Unlocking The Secrets Of Loan Origination System: Prioritizing Its Essence!

Financial companies will always look for new ways to improve customer experience and services. Moreover, they want to practically alter ways to enhance operations according to the current loan industry. They work smartly and put in all their efforts fruitfully. Hence, the loan origination system (LOS) is one scheme that has gained traction.

For many organizations, LOS is a strength. It helps to lawfully process loans, improve decision-making, and work according to the needs of the borrowers. A good LOS system will steer risk management with ease. For example, encompass integration services comes up as a leading partner. It helps improve the borrowing process with ease and comfort.

Revolutionizing Lending: The Power of Loan Origination Systems

A loan origination system smooths the lending process by handling all the phases. From the beginning of the paperwork till the final approval. It ensures security and compliance when managing private customer data. In addition, the LOS can be more effective because there are no human errors. It is known to manage loan applications more quickly.

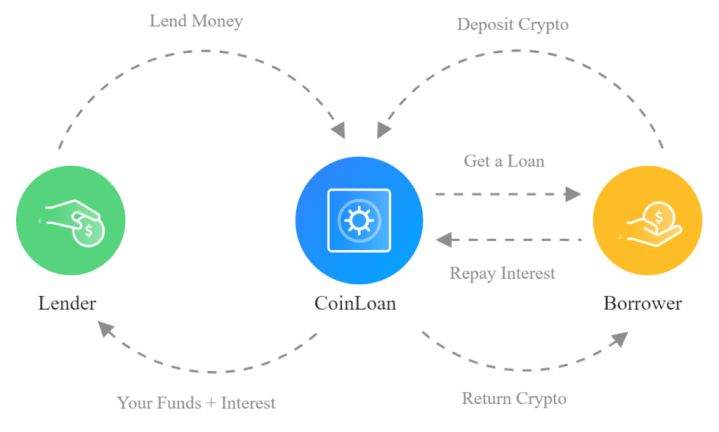

To put it simply, loan origination is a process that helps the mortgagor apply for a loan. In return, an investor either agrees or rejects the application. This process has various stages, from loan application to approval or refusal of the application. Overall, it helps ease out and manage the loan application and payment processes.

Loan Origination

When the borrower applies for a loan, he is unsure of the refusal or acceptance. This is because the lender’s risk assessment has yet to be discovered. The final decision cannot be forecasted in the beginning. Hence, there can be two outcomes—cash distribution and rejection. Many LOS are available in the market. However, reliable loan origination software is needed.

Encompass LOS optimization can be a good option to ease the loan application process. It helps optimize the difficult loan origination process flow. The core reason is that it increases the effectiveness of the workflow and lending experience for the lender. For the borrower, it simplifies the entire loan application procedure. So, we can say that it is a win-win situation for both parties.

A lender who wants to process many loan applications at once can do it. The good news is that there is more accuracy because of less manual work. There is a designed process that works on its own. Hence, the efficiency factor brought by custom mortgage development is vital in today’s world. The fast financial sector is enjoying booms because of this system. Every financial institution can gain success with more speed and reliability in the entire process.

Three Key Benefits of Systems for Loan Origination

The most important benefit is the factor of more productivity and efficiency. Thanks for fixing the processes within the organization. For a firm, it is affordable, improves production, and increases turnaround times.

Furthermore, loan origination procedures will increase your company’s competence to control risk. They are using automation and data analytics. By assessing risk before offering the loan, you can reduce the chance that a borrower will fail to pay.

Perhaps most importantly, the best loan origination approach, such as Encompass LOS optimization, improves the client experience. The borrower can benefit from fast loan administration, clear communication, and self-service possibilities, which are available via mobile apps and web portals.

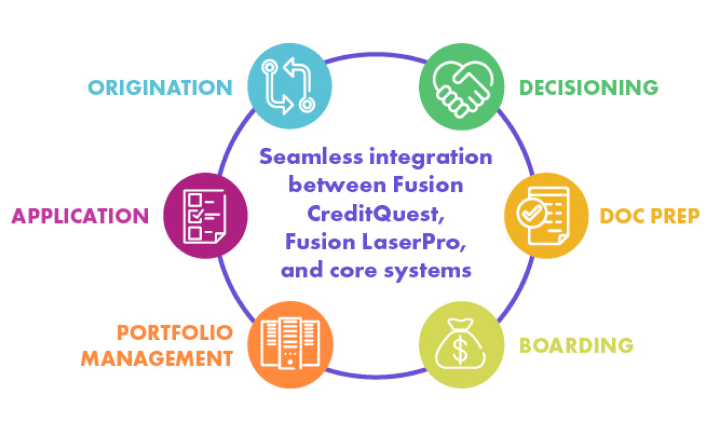

Key Components of a Loan Origination System

LOS manages and simplifies The loan procedure from the funding application. Every aspect of a LOS is vital to ensure efficiency, conformity, and a positive borrower experience. Below is a full summary of the key elements:

- Application Receiving:

There are many ways to collect information about borrowers, including phone, direct application, and online forms.

- Gathering Documents:

It eases the process of getting documents from the borrower. The documents should contain identity, income, and job details.

- Integration Of Credit Reports:

LOS helps establish a relationship with credit agencies and obtain and evaluate credit reports, which are important for evaluating debtors’ creditworthiness.

- Analyzing Risk:

Credit scores and other financial data are useful for analyzing risk. Every loan application has a risk factor. Also, it helps to make a decision and attempt underwriting.

- Analytics Of Data:

Using LOS makes it easy to study trends, understand the borrower’s mind, and learn other important things. These include strategic planning and process development.

- Integrations With Third Parties:

Links to external systems, such as credit bureaus, appraisal management systems, and e-signature platforms, help to boost functionality and speed up processes.

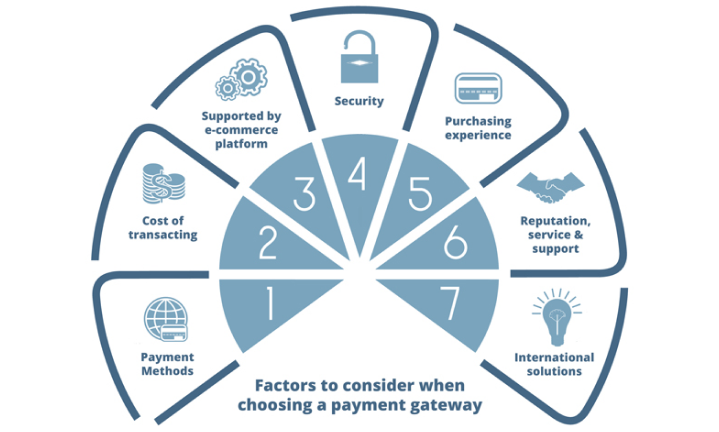

Most Important Factors To Consider While Choosing A LOS

The following criteria should be considered when searching for fair lending software.

1. The Domain Experience Of The Vendor

In the FinTech industry, many software providers, such as Awesome Technology, are experts in many fields. A company like Awesome Technology has a legacy of trust and lending history. The experts know all the ins and outs, which are not available elsewhere.

2. Easy To Operate

Any automation project wants to reduce the time spent on onboarding and system usage. A vital feature of quality is how simple it is to integrate LOS into your business’s software.

3. Easy To Pick Up

User onboarding is important when adding on new technologies. The loan origination system you select should be easy for employees and clients to use and understand. It should offer a complete feature set and the ability to track loans more realistically.

4. Basic Modification Of Business Logic

Highly configurable LOS systems are the most efficient ones. They allow updates and changes to fulfill unique business demands.

5. Strict Security Measures

One of the main barriers to digitizing lending firms is protecting user privacy and security. Data protection systems should be smart to protect sensitive data, which can be a cause of concern for regulators and customers.

How To Pick The Finest Software For Loan Origination?

Here are a few things to remember while selecting your company’s loan origination software. The aspect of specializing in custom mortgage development should not be ignored:

- Flexible And Easy To Use:

A good loan origination system (LOS) should be simple to use. This is especially important for those who know little about software use.

- Sturdy Interfaces And Efficient Processes:

It should consider the workflow features and API connection of LOS. These two things are vital to managing many loan processes at once.

- A Unified Approach To Cost Effectiveness

Using a smart LOS will help to reduce expenses. Many financial companies consider smart functionality and take advantage of economies of scale.

- Entire Database:

A complete LOS should promise to link with credit principles during loan assessments and have an intelligent database.

Encompass Integration Services

Encompass Integration Services is a collection of tools and solutions. It helps companies make smart choices when using other software programs. Both systems will improve efficiency and create a continuous workflow. Moreover, they should enable all-in-data interchange and automation.

Benefits of Encompass Integration Services

1. Automated Processing Of Applications

Data entry, document authentication, and application review are difficult processes. Hence, a good platform should be systematized as part of application processing.

2. Flexibility And Customizability

Thanks to its smart design, mortgagees may use the loan origination platform more efficiently. Hence, the LOS should be suitable for business needs.

3. Risk Management And Compliance

Investors may smartly control risk and follow regulatory conditions. The benefit is that they can easily use a thriving loan origination platform.

Encompass LOS Optimization

Encompass LOS optimization involves increasing performance, productivity, and effectiveness. It is useful for better reassuring lenders of their needs and rationalizing the loan origination process.

Optimization involves fine-tuning systems to enhance their potential and agree that they connect with an organization’s goals and processes.

Pondering over these aspects of Encompass LOS Optimization can help businesses enhance their loan origination procedure. It helps increase throughput, save expenses, and offer a better experience for employees and clients.

Benefits Of Encompass LOS Optimization

1. Streamlined Processes

Workflows can be modified to fit the processes used by your company.

2. Regular Procedures

The regular process reduces the chances of errors. Unpredictable and manual processes can cause these errors.

3. Personalized Interfaces

Making the user interface more responsive to each user’s specific needs helps to improve the system’s usage.

Custom Mortgage Development

Creating expert mortgage lending solutions to address the exceptional goals and difficulties a lender or financial institution encounters is called custom mortgage development. Simplifying and improving the mortgage process may result in better software output. Moreover, it helps to modify modern systems and merge changing technologies. Through custom mortgage development, lenders can introduce advanced systems. These advanced systems become more efficient and beneficial in mortgage development.

Benefits Of Developing Custom Mortgages:

1. Increased Effectiveness

Customized solutions help to change functionalities. They also cut down on lengthy manual processes. Hence, they increase effectiveness and speed up loan processing.

2. Enhanced Precision

Custom solutions can be constructed to trim down mistakes and ensure precise recording and handling of all data.

3. Advantage Of Competition

Customized solutions may provide new features and expertise that make the mortgage stand out.

The Proud Offer Of Awesome Technologies

Awesome Technologies offers modified options for every kind of funding. It can help if you’re prepared to offer your staff the benefits of an extensive LOS. Financial institutions of all sizes can use the lending and loan origination software.

The following are some advantages of trusting LOS solutions from Awesome Technologies:

Simple Customization

Here at Awesome Technologies, the experts understand that lending software should be able to serve the needs. Because of this, you can quickly adjust to LOS to match your solo needs, regardless of whether you require more technical capability.

More Than 100 Integrations

Any third-party provider can be integrated with Awesome Technologies in a few days. Awesome Technologies, consequently, works perfectly with the apps you already have.

To Conclude

The ability of a (LOS) to systematize the loan process is very important to its operation. By adding all required aspects, lenders may enhance efficiency, decrease errors, and speed up turnaround times. As a result, customers will have a better experience, and your team will be far more dynamic.

Hence, a LOS like Encompass Integration Services offers more benefits than automation. Moreover, it offers more insights, which helps financiers understand setbacks and make better choices. With real-time data and assessment, it is easy to adjust to recent market trends and be the boss!

Enabling a robust Loan Origination System is now vital for mortgagees. They always aim to stay ahead of the competition in this thriving market. Accepting this technology could help your business reach new heights of success, improve debtor involvement, and set the ground for long-standing victory.

Read also -> Top Mortgage LOS Systems

FAQs

What Constitutes A LOS’s Principal Parts?

Application and document management, credit scoring and risk assessment, underwriting, workflow management, compliance and regulatory management, loan pricing and product management, funding and closing, CRM, reporting and analytics, integration capabilities, user management, and security are some of the main aspects of LOS.

What Should I Think About Choosing A LOS?

When selecting a LOS, consider the system’s benefits, capacities, usability, customizability, customer service, conformity support, and budget. All these factors are equally important to meeting the company’s goals.

In What Ways Might Loan Origination Software Enhance Loan Administration?

LOS smooths loan management by computerizing data collection, document authentication, underwriting process, and facilitating third-party communication. It is also attached with CRM systems to keep track of debtor profiles until the confirmed repayment.

How Does A System For Loan Origination Work?

LOS provides a formed approach to customer onboarding, verification, loan documentation, and payout. It allows banks and other lending institutes to adhere to responsibilities and internal and external guidelines.