The current mortgage industry is highly competitive. The real success is all about converting leads into closed loans. Since mortgage products often involve high-value transactions and long decision cycles, quality leads and efficient follow-up processes and critical and highly time-consuming. That is where a good lead generation software plays a key role, impacting mortgage operations positively. Particularly platforms the Velocify is a strong player in the market nowadays.

To embrace success in the current competitive market, you need a sales process that is both efficient and optimized. That is where Velocify, part of the ICE mortgage technology platform, plays a great role. This outstanding tool uses sales automation to help keep your team organized and focused on what impacts good business growth.

Velocify serves as an important tool to simplify the daily mortgage operation, ranging from lead generation to beneficial conversions. Velocify lead manager integration is what gets the job done. Velocify is a sales acceleration platform that easily streamlines lead management and automates workflow for mortgage workers. It is especially popular in industries with complex sales cycles like mortgages, insurance and education. The software helps sales teams respond quickly to leads, prioritize and improve conversion rates.

It is useful to track potential customers store and process data and guide agents through the right steps to capture each lead. This streamlined approach does not just help you stay organized but also ensures exceptional conversion rates, which are later directly changed into increased profits. If you want to utilize strategic advantage then Velocify integrations will help you take on any challenge.

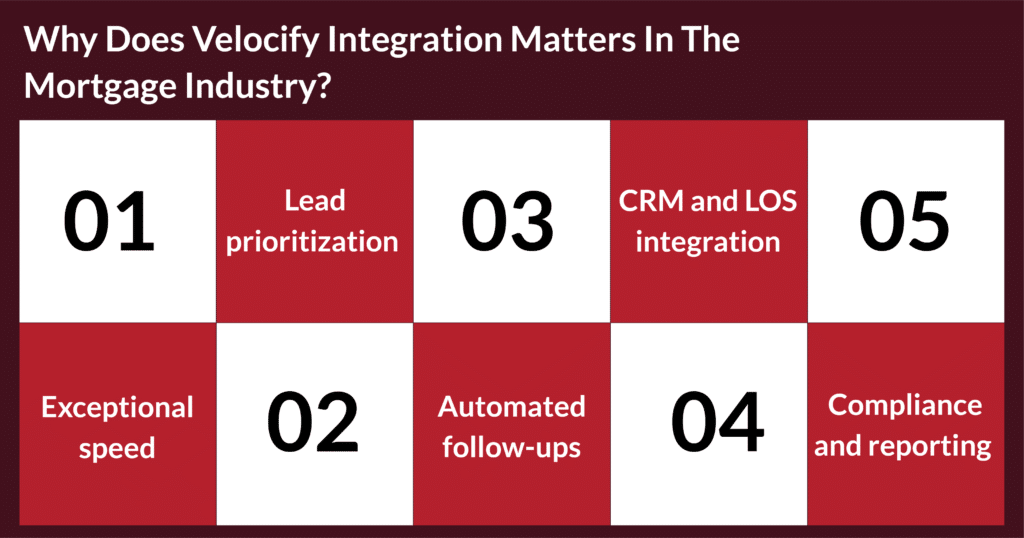

Why Does Velocify Integration Matter in the Mortgage Industry?

Velocify is more than just a lead management software, it is a comprehensive system designed to support every stage of your sales process. When it comes to sourcing best leads, Velocify integrations is helpful to collect data but it also evaluates opportunities and smartly assigns leads to the right people, ensuring no opportunity is wasted or remains unattended. During the discovery phase, it helps your team stay organized by ranking leads, adding context and making it easier to prioritize follow-ups. What’s unique about Velocify integration is how seamlessly it all works together.

The platform is secure, automated and fully integrated, allowing your team to stay efficient and compliant. It even allows to generate and record calls, making communication easy and keeps everything rightly documented. Furthermore, valuable analytics offer insights so you can continually improve lead strategy and impact the outcome accordingly. We have listed below, the top benefits that you must know for its right use, they are:

- Exceptional speed

Timing is everything when it comes to the sales in mortgage. The first lender to respond to a lead often wins the business. Velocify Salesforce integration automates lead routing and notifications that assure the following:

- New inquiries are assigned instantly

- Loan officers follow up quickly, often within minutes. This significantly increases the chances of engaging and initiating the deal way before the competitors do.

- Lead prioritization

It is common knowledge that not all leads are equal therefore, Velocify integrations uses customizable rules to prioritize leads based on factors such as:

- credit score

- loan amount

- special focus on different stages in the buyer’s journey because this allows mortgage lenders to focus on high-potential borrowers first

- Automated follow-ups

The best part about using Velocify is that it helps to ensure no lead goes unattended or unanswered by automating:

- Follow-up reminders

- email and sms campaigns

- call scheduling – when this is done consistently, it improves borrower engagement and attracts more and better mortgage applications

- CRM and LOS integration

Velocify integrates seamlessly with popular CRM systems and Loan origination systems (LOS), enabling the following:

- A standard and clear view of the customer journey

- smooth exchange of important information or key financial data between marketing and loan processing teams

- lesser requirement for manual entry and significantly reducing errors, which on the other hand saves massive time

- Compliance and reporting

Since the mortgage industry operate under heavy or strict regulations so Velocify makes things simple by helping lenders:

- Maintain communication logs

- Track leads and activities

- Generate reports for compliance audits – this is beneficial to reduce risk and ensures transparency for all

The Ultimate Velocify And Salesforce Integration

Salesforce is a powerful cloud-based CRM tool, commonly used for its unique features to streamline sales, marketing customer service and other important customer service related jobs. It allows business owners, of any scale or size to analyze customer data or track interactions easily from a single platform. It has great customizable features that can fit according to the needs of different industries including marketing, healthcare, finance and many more.

The Velocify Salesforce integration streamlines lead management and enhances sales efficiency by automating lead capture, routing and follow-ups directly within Salesforce. It manages leads based on custom criteria, lessens the need for manual data entry, and creates customized sales workflows for faster response time and strong lead conversion rates. The purpose behind this integration is to provide real-time analytics and reporting, enabling improved decision-making and strategy planning. By automating administrative tasks and ensuring seamless data flow, it boosts productivity through lead to loan conversion and helps mortgage

The best Velocify solutions to opt for

When looking for the best solutions, it is important to consider the features and tools you want to make use of the most, according to your business objectives. Do you need help to optimize your lead management, streamline workflows, and improve your conversion rates? Here are some of the best solutions Velocify offers listed below:

- Velocify Pulse

Streamline your sales processes with Velocify Pulse and Salesforce. This amazing integration helps sales leaders, admins and loan officers focus other important tasks essential for growing the business and closing more loans. With Velocify Pulse, you can turn your Salesforce environment into an efficient sales engine for securing deals, closing and reporting. This is particularly designed to help your team close more deals with less effort.

- Velocify LeadManage Enterprise

Are you the one ready to boost your lead conversion rates by upto 400%? Velocify LeadManage Enterprise allows you to pull mortgage leads from over 1,400 integrated sources and ensures no is left behind. It automatically distributes new leads and helps prioritize communications plus with custom sales workflows, your team can ensure every lead gets the attention it needs, immediately. The results impact prompt responses, smarter selling and more loans closed.

- Velocify Leadmanager Essentials

Did you know that manual processes can add over eight extra days to finalizing the loan processing? Velocify’s leadmanager essentials helps loan officers close loans faster with an automated, multi-channel marketing solution. If you are following up on a missed application, looking for key documents or providing important updates, LeadManager essentials makes it all easier, with minimal effort on your part as well as no need for loan officers to log in all the time, saving precious time and energy.

- Velocify DialIQ

Dial-IQ is a dialer assistant built specifically for the mortgage industry to boost sales. It not only helps your team make more calls but ensures those calls lead to actionable conversations. This means, more and more productive calls, faster closing times, and real-time reporting insights. In short, Dial-IQ is a super useful choice for any loan officer looking to improve their productivity and close rates.

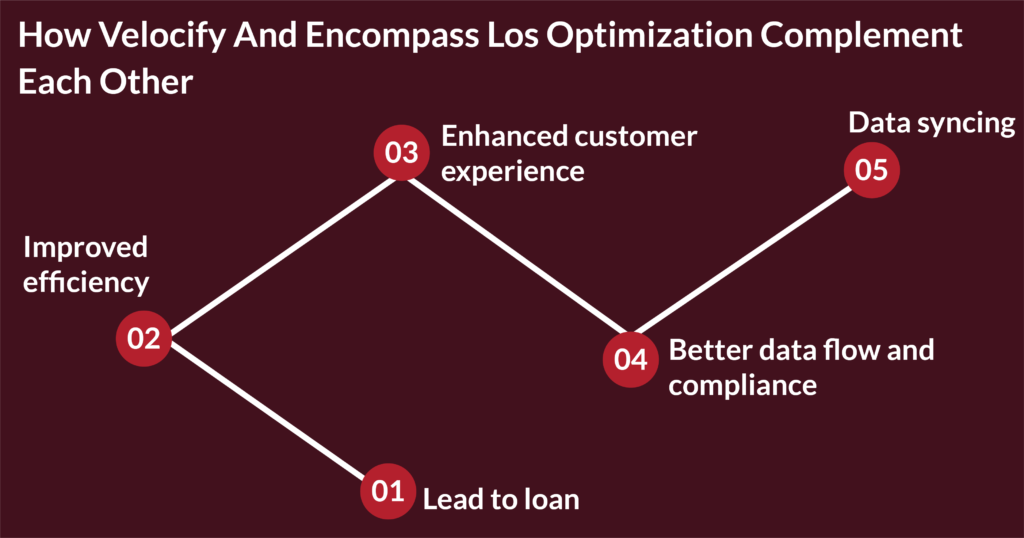

How Velocify And Encompass LOS Optimization Complement Each Other

Velocify and Encompass integration provide a seamless workflow from lead generation through to loan origination and closing via Encompass 360 customization.

Did Velocify integrate with Encompass 360? Yes! This has significantly enhanced mortgage operations for lenders and customers equally. Here is how the integration benefits mortgage businesses:

- Lead to loan: Velocify captures and qualifies leads, automates the follow-up process, and ensures that sales teams are engaging with leads at the right time. Once a lead is converted into a customer, the data can be transferred directly into Encompass, where the loan process begins. This eliminates duplicate data entry and streamlines the transition from sales to loan processing through the ease provided by these advanced tools.

- Improved efficiency: By integrating Velocify’s lead management system with Encompass’s loan origination platform, you minimize the hassle in between marketing and mortgage operations. Sales teams can focus on improving relationships and transforming conversions, while the loan origination team focuses on getting the deals secure.

- Enhanced customer experience: Encompass integration lets both system work together to provide a more consistent and faster experience for customers. Lead capture, follow-ups, loan application and processing are all integrated, ensuing customers receive quick and professional service throughout their mortgage journey.

- Better data flow and compliance: Both of these platform are uniquely designed to support compliance and regulatory standards so integrating them together ensures that all customer data, communication and documentation are kept accurate and fully functional throughout the entire process.

- Data syncing: the Encompass integration ensures that critical loan data is synced in real-time between velocify and Encompass 360 customization, as this assures teams to progress loans faster with visibility into borrower information and loan statuses.

How to set up Velocify lead source integration

Setting up Velocify lead source integration involves a series of steps that allows your lead sources from everywhere including different web forms such as third party providers or CRM platforms to automatically send new lead data into Velocify in real time.

It begins through a very important first step; by identifying the type of lead source you want to integrate. This could include your website’s lead capture forms, external lead vendors such as Lending Tree or Zillow, or other tools like Salesforce or Hubspot. Once you have identified the source, you’ll log into the Velocify Admin portal and navigate to set up then lead sources, where you can create a new lead source. You’ll be asked to provide a name for it and a unique Lead Source ID and to select a post method (usually HTTP POST or GET). After the lead source is created, Velocify will generate a unique posting URL. This is the address your lead provider or system will use to send leads into Velocify.

Once the integration is performing up to the mark, you can enhance the setup by configuring lead routing rules. Velocify integrations allows for flexible and lead distribution based on criteria such as a round-robin assignment, lead priority or geographic territory. These settings can be managed under setup > lead distribution. After everything is set up, make sure to notify your sales team and monitor incoming leads through velocify’s reporting and analytics tools. These provide great support to help you track the traffic and performance of each lead source and make adjustments as needed.

To ensure long-term success, follow best practices such as unique source IDs for tracking, testing thoroughly before launch, and keeping all lead providers updated on any changes to your posting URL or data fields. You may also consider setting up auto-responses via Velocify integration. This automates its best features to increase engagement and improve conversion rates.

Conclusion

While lead management software like velocify is widely used by mortgage brokers, insurance companies and highly beneficial for businesses in the B2C space, Velocify lead manager integration is highly scalable, meaning it can grow with your business, of all scale and size. And with flexible pricing based on the number of users, it is easily accessible to all types of business owners. Velocify integration in the mortgage industry is best used to streamline lead management, improves conversion rates and enhance sales efficiency by automating key processes like lead distribution, follow-ups, and simplifies task management.

It allows mortgage lenders to gain and prioritize leads from many sources ensuring timely responses and better engagement with prospects. By combining forces with various CRM systems like Velocify Salesforce integration, Encompass and other loan origination systems ensures seamless data flow, reducing manual effort and improving accuracy. With features such as automated multi-channel communications, sales dialers and real-time analytics, Velocify integrations help mortgage professionals work smartly, close loans faster and eventually expand business in today’s market.