompass a cap on the quantity of your mortgage. Moreover, when you discover the proper residence, make an offer that will fit your needs and your budget. Your preapproval includes a small amount of your loan. After finding the right place, make an offer that includes:

- The seller might accept the offer.

- Decline the offer: if the offer was not enough to agree upon, then you should decline the offer.

- Counter-offer: keep in mind that the seller may negotiate with you so it is crucial to back and forth until you reach the agreement.

- Offer accepted: After the approval of the offer, you need to sign the purchase agreement. After that, you are under the contract.

Additionally, these things must happen before the process continues. These deals hinge upon obtaining financing within a specific time frame. Other than that, it may require a home inspection or certain repairs. However, this may include too many scars away from the offer.

Loan Application

The loan application is the process that comprises saving information about employment, education, income, debts, installation, payments, and a previous record of mortgage.

In addition, all these things are necessary to provide a loan. For instance, closing a mortgage transaction takes 45 days, approximately on average.

Furthermore, all the mortgage applications, if it is one way or two, follow the same format as the US loan application. It follows five pages of questions regarding the finances, debts, loans, and property.

Loan Processing

Load processing is the process in which the lender takes the loan application under examination to verify all the documents. this will also be necessary to prepare the loan file for underwriting.

Furthermore, after that, the application undergoes more and more scrutiny for more authentication.

During the document processing stage, the lender must verify assets, incomes and employment. The documentation requested by underwriting routinely includes:

- Evidence of Money

- Verification of asset

- Borrower Letter of Explanation

- Gift Letter

- Copy of Note

- Source Large Deposits

- Verification of Employment

- Fully Executed Sales Contract

- Loan processors gather documentation about the borrower and property and review all information in the loan

- Order credit report (if not already to go for a preapproval)

- Start verifying employment (VOE) and bank deposits (VOD)

- Order property inspection {optional}

- Order property appraisal

- Order title search

- Orders a home appraisal to determine the value of the property

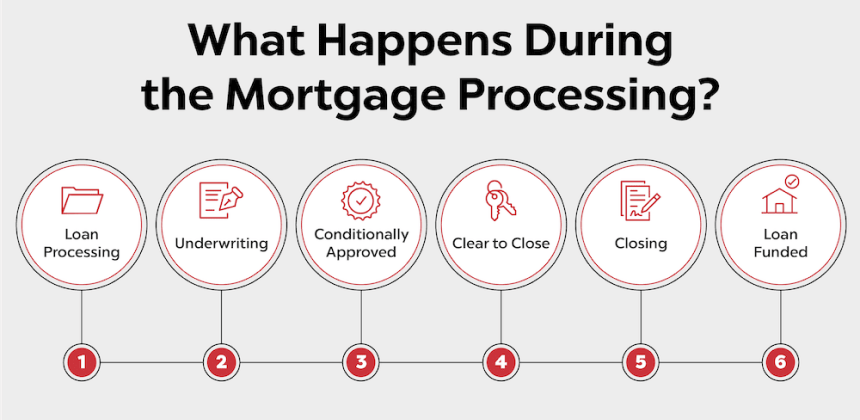

Steps in a Mortgage Loan Process

The mortgage loan origination process typically includes several key components. Below we have elaborated the mortgage loan process step-by-step. Let’s get started!

Step 1: Initial Consultation

The journey typically starts with a consultation between the borrower and the lender. In this meeting, the borrower shares their economic profile, which includes income, debts, and credit history. With this data, the lender is able to direct the potential borrower to which mortgage products to consider and the approximate loan amount the borrower may qualify for.

Step 2: Preapproval

The following step is getting preapproved and sending financial documents to a lender. This initial evaluation is useful for the borrowers to know what their budget would be and also enhances their standing when they bid for a home. Preapproval is when the lender assesses the borrower’s credit report and financial situation.

Step 3: Loan Application

After a preapproved process, the borrower completes a mortgage loan application, also known as a formal application. This document includes all the borrower’s financial history, employment, and purchased property. Moreover, it is crucial to submit authentic information, as this lays the foundation for the entire mortgage process.

Step 4: Processing

After submitting the application, the loan enters the implementation stage. At this stage, the lender verifies all the information. This step involves reviewing the credit report of the borrower, employment references, income documentation, and existing debt. This is a critical step that provides the lender with a comprehensive overview of the borrower’s financial status.

Step 5: Underwriting

Next step, the application moves to underwriting.

In this process, the underwriter is responsible for all the risk

the underwriter is responsible for assessing the risk of lending to the borrowers. They evaluate the creditworthiness of the borrower and the property’s value to ensure it meets the lender’s criteria. This level can involve extra requests for documentation or clarification, which borrowers have to be prepared to provide.

Step 6: Approval

If the underwriter accepts the application, then a loan approval is issued to the borrower. Mortgage loan approval details the terms of the mortgage, including interest rates and loans. This is as exciting a milestone for borrowers, who will now have one step closer to possessing their dream homes.

Step 7: Closing

In the final stage, the last paperwork finalizes among the borrower and the lender. Several documents, loan agreements, promissory notes, and disclosures have to be read and signed by the borrower. In the last stage, when the process of closing the loan is over, then the funds are disbursed by the lender, and the property is legally handed over by the lender.

The Importance of the Mortgage Lifecycle

All the borrowers deeply understand the mortgage lifecycle.

All phases are essential to a smooth transaction. In addition, this transaction also helps borrowers achieve their goals. We might see the life cycle of a mortgage as a series of actions that involve the borrower as well as a number of professionals (realty agents, appraisers, closing agents).

1. Preapproval and Its Significance

Preapproval is the starting point for the whole mortgage journey. By obtaining preapproval, borrowers can:

- Be Specific About Their Financial Capacity: By knowing how much money they can borrow, buyers can narrow down their home search and do not waste time on properties they cannot afford.

- Increase Offers: Preapproved buyers are typically the ones who really stand out. This can make a difference in markets where multiple offers are common.

- Catch Problems Before they Happen: During preapproval, you’ll see credit or financial problems early on, before the house search, so borrowers can take action.

2. Application Process: Detail Matters

You have to be meticulous when it comes to getting a loan. Borrowers should ensure that:

- Document completion: The most common files are W-2 forms, bank statements, and tax returns. If you have all the documentation needed up front, this can speed things up.

- Reconciliation Is Vital: Financial deception can cause you to lose the loan or end up in court.

- Open Line of Communication: Being open with the lender throughout this stage will help to clear up any questions or issues early.

The Role of Technology in Loan Origination

In this digital era, technology plays a crucial role in the mortgage origination process.

There are several new technologies that emerged. Which is why this process makes the process more enhanced, efficient and user-friendly.

Lending Origination Systems (LOS)

A LOS system is a software solution that helps to optimize the loan origination process. They can perform various automated tasks, including document collection.

Moreover, it also helps with compliance verification and communication with borrowers. This will also reduce manual efforts. In addition, it can speed up the process, and there is also a lower risk of errors.

The main features of a LOS usually include:

- Document management Powerful LOS: makes it easy to upload and track documents, as it reduces the risk of losing the documents.

- Automated workflow: This helps ensure that each step of the loan process is tracked consistently. And improve efficiency.

- Unified communication tools: These tools facilitate seamless communication between lenders and borrowers.

- Mortgage automation software: Mortgage automation software helps increase efficiency in the mortgage process by automating repetitive tasks.

- Data entry: Automated data entry reduces the time required to enter borrower information. And minimize human error.

- Performance monitoring: These platforms can provide valuable insights into the performance of loans. It helps lenders identify trends and areas for improvement.

- Business intelligence platform: The mortgage Business intelligence platforms enable industries to increasingly use business intelligence platforms to analyze strategic insights and data and improve decision-making.

Experts also examine mortgage software development play a crucial role in the process by streamlining tasks and improving accuracy with tools like lending origination systems (LOS), mortgage automation software, and business intelligence platforms.

The Role of Loan Officers

Loan officers are crucial for the mortgage loan origination process.

They help the borrowers to apply for loans and guide them on what to do in the complex journey of the mortgage.

Moreover, their roles and expertise are to ensure a smooth, successful and hassle-free loan origination journey.

Responsibilities and Expertise

There are many roles and responsibilities of loan officers. One of their main roles is to act as a connector between borrowers and lenders.

In addition, they will ensure the collection and evaluation of necessary information.

Furthermore, they help navigate the hassles of the mortgage application process. This will make it more manageable.

Their responsibilities include:

- First gather the necessary documentation to complete the mortgage loan application.

- Evaluate the debater’s facts, including credit, revenue, profit, verification, etc.

- Guiding borrowers in deciding on the most appropriate mortgage options based on their economic desires and circumstances.

- It can also provide information on loan origination, repayment and interest charges.

- Answering debtors’ questions and concerns throughout the loan origination method.

Conclusion

As we all know, the mortgage loan origination process seems intimidating. However, knowing each and every step can help you from application to final approval so the mortgage lifecycle navigates with clarity.

Furthermore, whether you are a first-time homebuyer or possibly refinancing, you can make better financial choices by deeply understanding the cons and pros of loan origination.

Nevertheless, the process seems long and stressful. However, make sure you don’t rush it. Clearly and carefully check all your documents and make sure to understand what is loan origination, the steps in a mortgage loan process and all the policies and terms of the mortgage. Also, seek help if you are unsure about anything.

Remember that you will pay your mortgage loan for a longer time, so choose wisely.