As a significant financial sector, the Mortgage industry is at a critical point. If you are a lender, you suffer continuous pressure, too. There are examples where the impact of high competition, increased customer hopes, and heavy legalities is poisoning the mortgage industry. It is not shocking that lenders are the receivers of worst-case scenarios! But like every problem has a solution, mortgage automation helps as a game-changer.

When you recall the vision of your lending business, you expect to have a solution that processes loans faster. In today’s world, having a solution is unimportant, but your business needs a reliable support system. With mortgage automation, you can ease the processes of your lending business. It is a complete framework that transforms how things work in the mortgage industry.

In this blog, we will discover how loan automation can help lend businesses to tackle the challenges coming ahead. Setting up one effective automation process today will continue to help grow your business for years.

What Is Mortgage Automation and Why Does It Matter?

Mortgage automation is a full-fledged term that simplifies and automates hectic manual processes. Thanks to automated mortgage processing, you don’t have to spend hours juggling paper forms or spinning your mind for hours and hours. When automation takes over repetitive tasks, you can divert your team’s focus to other business endeavors.

It has always been paramount to invest in mortgage process automation. Moreover, you can organize your workflows more effectively. CRMs are of great help because your business always requires prioritizing customer satisfaction.

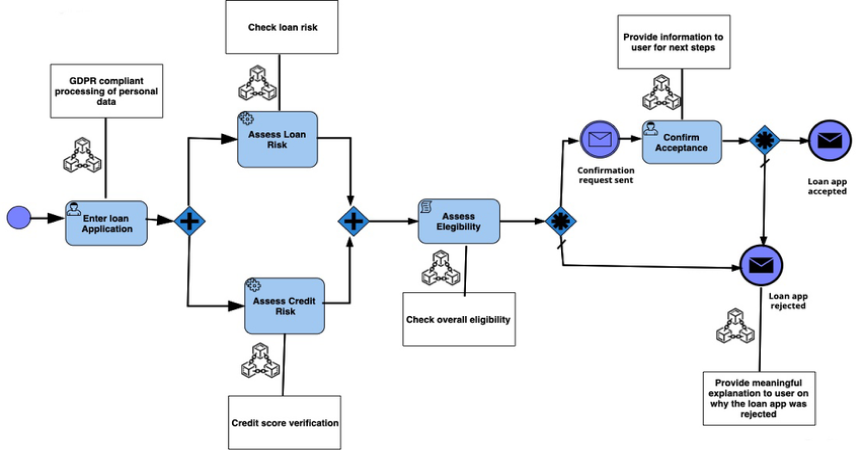

There are only a few areas of lending business that can be automated, such as:

- Document Collection: Borrower documents such as income statements, tax returns, and credit reports can be automated. Automation refers to requesting, tracking, and verifying the documents without the hassle of manual work.

- Underwriting: Gone are the days when financial data meant analyzing massive piles of files and folders. Now, your lending business has AI tools to assist it. So, assess your business data, credit score, and risk factors with ease. Once the underwriting process is faster, your business can benefit from accurate decisions.

- Approval Workflows: When lending automation is the main ingredient, processing becomes convenient. This is because every step of the process is followed, and there are no chances of errors or delayed work.

Real-life example:

Imagine a situation where a borrower must submit all the important documents for a loan application. He is eventually introduced to the automation method, which helps him extract the data, present it accurately, and identify missed information. This real-life incident didn’t take years to happen. Automation sets everything right in a few seconds!

Accelerating the Loan Application Process: Fast-Tracking Success

You must maintain speed when it comes to the loan application process. Today’s fast world welcomes faster processes and quicker outcomes. Also, borrowers expect fast replies and quick approvals. The borrowers will soon leave your business and go to your competitor to get the service. Hence, the essence of mortgage workflow automation is undeniable. If you have the right tools, the time duration of loan processing is not in days; it can be completed in hours.

How Does That Work? Let’s Break It Down:

1. Digital Document Collection: The digital document collection is a reason that makes mortgage automation a sigh of relief! The borrowers can upload their documents only, and the automatic system verifies them in less time.

2. Simplified Application Process: Automation in mortgage industry is not just for paperwork. It is a complete process to fulfill the rituals of loan application. It is straightforward because the borrowers can upload the documents themselves. They can also track the status and upload the other documents, if needed, without help.

Ready to turbocharge and command your borrower’s loyalty? Mortgaging automation is a surefire way to accelerate success. Now, let’s look at how it can be applied to underwriting and decision-making:

Innovative Underwriting: Making Faster, More Accurate Decisions

Every underwriting decision depends on speed and accuracy. With the evolution of AI, the intelligent process of underwriting seems the easiest way. It is not just the most accessible; you can complement it for reliability, too. This is how it is done:

1. Automation Speeds Up Data Analysis

The underwriters maximize loan automation by assessing a vast amount of data from many resources. The traditional practices of physically reviewing data are no longer valid. In such cases, automation speeds up data analysis. Many automated systems link the information within minutes and with accuracy.

2. AI-Powered Risk Assessment

Like in every industry, AI and machine learning are your friends in need! These two technologies ignite the soul of everything and take it one step further. AI can quickly assess a borrower’s risk profile. It is the capacity of AI to analyze past data and identify patterns. This makes it easier to understand the applicants’ habits because it cherry-picks the indicators! The most common signs are spending habits, income variations, or even outside factors impacting the capacity to repay a loan.

Improving Compliance with Zero Stress

You might be wondering how mortgage automation solutions can help your lending business improve compliance. Even the most careful team gets overstressed by keeping up the compliance factor. It is because a single mistake results in heavy fines, lawsuits, and reputation damage! At this point, you might be having high levels of serotonin! But wait! Here is the good news: Mortgage automation can be your savior. It eases all the burdens, ensures that the processes are more innovative, and follows the legal requirements.

Now, let’s discover how mortgage process automation help in keeping track of workflows and foster easy auditing:

1. Automated Workflows Keep You on Track

With an automated workflow, you can keep track of every step of the loan process. Also, you need to align each step with present-day legal needs. From start to end, lending automation takes care of the entire process. It makes sure that all the essential documents are completed and filed factually.

2. Automated Reporting Tools for Easy Auditing

The other benefit of mortgage workflow automation is automated reporting. For audit and regulatory reports, there is no need to compile data physically. Automated tools are available one click away – eliminate lengthy and vulnerable tasks! Now, the detailed compliance reports can be made available on demand. You need not put effort into tracking every change in the document. It is done automatically. Moreover, the mortgage automation system provides an audit trail. An audit trail can quickly be edited, evaluated, and shared with regulators.

Cost Savings and Efficiency

Saving a few extra bugs seems like a delight, especially in the mortgage industry. The mortgage industry is resource-driven and open to excessive costs, mainly manual labor and administrative overheads. But what if you can reduce these costs and simplify the loan process? High costs don’t determine whether quality will be maintained. Reducing costs here means maintaining quality and retaining high-quality customer service.

The mortgage industry can be resource-intensive, especially regarding processing loans’ manual labor and administrative overhead. But what if you could significantly reduce those costs and streamline your operations—without compromising on quality or customer service?

Automation in mortgage industry is the key to making that happen. Let’s highlight how it is done:

1. Reducing Manual Labor and Administrative Costs

The traditional loan processes were dependent on manual and time-consuming practices. Now, mortgage automation acts as a catalyst to replace boring manual tasks. Hiring people who will spend hours on data entry and document collection is unnecessary. Behind the scenes, a mortgage automation system for your loan system also monitors compliance rules.

2. More Efficiency, More Loans

Team up to handle more loan applications without the need for excessive resources! Mortgage automation solutions fasten processes and reduce manual work. A practical example is that the’ more efficiency, more loans’ rule applies in high-volume periods, and there, you need to scale up quickly!

Delivering a Seamless, 24/7 Customer Experience

As we move ahead, we can sense that customer demands are skyrocketing. They look for instant access to information and smooth, 24/7 service. So, automation in mortgage industry acts as a guardian angel as it helps lenders meet customer demands. A seamless, round-the-clock service keeps borrowers aware and connected throughout the entire loan process. What’s the outcome? No usual waiting times or frustrations!

- Instant Access to Loan Information, Status Updates, and Document Uploads

Split seconds is the science of today’s fast world. Borrowers don’t have to wait for business hours to resume getting loan processing updates. Loan automation offers a secure online portal. On an online portal or mobile application, there is a great option to view real-time updates on the loan application status. Furthermore, checking and uploading documents are the easiest things in the world with automation!

- Scaling Your Business Without Losing Quality

You are a lender in today’s world, and your lending business is set on foot with automation. Your company might come across fluctuating loan volumes. Managing these fluctuations can be challenging, whether a seasonal spike, a significant market shift, or a sudden surge due to a rate change. But we suggest you ease your operations with custom mortgage development while keeping high-quality and affordable processes in mind.

The Scalability of Mortgage Automation

Imagine an occasion of the year when it’s peak time to buy a home; there are heavy loan volumes. You are under a lot of pressure to automate time-consuming tasks. However, a reliable mortgage company offers a solution to help you handle data entry, document management, and compliance checks. With lending automation, your business will be blessed with more applications. The surety is that all workflows run efficiently and well without overstraining your team!

So, increase your headcount today with a mortgage automation solution available at Awesome Technologies Inc.!

Risk Management: Reducing Errors and Protecting Your Bottom Line

A high-risk business is like a nightmare! So, risk management centers around accuracy and vigilance. A single mistake is dreadful for an intricate process like a loan application! Loan processing, underwriting, and documentation are vulnerable to costly mistakes. So, mortgage workflow automation can help your lending business with compliance issues, taking care of your business and reducing the chances of errors. Fortunately, automation significantly reduces these risks, improves accuracy, and protects your bottom line!

Reducing Human Error in Loan Processing

Mistakes are humanly impossible to eliminate. Similarly, even an insignificant error in mortgage lending, such as a missing document, miscalculated interest, or breach of compliance, can delay the loan process. In the worst case scenario, it costs an individual his or her fortune.

Real-Time Data & Analytics: Gaining Insights to Drive Success

When you don’t know enough about the right insights, your business can be a victim of low outputs. So, to prevent you from missing out, we suggest you trust unfailing automated mortgage processing platforms. These platforms integrate real-time data and analytics. Lenders can gain a transparent view of their loan pipeline performance, customer behaviors, and strategic business metrics—allowing them to stay responsive and make data-centric decisions.

The Future of Mortgage Automation: Innovation on the Horizon

Innovation on the horizon of loan processing ease with unique lending automation possibilities. Emerging technologies such as AI, Machine Learning, and blockchain are the cornerstones of the future of loan processing. These technologies are all set to provide a paradigm shift in how lenders approach innovation in today’s fast-moving world. So, are you ready to create a more agile and customer-centric mortgage future for your lending business?

Let these technologies handle the rest, such as underwriting, product offerings, analysis of big data, identification of patterns, and accurate predictions about the borrower’s risk factors and behavior!

Ready To Automate? The time of revolution Is Just around the corner! Book a free consultation session before you turn the pages to 2025!

To Conclude

When you turn to mortgage process automation, you must do what everyone around you does. Mortgage automation can ultimately be your business’s competitive advantage. In a highly competitive lending world, you must accept it as a game-changer! At this moment, we admit that automation’s transformative power is indisputable.

Technology will continue to overcome the industry’s challenges, such as artificial intelligence, machine learning, and blockchain, creating future opportunities and better results for lenders and borrowers alike. Given the digital-first world, lenders should embrace automation to be competitive and future-proof their businesses. For this reason, Awesome Technologies Inc. is here to streamline your mortgage process today. Request a free demo to unlock faster loan approvals and easy workflows!