Imagine you’re buying a house and need a loan from a bank to make it happen. Getting that loan involves many steps and paperwork, which can be complicated. That’s where Loan Origination Systems (LOS) come in. They’re like the behind-the-scenes technology that helps mortgage companies, credit unions, and private lenders manage all the tasks involved in giving out loans.

There are several different LOS options out there, each with its own strengths and weaknesses. Choosing the right one for a mortgage company is a big decision because it affects many parts of your business. But with more than 25 choices, it can be overwhelming to pick the best one.

If your company is going with Encompass LOS, learn about our implementation services here.

That’s where we come in. We have dedicated experts in both the mortgage industry and technology, and we help mortgage companies figure out which LOS will work best for them. We consider numerous different factors like the company’s goals, how the LOS will fit with their current systems, how much it costs, and how long it will take to set up.

We believe it’s our job to make this decision-making process easier for mortgage companies. We explain what to think about when choosing one, and how to compare different options so that your company can make the best choice for their needs.

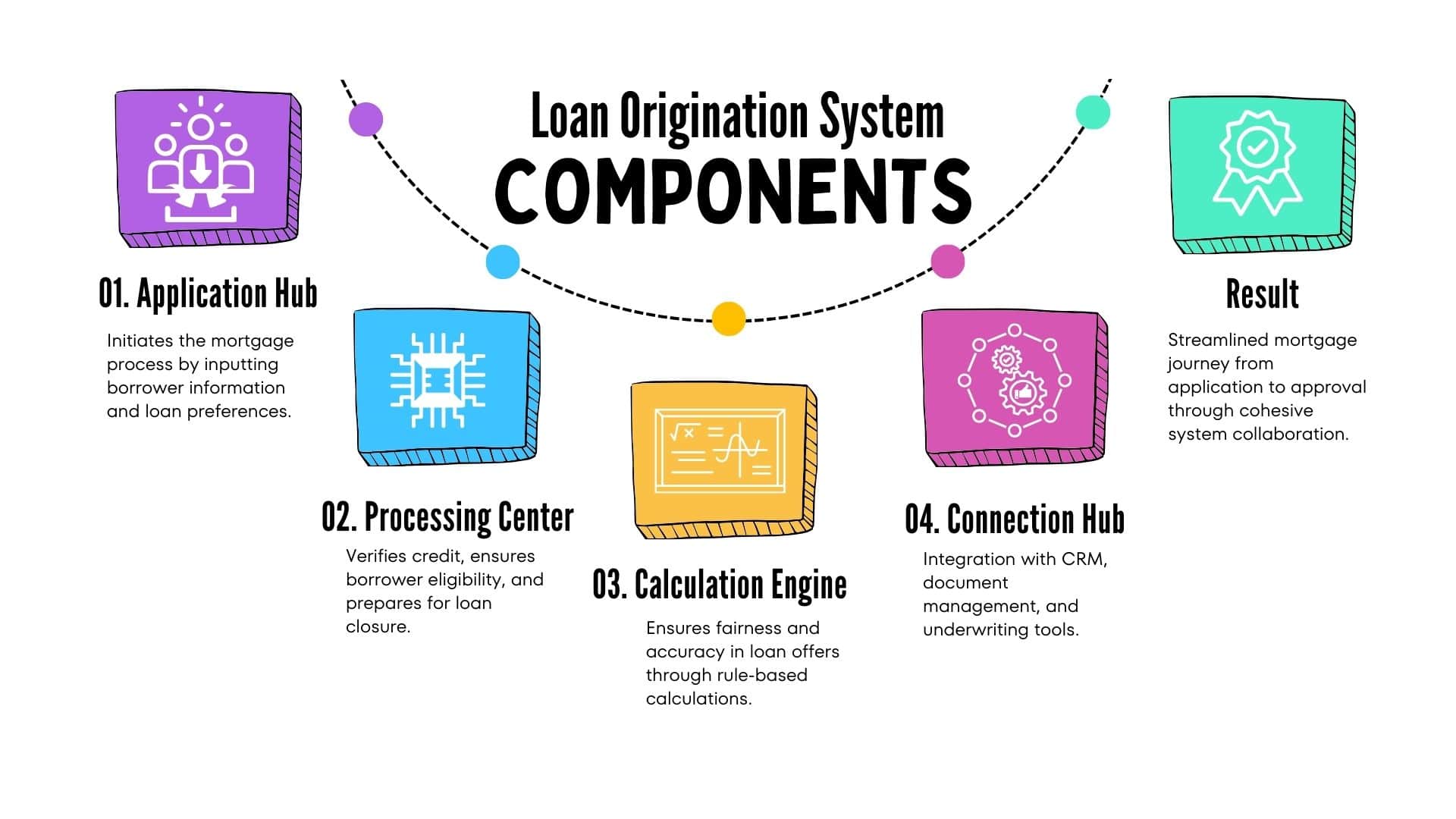

Every LOS Has 4 Essential Components

Application Hub

This is where the mortgage process begins. Consider it the starting point where borrowers provide information about themselves and the loan they want. Depending on whether you’re a bank, a mortgage broker, or someone else, there might be different POS systems. These systems gather all the necessary information and kick off the loan process.

Processing Center

Once you’ve started the process, the processing stage takes over. This step involves processing loan applications, checking credit, ensuring the borrower meets all the requirements, and finally, getting everything ready for closing on the house. It’s the biggest part of the whole system because it covers everything from start to finish.

Calculation Engine

This part of the system deals with the behind-the-scenes rules and calculations. Different lenders have different rules about who can get a loan and how much it will cost. The product and pricing engine makes sure that everything is fair and accurate. Some LOS platforms have their own built-in systems for this, while others connect to external ones.

Connection Hub

This stage is like the bridge that connects the LOS to other systems and tools that are used throughout the mortgage process. For example, it might connect to customer relationship management (CRM) systems, document management systems, or tools used for underwriting loans. This helps keep everything organized and running smoothly.

A loan origination system is like the engine that powers the mortgage process, making sure everything runs smoothly from start to finish. It’s a crucial part of the process for both the lenders and the people getting the loans. This is the reason we suggest you always contact the best people for the implementation of your LOS.