Essence of Automating Your Mortgage Loan Process

In the past, completing mortgage loans required much physical labor and prolonged data entry. It was more vulnerable to mistakes and was overall not useful. However, the mortgage firms had no other choice.

Thanks to the benefits of loan processing automation today, the mortgage industry can now get many loan operations. Be it a mortgage discharge or a loan application. Mortgage experts can focus on the client, and work on the loan application process as per the needs. Usually, their aim is to pick projects that better match their background and skills.

Even today, the present mortgage lenders face more difficulties than ever before. It is because the functional and supervisory developments progress and make the industry complex. This makes it easy to understand why so many small and medium-sized mortgage lenders are closing their doors.

The problems continue because most lenders still depend on old structures and legacy systems. They mostly count on manual ways. Also, most mortgage lenders have to spend their time and resources managing features which are not consistent.

Who Gains from Automation of the Mortgage Process?

The benefits of mortgage automation are many for company personnel, each affecting differently.

- Leadership & Management

The process of providing mortgage automation solutions promises compliance. This technology’s ability to provide information and data trails will also impress leaders. They’ll be able to act and make promises more confidently than they could have.

- Agents of Customer Service

Mortgage workflow automation will create records and information. It also helps in facilitating customer care departments to respond rapidly to customers. Also, they can also make more accurate product recommendations and update records. All these changes work on data from their existing customers.

- Teams In Charge Of Sales And Marketing

If sales and marketing teams work on risk evaluations and better understand their clients’ products, it is worth it. They can work on useful marketing techniques. Also, the sales team can make recommendations and upsell potential customers.

- Departments of Finance and Accounting

Automating the mortgage process creates information trails that make it easy to prove submission and observance. If these needs are changed, it is simple to alter them and request any missing documentation.

Top 10 Benefits Of Mortgage Automation Process

1. Increased Output

Any mortgage lender you speak with will tell you that time is what they value most. Mortgage lenders want to materialize the means, and buyers want to move into their new homes as instantly as possible.

Most mortgage lenders are unhappy with the tiresome tasks of processing applications. It is because they cut into the time allocated for other important issues. When the mortgage process is set, it helps lenders to process mortgages in a short time.

2. Enhanced Precision

Resolving human error in loan processing is painstaking. According to IRPA, people are projected to make 10 mistakes in every 100 loan processing stages, including dismissed work. Mortgage lenders must quickly employ RPA to automate their procedures. It reduces the need for formal training and creäte error-free work immediately.

3. Better Capture of Fraud

Due to the sharp rise in mortgage fraud, mortgage lenders are forced to utilize several strategies to reduce the damages. Hence, LOS (Loan Origination Systems) brings sophisticated predictive analytics.

On the other hand, lenders can influence robotic process automation for mortgage services. Because the process is automatic, you may reduce losses by quickly verifying which loan needs fraudster analysis. Undoubtedly, these mortgage software solutions are great!

4. Improved Customer Experience

Documentation during loan origination and closing may take two weeks to a month to process. It depends on the accuracy and speed of your employees, the details of your internal process, and the availability of buyers. Giving your clients the best experience possible will be a difficult challenge.

Hence, the systems guarantee 24/7/365 operations that quickly boost customer satisfaction. They have low interruption and can operate on cloud infrastructure appropriately.

5. IT Procedures Are Not Interrupted

It is feasible to complete automating mortgage tasks in as little as sixty days. This is a boon for a sector that must deal with antiquated infrastructure and protracted processes. It will be a switch to a more efficient, smooth, and instant process.

Powering the mortgage loan process is a handy process. Collection of information from many locations, combining checklist- and rule-driven tasks, validating information with a third party, etc. become easy. Thanks to mortgage automation solutions.

6. Defined and Consistent Workflows

Most mortgage lenders declare that their current processes must be laid out. There are too many variables for lenders to design specified processes. They range from data entry to document collection and routing, task assignments, email notifications, processing, etc.

As document management systems advance, acquiring loan applications becomes easier. Eventually, having a full grip of your process through the analytics offered by such a system facilitates you in many ways. Such as you can make more informed decisions and accommodate resources as needed.

7. Simple Auditing

Automating documentation and other loan processes helps you in a number of ways. It creates more efficient and consistent compliance requirements, limits risks, and responds to them more quickly. Obtaining a mortgage loan is a difficult process, even with today’s advanced tools and solutions.

As a result, following the regulations is also taken care of because the automation process does it. You don’t have to worry about whether all your employees followed the rules. Thanks to the mortgage workflow automation!

8. Improve Scalability

Scalability is vital for mortgage firms to execute machine-based automation. A strong grasp of the mortgage industry is essential to understand the thousands of diverse types of mortgage papers. It is useful for better data extraction, document stacking, data analysis, and organization.

For this reason, it is tricky to contract these jobs. However, the mortgage lending process becomes easy, specifically if cloud-based infrastructure installations are involved. Real-time server cloning facilitates immediate response to surges in demand.

9. Consistent Income

With loan process automation, you can forecast how much money your leads will bring in. Also, how much the loan procedure will earn right through your loan cycle.

Subsequently, this understanding of mortgage automation solutions will facilitate lenders to accommodate the evolving client demands. At the same time, they have to comply with freshly authorized legislation.

10. Better Adherence To Legal Requirements

Mortgage lenders show full devotion to difficult regulatory regulations while controlling the relevant risks.

Lenders can now gain improved compliance through automation processes. It is because it decreases operational risks, improves the reliability and quality of the operations. Also, they make sure that they are completed each time.

The Features Of Mortgage Automation Software

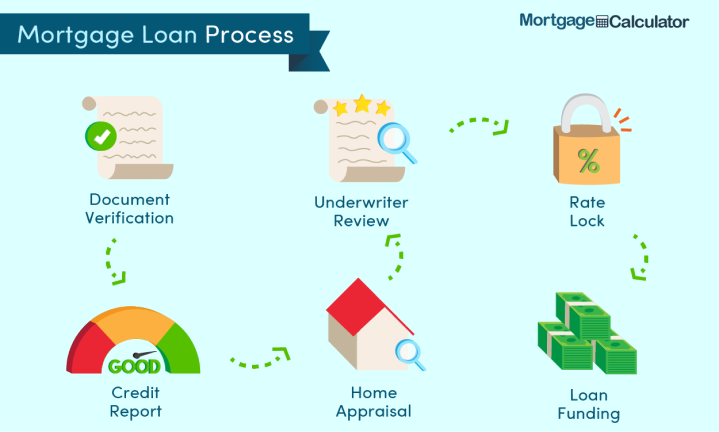

- Incorporating mortgage automation solutions with origination systems absolutely rationalizes the loan approval process.

- Using automated administering methods makes underwriting perfect and well-timed.

- Process efficiency is strengthened through workflow efficiency, which reduces manual faults.

- Automated document processing and management undertakes precision and fulfillment when handling financial papers.

Automating Your Mortgage Loan Process In 2024 And Beyond

The mortgage industry is continuing to quickly as 2024 draws near. It is driven by changes in borrowing expectations and technology improvements. It is because automating your mortgage loan procedure is necessary to remain competitive and efficient. So, don’t wait for this year to end and have an asset of your own! Awesome Technologies can help you to know the best options for the mortgage loan process. Do you know why? Blockchain, AI, cloud computing, and sophisticated data analytics can ease mortgage workflow automation. They also enhance borrower satisfaction and adherence.

In Conclusion

Automating your mortgage loan procedure can help speed up the consent and application procedures. By employing technology, you may need less time and less effort. This increases effectiveness, accuracy and pace.

Automating the mortgage loan procedure is a wise decision. It was much needed since the start and was necessary to renovate the mortgage industry. The benefits are that it reorganizes operations, decreases expenses, and improves the overall experience. The lenders and borrowers both have benefits from the loan automation system.

It also makes it feasible to manage regulatory responsibilities and fulfillment more successfully. Specifically, the mortgage market gains from the exploitation of automated technologies. It helps to create a more accessible and financially compliant environment for lenders and borrowers.

FAQs

How does Automation increase the Efficiency Of Mortgage Processing?

Employees can focus on other work while mortgage workflow automation works on its own. It can carry out its routine processes like data entry, document authentication, and risk evaluation. Automation also completes these jobs more quickly than manual methods.

Is It Possible For Automation To Reduce The Time Needed To Complete A Mortgage Application?

Certainly, automation lowers processing time by fastening data processing and authentication, restructuring workflows, and decreasing manual involvement.

What Financial Benefits Are Possible From Automating The Mortgage Process?

Less manual labor is needed. It is possible that fewer mistakes need costly corrections. And progressing operational competence lowers the cost of processing.

Is It Possible For Automated Systems To Process A Lot Of Mortgage Applications?

Automated systems are available, meaning they can administer higher application volumes without experiencing raises in costs.

How Does Automation Enhance The Security Of Data When Processing Mortgages?

Enhanced security aspects like encryption, access limits, and safe data storage are generally included in automation solutions. These aspects lower the risk of data violations and uphold sensitive borrower data.