Top Mortgage CRM Solutions for Loan Officers

Selecting a suitable mortgage CRM (Customer Relationship Management) solution for top mortgage loans is critical for loan officers. Whether it is mortgage loan lead generation, building client relationships and staying organized throughout the lending process, CRM for mortgage does wonders! The mortgage industry is filled with distractions and having a CRM that fits your needs can create efficiency and ultimately profit for loan officers.

If you are an independent loan officer, or part of a wider mortgage company there are so many tasks throughout a mortgage process that a particular CRM can automate. CRM specific to mortgage processing can be extremely beneficial to loan officers in automating their follow ups, organizing document collection, tracking verbal and written communications throughout the process as well as overall compliance which will ultimately create more time for finding the next loan and closing deals for customers. It can be overwhelming to keep track of all the various CRM options available for use.

In this blog, we have compiled a range of the best mortgage CRM solutions for loan officers including overview, features, benefits etc. for every type of mortgage officer. Whether you are looking for the finest CRM that is fully automated, integrates flawlessly with other technologies or is just easy to implement and begin using, there are plenty of solutions for you to utilize to do a good job and grow your mortgage business.

What Is a Mortgage CRM?

A mortgage CRM system is not just a digital address book; it’s a powerful and customizable tool designed exclusively for mortgage professionals to manage every step of the borrower’s journey, from initial contact to closing, and even after the loan is completed.

With a mortgage CRM or a software mortgage, loan officers can manage and stay on top of leads, have clear communication records with borrowers, and automate repetitive, time-consuming tasks. Plus, everything is done in one platform that is simple to use like it is done in a loan processing software.

Compared to the typical Client Relationship Management system, the best CRM for mortgage brokers allows lenders to stay organized, provide seamless experiences for borrowers, and establish stronger relationships with clients. It’s important to keep in mind that choosing the best mortgage CRM is about more than just features—it’s about identifying the system that meets your workflow, assists in achieving your goals, and allows for efficient business growth.

Why Do You Need a Mortgage Loan CRM?

A mortgage-specific CRM gives loan officers the tools to manage leads, automate communication, and facilitate the loan process from one location. It’s easy to miss follow-ups, forget to collect documents, or lose track of client communications without a centralized system – so let mortgage CRMs handle everything!

A top mortgage CRM will ensure that no opportunity slips through the cracks by keeping you organized and your pipeline working for you. It will also increase client satisfaction with timely, relevant, and personalized communication. The best mortgage CRM for loan officers isn’t just a useful tool; in a competitive industry, it is an essential piece of software if you want to scale your business.

CRM for Mortgage Agents: What to Look For

When looking for the best CRM for mortgage brokers specific for use in the mortgage industry, you should look for features that are catered specifically to your lending process. These include lead tracking, milestone automation, document collection and electronic signature support, as well as compliance. You should also make sure the mortgage CRM software such as surefire CRM or ATI CRM for mortgage have customizable workflows that align with your loan cycle.

Usability is very important if your loan officers are busy and don’t want to get overwhelmed learning the software. Rich reporting capabilities, mobile access, and customer support are very important as well. The right mortgage CRM should help you close loans faster while providing a first-class client experience!

Best Features Of CRM For Loan Officers

1. Lead Management & Tracking

Mortgage CRM systems allow you to capture, organize, and track leads from multiple sources (web forms, referrals, real estate agents, purchased lists) so you never miss opportunities and utilize hot leads effectively.

2. Automated Follow-Ups & Reminders

Loan officers or top mortgage agents manage dozens of prospects simultaneously, and automation tools enable timely follow-ups, loan milestone updates, and post-close check-ins without added burden. Thanks to the loan officer CRM system to perform in the best manner!

3. Loan Pipeline Management

The loan pipeline visually outlines deal status, whether pre-approval, underwriting, funding, etc. With mortgage loan CRM, loan officers can easily see their progress, where bottlenecks exist, and there are expectations for closings.

4. Document Management & e-Signatures

The best mortgage CRM software will allow you to securely upload, store, and share loan documents indefinitely, while integrating with e-signature platforms lets your clients sign forms quickly and efficiently.

5. Integration with Loan Origination System (LOS)

Having the best mortgage CRM system that productively integrates with your LOS keeps your data synced up and eliminates the burden of double entry, as well as allows you to update loan statuses in the CRM in real time.

6. Customizable Email & SMS Campaigns

Included templates, along with drip campaigns, will help keep leads active over time on CRM for loan officers. Messages can be personalized with specific actions, loan stages, or dates as the trigger.

7. Compliance Monitoring

The Mortgage CRMs will often include tools to help make sure your communications and documents are compliant to industry regulations (TRID, RESPA, etc.). This is a critical feature to avoid potential legal issues.

8. Reports & Analytics

The CRM for mortgage agents helps in reporting on lead sources, conversion rates, team performance, and pipeline value will give loan officers and managers the data they need to make informed decisions.

9. Mobile Access

Having mobile friendly CRM mortgage means in the field, when meeting clients and agents your loan officer can access client info and send updates or notes.

10. Referral & Partner Management

With mortgage CRM programs, one can easily manage and track the referrals from real estate agents and builders. This helps you establish a good referral partner and keep track of your business sources.

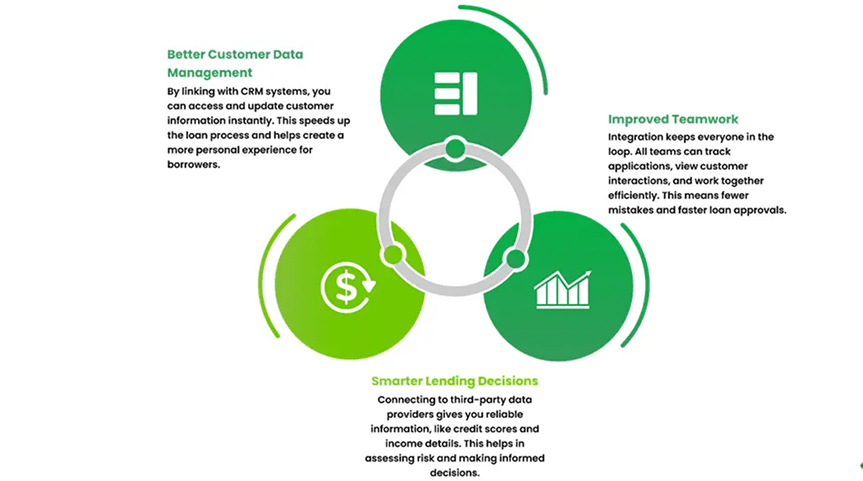

CRM Integrations with Loan Processing Software

A quality mortgage CRM should integrate with your loan origination system (LOS) and any other tools you frequently use such as email systems, credit checking services, and document verification technology. Those integrations are relevant to AI mortgage brokers and broker mortgage software as they reduce instances of duplicate data entry, provide error reduction opportunities, and allow visibility as to the status of each loan file in real-time.

When your mortgage broker CRM such as Shape mortgage CRM is integrated with mortgage broker software, it allows your sales team and operations staff to work from the same set of parameters as mortgage originators work through a loan file. Eliminating gaps will not only result in better turnaround times but will enhance the borrower experience from application through to closing. This is what the best mortgage companies for new loan officers expect from a CRM software!

What Makes a CRM Best for New Loan Officers?

When new loan officers consider what is the best mortgage CRM, it should be something easy to understand, easy to set up, and includes some simplified tools for lead nurturing and task management. Your CRM should also include templates, automation, onboarding tools, and your ability to jump in and get started right away.

A CRM for mortgage professionals can support coaching, or some degree of pipeline visibility could allow new loan officers to quickly discern where to concentrate their attention. When it comes to process and compliance, you should seek out a loan officer CRM that provides the simplest solutions, and to remove the stress from follow-ups, so you can confidently begin building relationships and growing your client base from the very start.

Top 5 Factors To Consider When Selecting The Best CRM for Loan Officers

1. Mortgage-Specific Features

Many best mortgage loan companies seek out a CRM that is designed specifically for the mortgage industry. A generic CRM may not offer the features to support tracking loan pipelines, complying with regulatory requirements, and managing document workflows and communications.

2. Compliance & Security

Mortgage lending or LOS integration involves working with some of the most sensitive customer information around. Mortgage companies have strict compliance protocols in place as well as a financial responsibility to protect consumer data. Your CRM needs to support these compliance aspects and security protocols.

3. Integration Capabilities

Mortgage CRM provides integration capabilities. Choose a CRM that has nice integrations with the systems you are already using, like your LOS, marketing platforms, calendars tools, and email tools and platforms.

4. Automation & Marketing Tools

Loan officers can benefit greatly from CRMs that have automation capabilities with repetitive tasks and lead nurturing campaigns that can run through a CRM.

5. Usability- the switch matters!

It does not matter how powerful the CRM is if it isn’t intuitive enough for your team to use it. Choose a system with a well-designed interface and customer support.

Top 5 Benefits Of The Best Mortgage CRM Systems

1. Efficient Lead Management

A mortgage CRM can help you capture, organize, and keep track of leads so no lead falls through the cracks.

2.Marketing & Follow-Up Automation

The best CRMs offer the ability to automate outreach across email, SMS and social media to keep clients engaged during the entire loan process.

3.Better Client Experience

By managing all communication, documents, and tasks in one platform a CRM allows you to provide a smoother, more professional experience for borrowers.

4. Better Compliance & Documentation

Mortgage CRMs help ensure compliance with regulations through secured data storage and documentation that can be seen at an audit at any time.

5. Increased Productivity & Team Work

The best CRM for mortgage loan officers can automate daily tasks and manage visibility of pipelines and workflows making teams more productive.

15 Best Mortgage CRM Software for Loan Officers

When confronted with a ton of ‘best mortgage CRM’ platforms, it’s easy to feel overwhelmed by the many choices available to fit your workflow and business needs. Each CRM service is unique—some CRMs are built specifically for automation, others for compliance or integrations. To help, we’ve constructed a list of mortgage CRM for mortgage brokers that hit the mark. Each CRM software for mortgage professionals describes the key features, pros, cons, and who it is for, so you can feel confident in making a decision.

1. LoanMore CRM

LoanMore CRM, one of the best mortgage CRM systems, is a full-service mortgage marketing and pipeline management program that aims to help loan officers generate exclusive leads, automate follow-up processes, and manage client interactions.

Features:

- Exclusive and pre-qualified mortgage leads

- 80+ automated follow-up campaigns

- Realtor partner management

- Appointment reminders and scheduling

- Performance analytics and reporting

- Mobile interface

Pros:

- No longer reliant on realtors for business

- Follow-up automation saves you manual labor

- Best lead generation through data-driven marketing

Cons:

- Steep learning curve to get started (for the newbie)

- Pricing not disclosed on website

Impact on Loan Officers in 2025:

LoanMore CRM allows loan officers to grow their business by giving them the ability to automate their lead generation and follow-ups, which allows them to focus on the client relationship and less on back-end processes.

Unique Selling Point:

Offers exclusive, pre-qualified leads and a complete automation suite personalized for mortgage professionals.

Rating:

4.5/5 (User ratings and industry reviews)

2. Velocify

Velocify is a lead management and sales acceleration platform developed to help mortgage professionals manage leads and convert those leads in a more efficient way.

Features:

- Lead priority and routing

- Automated reminders and follow-ups

- Real-time reporting and analytics

- Integrates with many loan origination systems (LOS)

- Mobile app to manage leads when you’re not at your desk

Pros:

- Improved lead conversion rates

- Greater efficiency in lead management

- Analytics giving actionable insights

Cons:

- The service may require integration with other systems to help you achieve full functionality

- Price not disclosed publicly

Impact on Loan Officers in 2025:

Velocify is designed to help loan officers manage leads more effectively and improve their follow-up and conversion rates that are critical to competing with other lenders.

Unique Selling Point:

Robust lead management and priority and routing abilities that create enhanced experiences for sales opportunities.

Rating:

4.3/5 (Based on user reviews and industry feedback)

3. ATI Mortgage CRM

ATI Mortgage CRM is a software application for mortgage professionals to help them manage client relationships, automated marketing, and automate the loan process.

Features:

- Lead and contact management

- Automated marketing automation campaigns

- Tracking client communications

- Integrations with multiple LOS

- Reporting / Analytics Tools

Pros:

- Helps to manage client relationships

- Helps to automate marketing

- Has analytics

Cons:

- UI may not as intuitive as other platforms offering similar functionality

- Pricing is not listed on their website

Effects on Loan Officers in 2025:

ATI Mortgage CRM assists loan officers in managing client relationships and automating marketing efforts that ultimately result in more efficiency and productivity for Loan Officers.

Unique Selling Point:

Comprehensive client relationship management with automated marketing tools.

Rating:

4.2/5 (based on customer reviews and industry opinion)

4. HubSpot CRM

HubSpot CRM is a widely used customer relationship management software that provides businesses with the necessary tools and data for managing and analyzing customer engagement and data.

Features:

- Contact and lead management

- Email tracking and notifications

- Sales automation capabilities

- Reporting capabilities

- Integration with third-party applications

Pros:

- User-friendly interface

- Scalable for businesses of any size

- Extensive third-party integration options

Cons:

- Some features are only available in paid plans

- Customization for unique industries may be necessary

Cost:

Free tier (basic features). Paid plans start at $50/month, plus costs for advanced features and integrations.

Impact on Loan Officers in 2025:

Loan officers can use HubSpot CRM integrations to effectively manage their leads and automation of sales functions that will streamline their run of business and client engagement process.

Unique Selling Proposition:

HubSpot is a full-fledged CRM solution that has a solid free tier and extensive integration capabilities and opportunities.

Rating:

4.6/5 (user reviews and industry feedback)

5. BNTouch Mortgage CRM

BNTouch Mortgage CRM is a digital mortgage system that is fully integrated to combine a CRM, marketing, and point-of-sale (POS) tool that enables mortgage professionals to grow their business!

Features:

- Automated marketing for Emails, SMS, and Video.

- Lead management and distribution.

- Digital 1003s.

- Borrower and Partner portals.

- AI assistant and content generator.

- Integrations with various LOS and third-parties.

Pros:

- Comprehensive suite specifically for mortgage professionals.

- Customizable marketing pieces.

- Feature-rich mobile application for managing everything on-the-go.

Cons:

- Onboarding process can take a while.

- Some specific integrations can have a learning curve.

Pricing:

- Individual Plan – $165/month.

- Team Plan – $95/month (pricing varies with number of users).

- Enterprise Plan – Request pricing.

Impact on Loan Officers in 2025:

BNtouch Mortgage CRM is an all-encompassing platform for loan officers to automate marketing, manage leads, and streamline many pieces across the loan process which could lead to increased productivity and ultimately more business.

Unique Selling Point:

The only all-in-one mortgage CRM offering a broad range of available integrations and an abundance of customizable marketing pieces.

Rating:

4.4/5 (User ratings and various industry reviews)

6. Mortgage IQ

Mortgage IQ is a customer relationship management software, created for loan officers to manage leads, automate marketing, and leverage technology to help facilitate the loan origination process.

Features:

- Lead Capture and management

- Automated marketing campaigns

- Client communication tracking

- Integration with various loan origination systems (LOS)

- Reporting and analytics tools

Pros:

- Provides a simplified client relationship management system

- Brings automation to marketing efforts

- Provides analytics and management statistics

Cons:

- User interface is not as user-friendly as some competitors.

- Limited disclosure of pricing options.

Effects on Loan Officers by 2025:

Mortgage iQ provides loan officers with the appropriate resources to manage client relationships, and automate some marketing functions. This creates more time and efficiency for their overall workload.

Unique selling point:

Mortgage iQ is a full client relationship management system with automated marketing tools.

Rating:

4.2/5 (According to user reviews and industry information)

7. Jungo

Jungo is a mortgage-specific CRM on the Salesforce platform that provides a broad array of functionality for managing leads, marketing automated workflows and communicating with clients.

Features:

- Integration with LOS systems like Calyx Point and Encompass

- Pre-built emails and marketing content

- Lead capture forms and landing pages

- Automated task management and reminder functionality

- Reporting and analytics tools

Pros:

- Built on the Salesforce platform

- Ability to manage and track all of the functionality specific to mortgage professionals

- Ability to customize the product

Cons:

- Pricing may be more expensive than some others

- Requires Salesforce knowledge to take full advantage of the product

Pricing:

- Jungo Mortgage App: $119 per month, per user

- Jungo Bundle: $149 per month, per user

- Jungo Enterprise: Custom pricing based on volume

Impact on Loan Officers in 2025:

Jungo is a fully-fledged CRM provider that is intertwined into loan offices existing technology frameworks, automates their marketing while providing additional ways to communicate with clients.

Unique Selling Point:

By being built on Salesforce, Jungo provides mortgage specific professionals a robust and customizable CRM solution.

Rating:

4.5/5 (Based on user reviews and industry feedback)

8. PipeDrive

PipeDrive is a sales-centric CRM program with an easy-to-use interface and a visual sales pipeline, and provides loan officers with a way to manage leads while also managing deals.

Features:

- Sales pipeline with visible management

- Email integrations and tracking

- Activity reminders and task management

- Reporting and analytics capabilities

- Ability to integrate with third party applications

Pros:

- Intuitive and easy to use

- Good reporting and analytic capabilities

- Integrations with many applications

Cons:

- Limited marketing automation features

- May require 3rd party tools to provide full mortgage-specific functionality

Pricing:

- Essential – $14/month per user

- Advanced – $39/month per user

- Professional – $49/month per user

Impact to Loan Officers in 2025:

Pipedrive provides loan officers with the ability to manage their leads and deals simply, along with providing reporting and automation to allow officers to be more productive.

Unique Selling Point:

Pipedrive, a CRM for mortgage loan officers, has an easy-to-use interface and significant visual sales pipeline option making lead management easy.

Rating:

4.3/5 (Based on user reviews and industry feedback)

9. Streak

Streak is a customer relationship management (CRM) solution, built directly into Gmail. Loan Officers can manage their pipeline and client interactions through Gmail, without leaving their inbox.

Features:

- Gmail Integration

- Customizable Pipelines

- Email Tracking

- Mail Merge

- Email Templates

- Pipeline Collaboration

- Task Management

- Contact Management

- Data Import/Export

- API Access

- Mobile Apps

- Reporting and Analytics

- Stage-based Filtering and Sorting

- Permissions and Access Control

- Google Workspace Compatibility

Pros:

- Gmail integration Affordable pricing plans

- Easy to setup and use

Cons:

- Limited features compared to mortgage CRMs

- Requires additional tools to do everything it offers

Pricing:

- Solo: $15/month per user

- Pro: $49/month per user

- Pro+: $69/month per user

- Enterprise: $129/month per user

Impact on Loan Officers in 2025:

Streak is an easy and affordable alternative CRM allowing loan officers to continue using Gmail efficiently to develop communication and streamline the management of their pipeline.

Unique Selling Proposition:

Gmail Integration to allow Loan Officers to manage their CRM from their inbox.

Rating:

4.0/5 (Based on user experiences and industry response)

10. MyCRM Dashboard

MyCRM Dashboard is another customized CRM solution designed to help businesses manage customer relationships, sales and marketing efforts.

Features:

- Manage contacts and leads

- Track your sales pipeline

- Automate email marketing

- Provide reporting and analytics

- Integrates with many third-party applications

Pros:

- Ability to be customized

- Allows you to manage everything in one software solution

- Cost effective.

Cons:

- Takes time initial set-up and to customize

- Limited industry specific functionality.

Impact on Loan Officers in 2025:

MyCRM Dashboard gives loan officers a customized CRM solution to effectively manage their leads, sales and marketing efforts.

Unique Selling Proposition:

This is one of the best CRM for mortgage lenders with a comprehensive feature set that fits within firms’ budgets and also matches with the selected loan mortgage software!

Rating:

4.1/5 (user reviews and industry review).

11. Keap (formerly Infusionsoft)

Keap is an adaptable option as both a CRM and marketing automation platform that allows small businesses to manage clients and marketing.

Features:

- Lead capture and management

- Automation email campaigns

- Appointment scheduling

- Payment processing

- Reporting & analytics tools

Pros:

- Strong automated features

- Integrates with multiple, third-party applications

- Easy to use

Cons:

- A higher learning curve for buyers who are new users

- Price is potentially more than some competitors

Pricing:

- Keap Pro: $169/month

- Keap Max Classic: $199/month

Impact on Loan Officers now going in 2025:

Keap, one of the best mortgage CRM platforms, provides Loan officers with a platform integrated with automating marketing, lead management, client interaction, and overall processes that allows them to respond better to their clients through interaction and increase productivity.

Unique Selling Point:

It is a complete automation platform and is easy to use.

Rating:

4.2/ 5 (Based on user experiences and industry ratings)

12. Bonzo

Bonzo is a purpose-built CRM mortgage software focused on the mortgage industry. It provides an array of automation features to assist loan officers in managing lead follow-ups, bank management, and communicating with existing clients.

Features:

- Automated Lead Follow-ups

- Banks Management

- SMS and Email Communication

- Task Reminders

- Reporting and Analytics

Pros:

- Mortgage specific features designed for the mortgage loan officer

- User friendly platform

- Strong automation functionality

Cons:

- Limited customization options

- Pricing information not publicly available

Impact on Loan Officers in 2025:

Bonzo is able to assist loan officers in automating lead follow-ups and bank management, so they can focus more on client relationships as opposed to time management and admin function of their business.

Unique Selling Point:

A mortgage industry specific CRM with strong automation capabilities.

Rating:

4.3/5 (Based on user articles, reviews and ratings from industry professionals)

13. Unify

Unify is an all-in-one mortgage CRM platform that you might try out to help mortgage professionals organize leads, automate marketing, and improve and document communication with clients.

Features:

- Lead capture and tracking.

- Automated multi-channel marketing campaigns.

- Tracking of all client communication.

- Integration with loan origination systems (LOS) (blend of systems).

- Data reporting and analytics.

Pros:

- Comprehensive range of mortgage marketing and communication features.

- Simple and easy-to-use interface of this best mortgage loan officer crm.

- Great integrations with systems.

Cons:

- Pricing is not disclosed on their website.

- You may have to talk to them about some training if you want everything available to you.

Impact On Loan Officers in 2025:

Unify allows loan officers to manage leads, automate marketing, and track all client communication to stay organized, faster, and more engaging with clients. It increases efficiency and helps banks or lenders engage with their clients more effectively.

Unique Selling Point:

A completely comprehensive all-in-one CRM for mortgage lenders.

Rating:

4.4/5 based on user reviews and feedback from Mortgage professionals.

14. SimpleNexus

SimpleNexus is a mobile-first top mortgage CRM software that helps loan officers conduct every step of the process from lead generation to closing.

Features:

- Lead capture and management

- Document upload and management

- Real time alerts and notifications

- Integrations with multiple loan origination systems (LOS)

- Reporting and analytics tools

Pros:

- Mobile-first platform allowing access on the go

- Seamless integration with Encompass

- Easy for end-users to use

Cons:

- Limited customization

- Lagging delays reported sometimes

Pricing:

- 1-9 user at $150/month per user

- 10-19 users at $125/month per user

Impact on Loan Officers in 2025:

SimpleNexus gives loan officers a mobile platform for managing leads and documents, and client interactions, which increases efficiency and client engagement.

Unique Selling Point:

SimpleNexus is mobile-first and integrates with Encompass seamlessly.

Rating:

4.5/5 (Across user reviews and industry feedback)

15. Aidium

Aidium – Mortgage specific CRM suited for loan officers to automate marketing, lead management and client interactions.

Features:

- Automate marketing campaigns with a few clicks

- Lead capture and management including information on each lead

- Track communication with clients

- Easy integration with multiple LOS

- Reporting and analytics tools

Pros:

- Mortgage specific features that include only what loan officers need to do their jobs

- Reasonably simple interface to navigate

- Great automation capability

Cons:

- Pricing information not available on the website, must inquire

- Some users reported bugs in the system and some service issues

Pricing:

- Monthly: $99/user with a one time setup fee of $399

- Annually: $949/year with a one time setup fee of $299

Impacts on Loan Officer activity into 2025:

Aidium automates their marketing process, lead management and makes it easy to communicate with clients, allowing loan officers to be more efficient and have higher engagement with their client base.

Unique selling proposition:

Mortgage specific CRM with strong automation capabilities.

Rating:

4/5 (based upon user reviews and taking into consideration industry feedback).

CRM Integrations with Loan Processing Software

Connecting your CRM with your loan processing software provides a seamless transfer of data between sales and operations, and eliminates the duplication of effort in entering information, as well as the potential for miscommunications. With the integration, loan officers/call center representatives can manage the loan’s progress through automation — sending updates in real time or updating status changes to clients/partners.

This integration increases efficiency by providing a holistic understanding of the borrower’s journey (initial outreach, up to closing). Creating a bridge between your CRM and your mortgage software programs (e.g., Encompass, Blend, Byte) also improves compliance tracking and client experience. Overall, in a growing lending market, moving your mortgage business forward must include this integration.

To Conclude

A mortgage CRM is a software platform and is more than a system; it is a revolution in how you manage client relationships, complete tasks in your daily work rhythm, and communicate with your team. A mortgage CRM brings all aspects of your mortgage operations onto a single, easy-to-use platform. You can track all your leads, know where each loan is throughout the process in near real-time, and provide your clients with personalized updates.

That being said, selecting the correct best CRM for mortgage professionals can be difficult with the multitude of features, pricing models, and eternally evolving integration possibilities. It is important to select a system that is well-integrated with what you already use (like your Loan Origination System(LOS) or Encompass) to streamline the data entry process and create no interruptions to work flows.

The mortgage brokers or mortgage loan officers looking for a custom solution that increases productivity and simplifies client management, the right CRM can provide unbelievable effects. Take advantage of mortgage loan CRMs and consider developing custom software. With the correct elements in place, your business will find it possible to achieve long-range efficiency and sustainable growth.

Ready to streamline your mortgage business with top CRM software systems?

Book a free consultation with Awesome Technologies Inc. today and discover how a powerful CRM for mortgage companies can help you close more deals, save time, and grow your business with ease.

FAQs

Q1: What is a mortgage CRM?

A mortgage CRM (Customer Relationship Management) is a type of software that is designed specifically for mortgage professionals and loan officers to help them manage their client relationships, track client leads and opportunities, automate marketing and follow-up, and to streamline the loan origination process.

Q2: Why do loan officers need a mortgage CRM?

A quality CRM platform can help loan officers stay organized, communicate with clients, stay compliant, and create efficiencies for managing the loan process from lead to closing.

Q3: Are there mortgage CRMs available for smaller mortgage teams?

Yes! There are mortgage CRM platforms like Shape Software, Pipedrive and EngageBay that are scalable and a good fit for small to mid-sized mortgage teams.

Q4: Can I connect and integrate a mortgage CRM with my existing mortgage systems?

Many mortgage CRM software systems, including Jungo, LoanCirrus, and BNTouch, either offer integration with popular loan origination systems and/or allow for integration with other third-party applications or services.

Q5: Do any of these CRMs have mobile apps?

Yes! Many mortgage CRMs, such as BNTouch, Shape Software, and LoanCirrus, do offer mobile apps for business on the go.